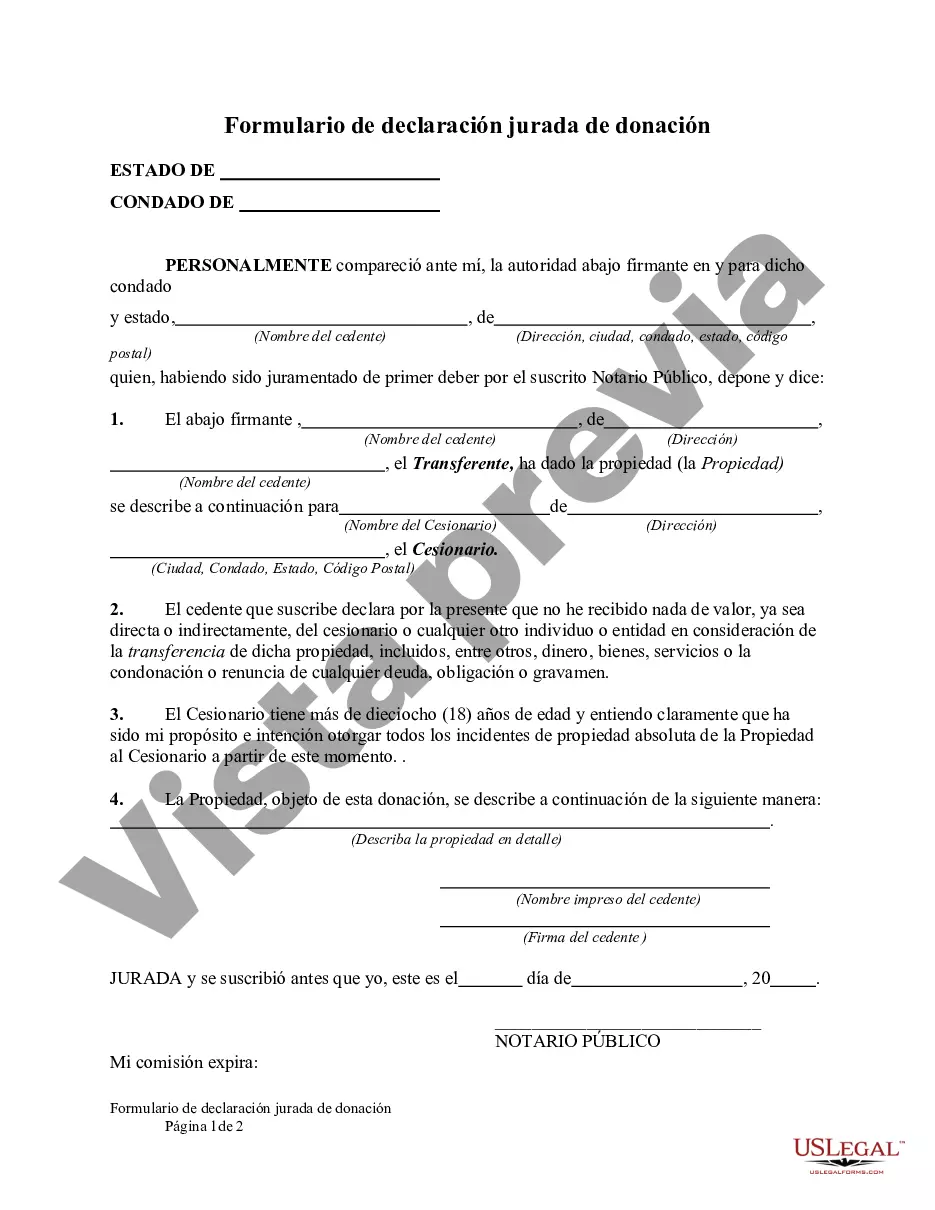

Cuyahoga Ohio Gift Affidavit Form is a legal document used in Cuyahoga County, Ohio, to record the transfer of a gift between individuals or entities. It serves as a sworn statement declaring that a gift has been given and received without any expectation of repayment or consideration in return. The form is typically utilized to provide proof of the gift transaction for various purposes, such as tax reporting, real estate transactions, or estate planning. The Cuyahoga Ohio Gift Affidavit Form requires several essential details to be filled out accurately. These include the names, addresses, and contact information of both the donor (the individual or entity giving the gift) and the recipient (the individual or entity receiving the gift). The form also requires a detailed description of the gift, including its nature, estimated value, and date of transfer. Additionally, the Cuyahoga Ohio Gift Affidavit Form may require specific information pertaining to the purpose of the gift, especially if it involves real estate transactions or tax reporting. For example, if the gift is related to a real estate transfer, details about the property, such as its address, legal description, and parcel number, may be required. If the gift has any associated debts, liens, or encumbrances, this information should also be disclosed in the form. It is important to note that there may be different types or variations of the Cuyahoga Ohio Gift Affidavit Form, depending on the specific gift transaction involved. Some common types or variations may include: 1. Cash Gift Affidavit Form: This form is used when the gift involves a monetary amount given in the form of cash or a check. 2. Real Estate Gift Affidavit Form: This form is specifically designed for recording the transfer of real estate property as a gift. It usually requires additional information related to the property, such as the property's assessed value, tax identification number, and any related mortgages or liens. 3. Vehicle Gift Affidavit Form: This form is used when a motor vehicle or any other type of vehicle is being gifted. It typically includes details about the vehicle, such as the make, model, year, vehicle identification number (VIN), and current mileage. It is essential to consult with legal professionals or county authorities to ensure the appropriate type of Cuyahoga Ohio Gift Affidavit Form is utilized for a specific gift transaction, as requirements may vary based on the nature of the gift and the intended purpose of the affidavit.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cuyahoga Ohio Formulario de declaración jurada de donación - Gift Affidavit Form

Description

How to fill out Cuyahoga Ohio Formulario De Declaración Jurada De Donación?

Laws and regulations in every area vary throughout the country. If you're not an attorney, it's easy to get lost in countless norms when it comes to drafting legal paperwork. To avoid high priced legal assistance when preparing the Cuyahoga Gift Affidavit Form, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions web library of more than 85,000 state-specific legal forms. It's an excellent solution for professionals and individuals looking for do-it-yourself templates for various life and business scenarios. All the documents can be used many times: once you obtain a sample, it remains accessible in your profile for future use. Thus, if you have an account with a valid subscription, you can just log in and re-download the Cuyahoga Gift Affidavit Form from the My Forms tab.

For new users, it's necessary to make a couple of more steps to obtain the Cuyahoga Gift Affidavit Form:

- Analyze the page content to ensure you found the right sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Use the Buy Now button to obtain the template when you find the appropriate one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Fill out and sign the template in writing after printing it or do it all electronically.

That's the easiest and most economical way to get up-to-date templates for any legal purposes. Find them all in clicks and keep your documentation in order with the US Legal Forms!