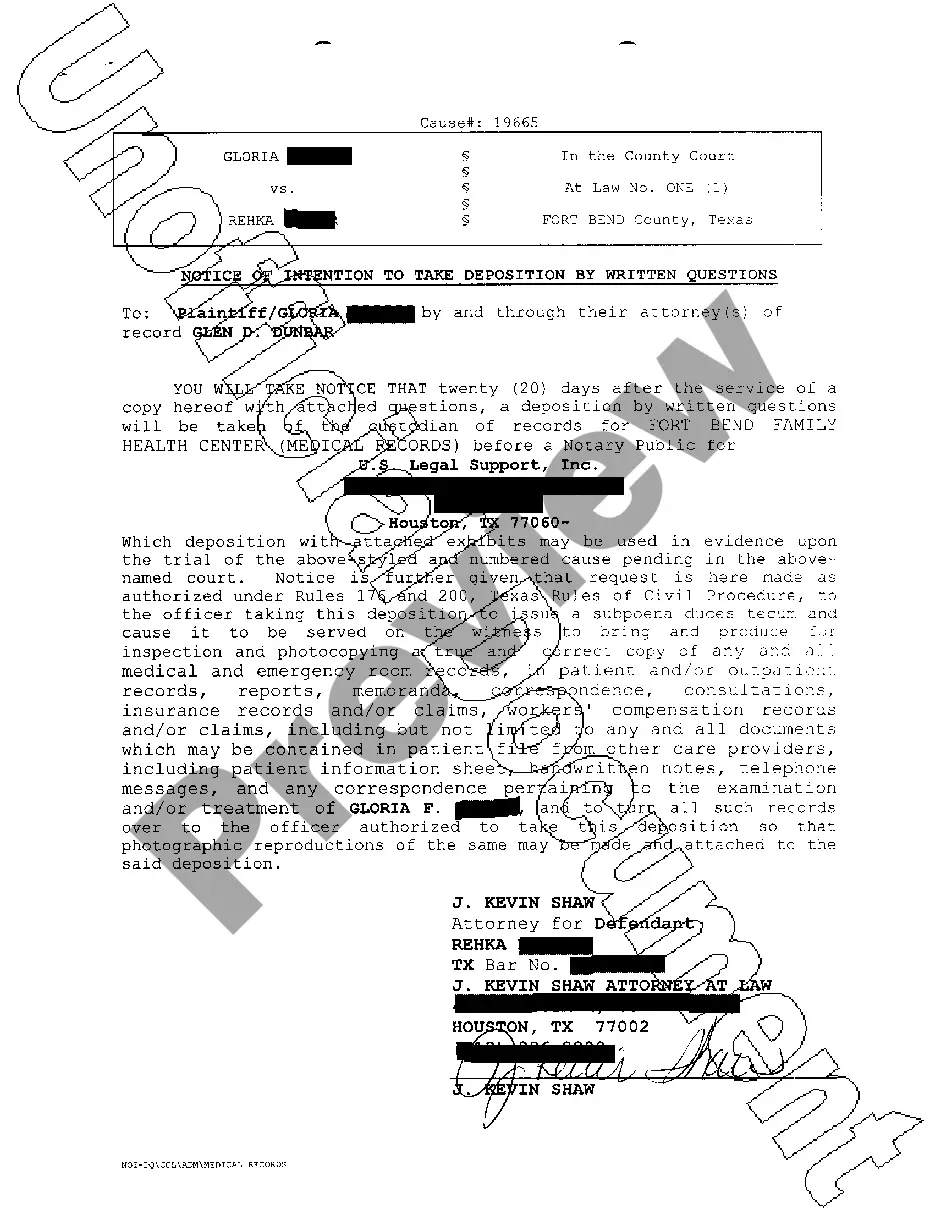

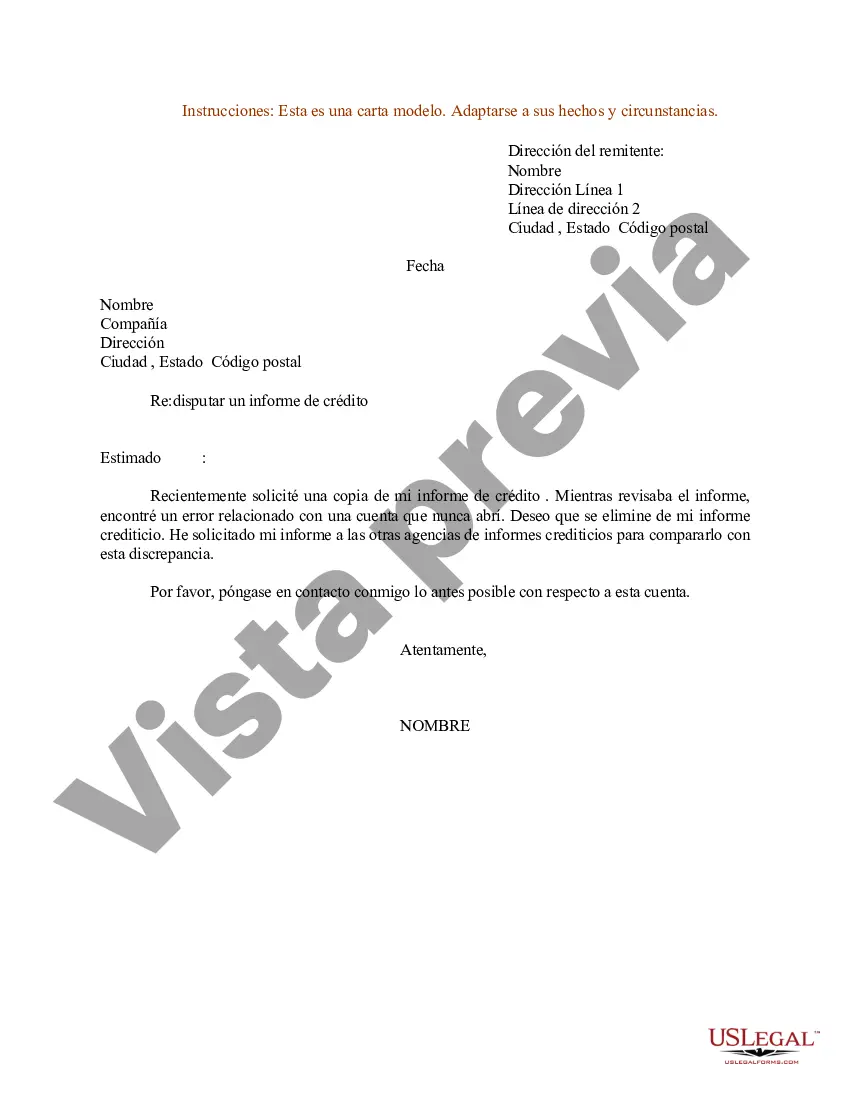

Subject: Addressing Erroneous Information on Your Credit Report — Fairfax, Virginia Dear [Recipient's Name], I hope this letter finds you in good health. I am writing to address a concerning matter regarding your credit report. It has come to my attention that there may be erroneous information impacting your creditworthiness. As a resident of Fairfax, Virginia, it is crucial to rectify this issue promptly for your financial well-being. Fairfax, located in Northern Virginia, is a vibrant and prosperous city renowned for its historical significance, educational institutions, and diverse community. With its proximity to Washington, D.C., Fairfax serves as an attractive hub for businesses and opportunities. Now, let us focus on the matter at hand. It has been reported that your credit report contains inaccurate information that could potentially damage your credit score, which can have adverse effects on your financial future. To rectify this situation, I strongly recommend requesting a copy of your credit report from all three major credit bureaus: Equifax, Experian, and TransUnion. Carefully scrutinize each report to identify any discrepancies, such as outdated or incorrect personal information, duplicate accounts, unauthorized inquiries, untimely payments, or collections. Make sure to highlight these inaccuracies and separate them based on the respective credit bureau. To ensure a comprehensive dispute, it is recommended to compose a Fairfax, Virginia Sample Letter for Erroneous Information on your Credit Report tailored to each credit bureau. Addressing each bureau individually allows you to emphasize the discrepancies found in their specific report. Here are the three kinds of sample letters you may need: 1. Fairfax, Virginia Sample Letter for Erroneous Information on Credit Report — Equifax: This letter should be sent to Equifax and should specifically highlight the inaccurate information or errors you have discovered on their report. 2. Fairfax, Virginia Sample Letter for Erroneous Information on Credit Report — Experian: Similarly, this letter should be addressed to Experian, emphasizing any discrepancies discovered on their credit report. 3. Fairfax, Virginia Sample Letter for Erroneous Information on Credit Report — TransUnion: Lastly, compose a letter tailored to TransUnion, outlining the inaccurate information identified in their report. Remember to provide detailed explanations for each error and include supporting documents such as identification records, payment receipts, or any other evidence that supports your claim. Clearly state your satisfaction of any actions undertaken as per the Fair Credit Reporting Act (FCRA) guidelines. It is your right as a resident of Fairfax, Virginia, to ensure your credit report accurately reflects your financial standing. By promptly addressing this issue, you can safeguard your financial future and maintain control over your creditworthiness. Should you require further assistance or have any questions regarding the dispute process, please don't hesitate to contact me. Together, we can rectify this matter and restore your credit report to its accurate state. Wishing you the best in settling this concern promptly. Sincerely, [Your Name] [Your Contact Information]

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Informe De Crédito Ejemplo - Sample Letter for Erroneous Information on Credit Report

Description

How to fill out Fairfax Virginia Ejemplo De Carta Por Información Errónea En El Informe De Crédito?

Laws and regulations in every sphere vary around the country. If you're not a lawyer, it's easy to get lost in a variety of norms when it comes to drafting legal documents. To avoid pricey legal assistance when preparing the Fairfax Sample Letter for Erroneous Information on Credit Report, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal forms. It's an excellent solution for professionals and individuals searching for do-it-yourself templates for various life and business scenarios. All the forms can be used multiple times: once you pick a sample, it remains available in your profile for subsequent use. Thus, when you have an account with a valid subscription, you can just log in and re-download the Fairfax Sample Letter for Erroneous Information on Credit Report from the My Forms tab.

For new users, it's necessary to make some more steps to get the Fairfax Sample Letter for Erroneous Information on Credit Report:

- Examine the page content to make sure you found the right sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Click on the Buy Now button to get the template when you find the proper one.

- Choose one of the subscription plans and log in or create an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Fill out and sign the template on paper after printing it or do it all electronically.

That's the easiest and most economical way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your documentation in order with the US Legal Forms!

Form popularity

FAQ

Datos esenciales en un reporte de errores Incluir un titulo descriptivo.Describir las circunstancias en las que ocurre el problema.Mencionar la plataforma o sistema operativo que se ha empleado.Mencionar el numero de veces que se ha repetido el error.

La ley estipula que las agencias de reporte de credito no deben reportar los casos de bancarrota despues de (10) anos de la fecha en que el caso de bancarrota fue presentado. Generalmente, la informacion de mal credito es eliminada despues de siete (7) anos.

La carta de credito es un documento muy preciso que sigue un formato internacional estandar que contiene una breve descripcion de la mercaderia, los documentos solicitados para obtener el pago, la fecha de embarque y la fecha de vencimiento, despues de la cual no se realizara el pago.

El vendedor es quien solicita la carta de credito al comprador por seguridad, puesto que a traves de ella se establece un compromiso irrevocable que no se puede cancelar (terminar), sino con el consentimiento expreso del beneficiario/vendedor.

Proceso de una carta de credito Nombre y direccion del ordenante y beneficiario. Monto de la carta de credito. Documentos a exigir. Banco Emisor y Banco avisador. Plazo presentacion de documentos. Puntos de Salida y destino. Fecha de vencimiento de la carta de credito. Descripcion de la mercancia.

¿Que debo incluir en mi carta de disputa crediticia? La fecha actual. Su informacion (nombre, informacion de contacto, fecha de nacimiento y numero de cuenta) La informacion de contacto de la agencia de credito. Una breve descripcion del error (no es necesario contarles una historia larga y complicada)

La principal consecuencia de los riesgos de tener un mal historial crediticio, es la negacion de creditos personales o empresariales mas altos. Tal vez hoy por hoy creas que en el futuro no necesitaras de algun banco o de una institucion financiera, y eso te lleve a no cumplir en tiempo y forma con tus prestamos.

A continuacion te damos algunos tips para limpiar tu Buro de Credito: Revisa tu Buro de Credito constantemente. Identifica cuantas deudas aparecen. Verifica que todas las deudas sean correctas. Reporta alguna deuda que no sea tuya. Acercate al banco o a quien te presto para llegar a un acuerdo.

Antes que nada, hay que solicitar el Reporte de Credito Especial en , porque para reclamar algun dato se tiene que hacer sobre un reporte que tenga menos de 90 dias de haber sido emitido.

Su finalidad es facilitar el comercio externo e interno, eliminando la desconfianza y riesgo que pudiera existir entre comprador y vendedor.