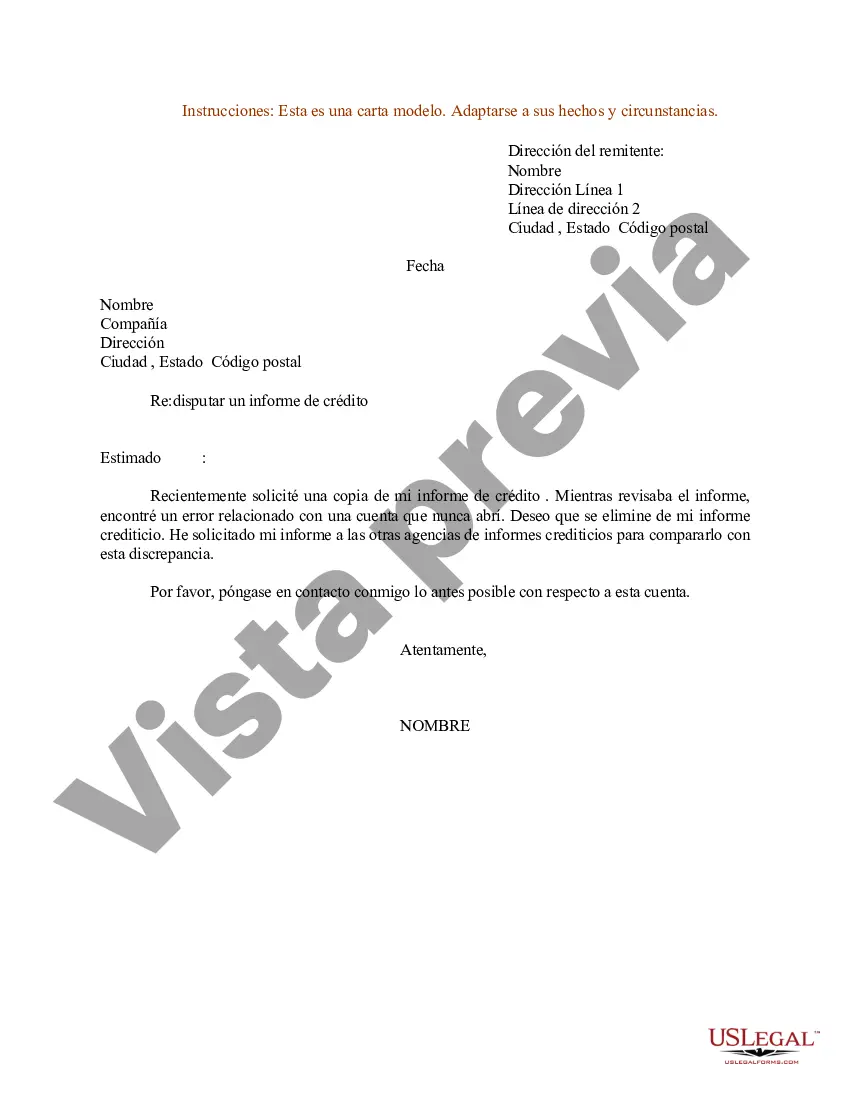

Harris Texas Ejemplo de carta por información errónea en el informe de crédito - Sample Letter for Erroneous Information on Credit Report

Description

How to fill out Ejemplo De Carta Por Información Errónea En El Informe De Crédito?

Laws and statutes in each region vary throughout the nation.

If you're not a lawyer, it's simple to become disoriented in numerous regulations when it comes to composing legal documents.

To steer clear of expensive legal help while drafting the Harris Sample Letter for Incorrect Information on Credit Report, you require a verified template valid for your locality.

That’s the most straightforward and economical method to acquire current templates for any legal needs. Discover them all in just a few clicks and maintain your documentation in order with US Legal Forms!

- That is when utilizing the US Legal Forms platform becomes particularly beneficial.

- US Legal Forms is a reliable online repository of over 85,000 state-specific legal forms, trusted by millions.

- It offers an excellent solution for both professionals and individuals seeking do-it-yourself templates for various life and business scenarios.

- All documents are reusable: after purchasing a template, it remains accessible in your account for future utilization.

- Therefore, if you possess an account with an active subscription, you can effortlessly Log In and redownload the Harris Sample Letter for Incorrect Information on Credit Report from the My documents section.

- For new users, additional steps are required to obtain the Harris Sample Letter for Incorrect Information on Credit Report.

- Review the page contents to ensure you have located the correct document.

- Make use of the Preview feature or read the form description if it is provided.

Form popularity

FAQ

A continuacion te damos algunos tips para limpiar tu Buro de Credito: Revisa tu Buro de Credito constantemente. Identifica cuantas deudas aparecen. Verifica que todas las deudas sean correctas. Reporta alguna deuda que no sea tuya. Acercate al banco o a quien te presto para llegar a un acuerdo.

La principal consecuencia de los riesgos de tener un mal historial crediticio, es la negacion de creditos personales o empresariales mas altos. Tal vez hoy por hoy creas que en el futuro no necesitaras de algun banco o de una institucion financiera, y eso te lleve a no cumplir en tiempo y forma con tus prestamos.

Estructura de la carta de presentacion para un de banco Encabezado de la carta de presentacion. Saludo de la carta de presentacion para un banco. Introduccion de la carta de presentacion. Ejemplo de cuerpo de carta de presentacion. Conclusion y firma de la carta de presentacion.

La ley estipula que las agencias de reporte de credito no deben reportar los casos de bancarrota despues de (10) anos de la fecha en que el caso de bancarrota fue presentado. Generalmente, la informacion de mal credito es eliminada despues de siete (7) anos.

Formato para presentar un reclamo por cargos no reconocidos Fecha. Nombre. Numero de tarjeta. Fecha en que se realizo el cargo no reconocido. Nombre del establecimiento. Monto. Firma.

Antes que nada, hay que solicitar el Reporte de Credito Especial en , porque para reclamar algun dato se tiene que hacer sobre un reporte que tenga menos de 90 dias de haber sido emitido.

Pasos para escribir una carta efectiva: Empieza con tu proposito y expresa tus sentimientos.Documenta la fuente de tu queja.Di quien eres.Di lo que te molesta y el dano que hace o, por el contrario, lo que valoras positivamente.Anade mas informacion sobre enfermedad mental.Di lo que quieres que se haga.

Asegurese de incluir los siguientes datos en su carta: Su nombre y numero de cuenta. El monto en dolares del cargo en disputa. La fecha del cargo en disputa. Una explicacion de los motivos por los que piensa que ese cargo es incorrecto.

Llama a tu institucion financiera; reporta los cargos que no reconozcas y cancela tu tarjeta, asi evitaras que los delincuentes realicen otras operaciones. Presenta tu queja en la Unidad Especializada (UNE) de tu Banco, donde te daran una solicitud de aclaracion, puede ser incluso a traves de su portal de internet.

El primer paso consiste en llenar la solicitud de servicio y autorizar a la compania Fix Credit en ayudarle en el proceso de rectificacion de su credito, para ello puede llamar al (787) 941-1212 o puede ir a nuestro Tab Solicitar Servicio, llene el formulario, escoja a alternativa de pago que desee y al someter