Subject: Rectify Inaccurate Credit Report Information with Our Phoenix, Arizona Sample Letter Dear [Credit Reporting Agency], I am writing to address a serious matter wherein my credit report contains erroneous information which I believe requires immediate rectification. I request your prompt attention and assistance in resolving these inaccuracies to ensure the accuracy of my credit history. First and foremost, I would like to introduce myself as [Your Full Name], a resident of Phoenix, Arizona. Having been a responsible consumer and successfully maintaining my financial obligations, I was extremely alarmed to discover discrepancies in my credit report which I recently obtained from your esteemed organization. The credit report in question reflects inaccurate information, including but not limited to: 1. [Inaccurate Information 1]: Provide a description of the incorrect information such as an erroneously reported late payment, an unauthorized account, or any other inaccuracies. 2. [Inaccurate Information 2]: Specify the second instance of erroneous information, if applicable. I kindly request that you thoroughly investigate these discrepancies and take all necessary actions to rectify them promptly. To facilitate this process I have enclosed the relevant supporting documents, including any receipts, statements, or records that prove the inaccuracy of the aforementioned information. As a consumer who values financial integrity and fair reporting, I am well aware of my rights under the Fair Credit Reporting Act (FCRA). According to this federal law, it is imperative that the credit reporting agencies investigate and correct any inaccurate or incomplete information within 30 days of being notified. Failure to comply with these legal obligations may result in legal consequences. In light of the above, I kindly request that you carry out the following actions: 1. Conduct a thorough investigation into the discrepancies mentioned above. 2. Inform the respective creditors/providers of the disputed information about the errors. 3. Provide me with written confirmation of the modifications made to my credit report within the legally required timeline. Furthermore, it is imperative that you furnish me with a free copy of my updated credit report once the necessary adjustments have been made. This will help me verify that all inaccuracies have been addressed thoroughly and completely. Kindly acknowledge receipt of this letter within [number of days, e.g., 10 days] to guarantee its delivery and avoid any further escalation of this issue. It is essential to note that failure to address this matter satisfactorily within the stipulated timeframe may lead to legal action on my part. Thank you for your immediate attention and cooperation in this matter. I trust that you will handle this issue with the utmost professionalism and urgency it warrants. Please find enclosed all the necessary documents for your reference and investigation. Should you require any further clarification or supporting documentation, please do not hesitate to reach out to me at the address and telephone number provided below. Yours sincerely, [Your Full Name] [Your Address] [City, State, ZIP] [Phone Number] [Email Address] --- Types of Phoenix, Arizona Sample Letters for Erroneous Information on Credit Report: 1. Phoenix Arizona Sample Letter for Incorrect Late Payment: Use this letter when your credit report shows a late payment record inaccurately reported by a creditor or lender. 2. Phoenix Arizona Sample Letter for Unauthorized Account: Employ this letter when your credit report exhibits an account that was opened without your knowledge or consent, indicating potential identity theft or fraudulent activity. 3. Phoenix Arizona Sample Letter for Expired Negative Information: Utilize this letter when negative information, such as a debt or derogatory mark, remains on your credit report beyond the legally mandated timeframe. 4. Phoenix Arizona Sample Letter for Duplicate Accounts: Employ this letter if your credit report displays duplicated accounts that inflate your debt or misrepresent your financial standing. 5. Phoenix Arizona Sample Letter for Mixed or Merged Credit Files: Use this letter when your credit report combines your credit information with that of another individual, resulting in inaccurate reporting and potential credit score detriment. Ensure to choose the most relevant sample letter according to the specific inaccuracies you want to address in your credit report.

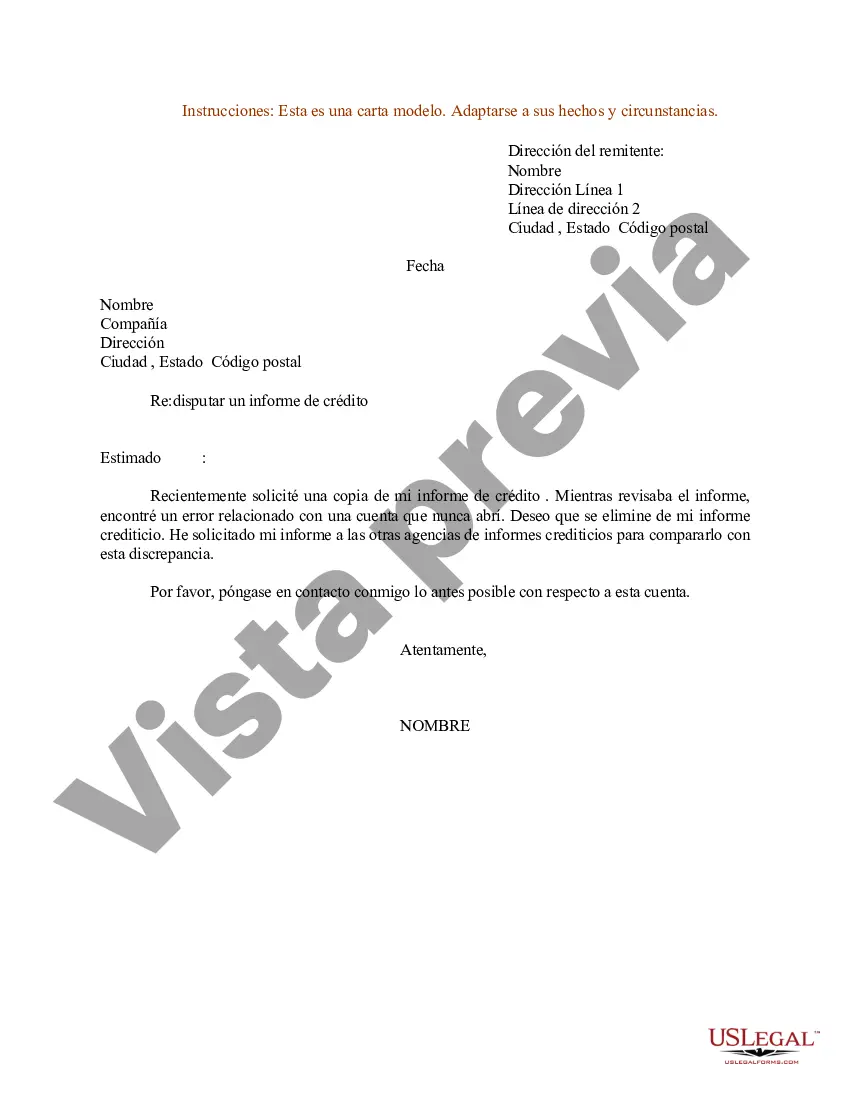

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Phoenix Arizona Ejemplo de carta por información errónea en el informe de crédito - Sample Letter for Erroneous Information on Credit Report

Description

How to fill out Phoenix Arizona Ejemplo De Carta Por Información Errónea En El Informe De Crédito?

Dealing with legal forms is a must in today's world. Nevertheless, you don't always need to seek qualified assistance to draft some of them from the ground up, including Phoenix Sample Letter for Erroneous Information on Credit Report, with a service like US Legal Forms.

US Legal Forms has more than 85,000 templates to pick from in various types varying from living wills to real estate paperwork to divorce papers. All forms are arranged based on their valid state, making the searching experience less overwhelming. You can also find information resources and guides on the website to make any activities related to document execution simple.

Here's how you can find and download Phoenix Sample Letter for Erroneous Information on Credit Report.

- Take a look at the document's preview and outline (if available) to get a basic idea of what you’ll get after getting the form.

- Ensure that the template of your choice is adapted to your state/county/area since state laws can affect the legality of some documents.

- Examine the similar forms or start the search over to locate the right document.

- Click Buy now and create your account. If you already have an existing one, choose to log in.

- Choose the option, then a suitable payment method, and buy Phoenix Sample Letter for Erroneous Information on Credit Report.

- Select to save the form template in any available format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the needed Phoenix Sample Letter for Erroneous Information on Credit Report, log in to your account, and download it. Of course, our platform can’t replace a lawyer entirely. If you need to cope with an exceptionally challenging case, we recommend using the services of an attorney to review your form before signing and filing it.

With over 25 years on the market, US Legal Forms became a go-to platform for various legal forms for millions of users. Become one of them today and get your state-compliant paperwork effortlessly!