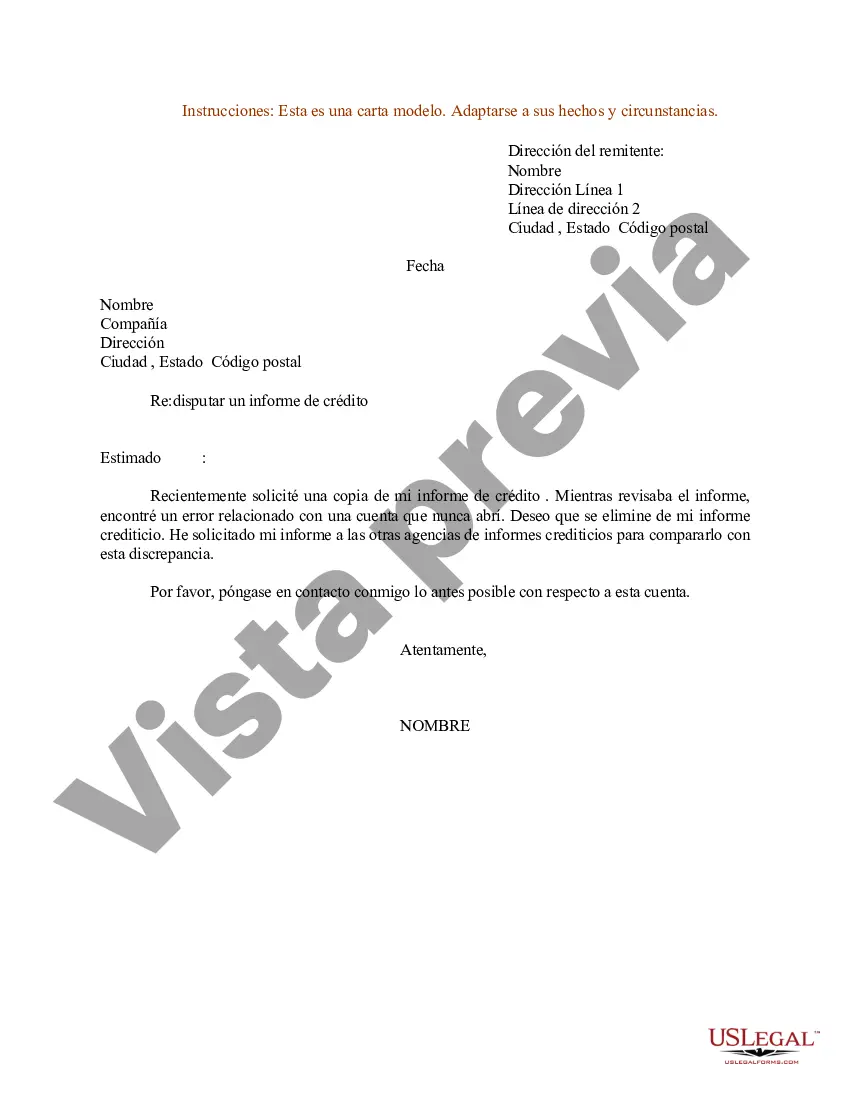

Subject: Rectification of Inaccurate Credit Report Information Dear [Credit Bureau], I am writing to address the presence of erroneous information on my credit report. This letter is intended to dispute and request the removal of the inaccurate details that unfairly affect my creditworthiness. I have conducted a thorough review of my credit report, and it has come to my attention that several inaccuracies exist, particularly in relation to my San Antonio, Texas residence. As a proud resident of San Antonio, Texas, I am deeply concerned about the impact these inaccuracies have on my financial well-being. San Antonio is a vibrant and culturally diverse city nestled in the heart of Texas. It boasts a rich history, iconic landmarks, and a thriving economy. From the historic Alamo to the enchanting River Walk, San Antonio is a city that encapsulates the true spirit of Texas. In terms of erroneous information, I have noticed that my previous address is incorrectly listed as 123 Main Street, whereas my actual address during the specified period was 456 Park Avenue. This misinformation has negatively affected my creditworthiness by possibly associating my name with inaccurately reported financial activities. To rectify this situation, I kindly request that you promptly investigate and correct this discrepancy. I have attached documents, such as utility bills and lease agreements, reflecting my proper address during the inaccurately reported period. Please cross-reference this evidence to ensure my credit report accurately reflects my residency in San Antonio, Texas. Furthermore, in accordance with the Fair Credit Reporting Act, I expect you to provide me with a written confirmation of the rectification within 30 days from the receipt of this letter. Additionally, please share an updated copy of my credit report to ensure that all other information is accurate and free from any further discrepancies. In the event that an investigation reveals that this misinformation has impacted my credit score, I urge you to take immediate action to restore my creditworthiness. This erroneous reporting has caused significant distress and prevented me from accessing fair financial opportunities. Should you require any additional information or documentation, please do not hesitate to contact me at [Your Phone Number] or [Your Email Address]. I trust that you will handle this matter promptly and professionally, adhering to the regulations set forth by applicable laws. Thank you for your immediate attention to this matter. I trust that you will take the necessary steps to rectify this erroneous information and restore the accuracy of my credit report. Yours sincerely, [Your Full Name] [Your Address] [City, State, Zip Code]

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Antonio Texas Ejemplo de carta por información errónea en el informe de crédito - Sample Letter for Erroneous Information on Credit Report

Description

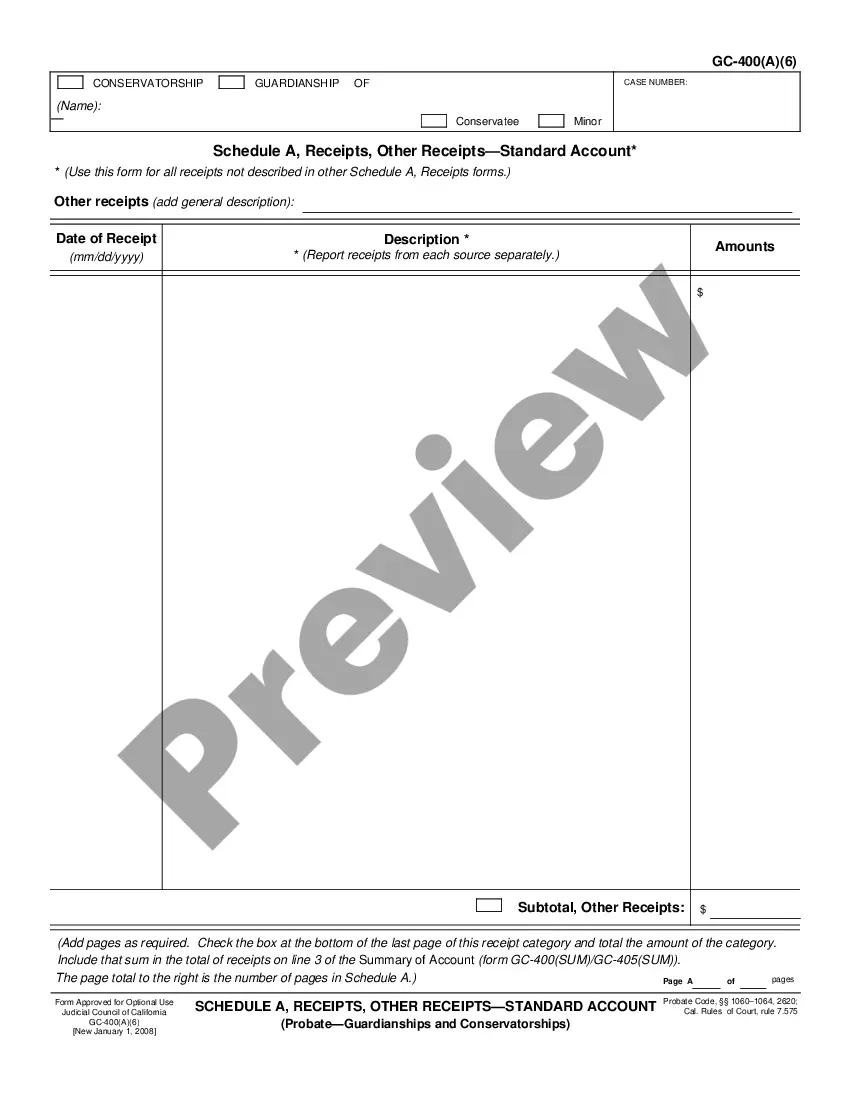

How to fill out San Antonio Texas Ejemplo De Carta Por Información Errónea En El Informe De Crédito?

A document routine always goes along with any legal activity you make. Staring a business, applying or accepting a job offer, transferring ownership, and lots of other life situations demand you prepare official paperwork that differs throughout the country. That's why having it all accumulated in one place is so beneficial.

US Legal Forms is the largest online library of up-to-date federal and state-specific legal forms. Here, you can easily find and get a document for any individual or business objective utilized in your county, including the San Antonio Sample Letter for Erroneous Information on Credit Report.

Locating templates on the platform is extremely straightforward. If you already have a subscription to our library, log in to your account, find the sample using the search field, and click Download to save it on your device. After that, the San Antonio Sample Letter for Erroneous Information on Credit Report will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this simple guide to obtain the San Antonio Sample Letter for Erroneous Information on Credit Report:

- Ensure you have opened the correct page with your localised form.

- Make use of the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the template corresponds to your requirements.

- Look for another document using the search tab in case the sample doesn't fit you.

- Click Buy Now once you find the required template.

- Select the appropriate subscription plan, then sign in or create an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and save the San Antonio Sample Letter for Erroneous Information on Credit Report on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most reliable way to obtain legal documents. All the templates provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs effectively with the US Legal Forms!

Form popularity

FAQ

¿Como puede disputar una deuda? Dentro de treinta dias de haber recibido la notificacion de la deuda por escrito, envie una carta a la agencia de cobranza disputando la deuda. Puede utilizar esta Carta de Disputa Ejemplar (PDF).

Pasos para escribir una carta efectiva: Empieza con tu proposito y expresa tus sentimientos.Documenta la fuente de tu queja.Di quien eres.Di lo que te molesta y el dano que hace o, por el contrario, lo que valoras positivamente.Anade mas informacion sobre enfermedad mental.Di lo que quieres que se haga.

Ocho pasos para eliminar deudas antiguas de tu reporte crediticio Verifica la antiguedad.Confirma la antiguedad de la deuda saldada.Obten los tres reportes de credito.Envia cartas a las agencias de credito.Envia una carta al acreedor informante.Consigue una atencion especial.

La ley estipula que las agencias de reporte de credito no deben reportar los casos de bancarrota despues de (10) anos de la fecha en que el caso de bancarrota fue presentado. Generalmente, la informacion de mal credito es eliminada despues de siete (7) anos.

La carta informativa a clientes es un documento que emplean con frecuencia las empresas y las instituciones publicas, con el objetivo de trasladar datos que consideran que el publico debe conocer: cambios relativos a la propia organizacion, nuevas aperturas, promociones, inicio de plazos, avisos, etc.

Para hacer una carta, se empieza con un encabezado correcto en el que se indique el nombre y datos de la persona a la que va dirigida la carta, ademas del cargo que ocupa si la enviamos a una empresa o departamento publico. Se aconseja, ademas, hacer una minima referencia al tema que se va a tratar en la carta.

Una carta de disputa de credito es un documento que puede enviar a las agencias de credito para senalar inexactitudes en sus informes de credito y solicitar la eliminacion de los errores (en ingles). En la carta, puede explicar por que cree que las informaciones son inexactas y proveer los documentos de respaldo.

Datos esenciales en un reporte de errores Incluir un titulo descriptivo.Describir las circunstancias en las que ocurre el problema.Mencionar la plataforma o sistema operativo que se ha empleado.Mencionar el numero de veces que se ha repetido el error.

¿Que debo incluir en mi carta de disputa crediticia? La fecha actual. Su informacion (nombre, informacion de contacto, fecha de nacimiento y numero de cuenta) La informacion de contacto de la agencia de credito. Una breve descripcion del error (no es necesario contarles una historia larga y complicada)

Asegurese de incluir los siguientes datos en su carta: Su nombre y numero de cuenta. El monto en dolares del cargo en disputa. La fecha del cargo en disputa. Una explicacion de los motivos por los que piensa que ese cargo es incorrecto.