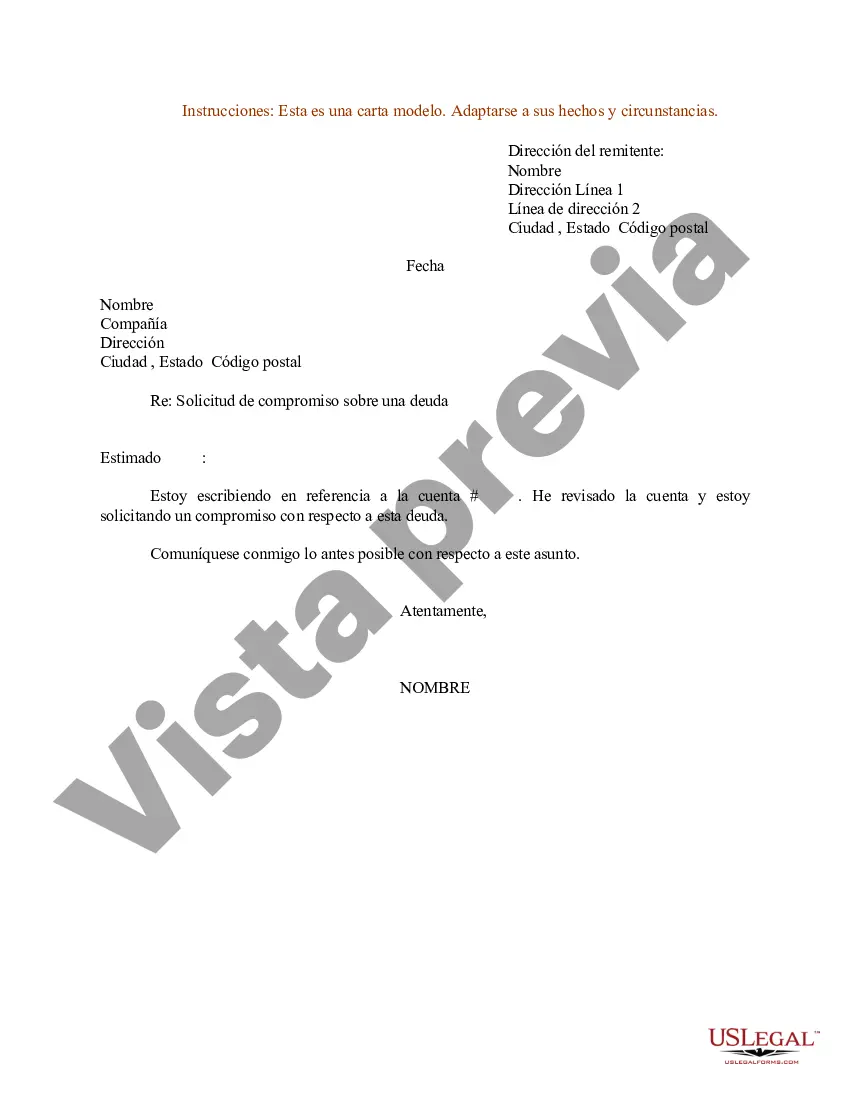

A Cook County debt compromise, also known as a debt settlement, is a procedure where debtors in Illinois reach an agreement with their creditors to settle their outstanding debt for a reduced amount. This process can help individuals or businesses facing financial hardships to reestablish their financial stability. A sample letter for compromise on a debt in Cook County, Illinois typically includes the following important components: 1. Heading: Include your contact information (name, address, phone number, and email) at the top of the letter. 2. Date: Write the current date of the letter. 3. Creditor's Information: Provide the creditor's contact details, such as the name of the company, address, and phone number. 4. Subject Line: Clearly state the purpose of the letter as a request for a debt compromise or settlement. 5. Salutation: Begin the letter with a polite salutation, addressing the creditor by their proper title (e.g., "Dear Mr./Ms./Mrs."). 6. Introduction: Begin the letter by briefly introducing yourself, explaining the circumstances that have led to your financial difficulties, and expressing your genuine intent to resolve the debt. 7. Debt Details: Clearly state the debt amount owed, including any interest or late fees that may have accrued over time. Include the original date the debt was incurred and any pertinent account numbers or reference information. 8. Financial Situation: Provide an overview of your current financial situation, emphasizing any hardships or changes in circumstances that have made it challenging for you to repay the debt in full. 9. Proposed Compromise: Offer a specific percentage or amount of the original debt that you are able to pay as a settlement. Express your willingness to make the payment promptly upon reaching a mutual agreement. 10. Justification for Compromise: Provide a detailed explanation for why the proposed compromise amount is fair, considering your financial constraints. Describe the potential consequences for both parties if a compromise is not reached. 11. Request for Confirmation: Kindly request that the creditor confirms their acceptance of the proposed compromise in writing. This will ensure that both parties are clear on the terms of the settlement and avoid any potential misunderstandings. 12. Contact Information: Include your contact details once again at the end of the letter, along with an invitation for the creditor to reach out to you with any questions or concerns. 13. Closing: End the letter with a professional closing, such as "Sincerely" or "Yours faithfully," followed by your name and signature. It is important to note that the specific content and structure of a Cook County debt compromise letter may vary depending on the individual's or business's unique circumstances. Seeking professional advice or assistance, such as consulting an attorney or a credit counseling agency, can be beneficial in navigating the debt compromise process effectively. Different variations of Cook Illinois Sample Letters for Compromise on a Debt may include letters tailored for credit card debt, medical debt, mortgage debt, or personal loan debt. Each letter should be personalized based on the specific debt type and individual circumstances while adhering to the general format and guidelines mentioned above.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cook Illinois Ejemplo de carta de compromiso sobre una deuda - Sample Letter for Compromise on a Debt

Description

How to fill out Cook Illinois Ejemplo De Carta De Compromiso Sobre Una Deuda?

Preparing legal paperwork can be cumbersome. Besides, if you decide to ask an attorney to write a commercial contract, papers for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Cook Sample Letter for Compromise on a Debt, it may cost you a lot of money. So what is the best way to save time and money and draft legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is a perfect solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is the most extensive online collection of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any scenario accumulated all in one place. Therefore, if you need the latest version of the Cook Sample Letter for Compromise on a Debt, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample with the Download button. If you haven't subscribed yet, here's how you can get the Cook Sample Letter for Compromise on a Debt:

- Glance through the page and verify there is a sample for your area.

- Examine the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't suit your requirements - search for the correct one in the header.

- Click Buy Now when you find the needed sample and pick the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a payment with a credit card or via PayPal.

- Choose the file format for your Cook Sample Letter for Compromise on a Debt and save it.

Once finished, you can print it out and complete it on paper or import the template to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the documents ever obtained multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!