This form is a notice of a failure to make a required payment when due pursuant to a promissory note. The form also contains a warning to the breaching party that legal action will be taken unless the breach is remedied on or before a certain date. This form is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a notice in a particular jurisdiction.

Allegheny County, located in the state of Pennsylvania, is a region known for its rich history, diverse culture, and thriving economy. In legal matters concerning financial transactions, specifically promissory notes, a Notice of Default in Payment Due on Promissory Note may be served to the involved parties when a borrower fails to meet their payment obligations. A Notice of Default is a legal document that notifies a borrower of their failure to fulfill the payment terms stated in a promissory note. This notice initiates a formal process to resolve the delinquency and may pertain to various types of promissory notes, such as: 1. Residential Promissory Note: This type of note involves borrowing and lending for residential properties like homes or apartment complexes. The Notice of Default alerts the borrower of their overdue payments and outlines the necessary actions to be taken. 2. Commercial Promissory Note: For loans related to commercial real estate, including office buildings, retail spaces, or industrial properties, this notice addresses the non-payment issues and provides a path towards resolution. 3. Business Promissory Note: In cases where individuals or businesses lend money to support business operations, the Notice of Default notifies the borrower of non-payment, ensuring they are aware of the consequences and potential legal actions. 4. Personal Promissory Note: Sometimes, individuals borrow money from friends, family members, or acquaintances using a personal promissory note. When payments are not made as agreed, the lender may send a Notice of Default to address the matter and seek a remedy. 5. Convertible Promissory Note: This unique type of promissory note gives the lender an option to convert the debt into equity in the borrower's company. If the payment obligation is not fulfilled, a Notice of Default serves as a first step towards potential conversion or resolution. When serving a Notice of Default in Allegheny County, Pennsylvania, the document must adhere to the county's legal requirements and include essential information such as: — Names and contact details of both parties involved in the promissory note. — Detailed description of the promissory note, including the loan amount, interest rate, and payment terms. — A clear statement of the borrower's failure to make timely payments, specifying the outstanding amount and overdue period. — An explanation of the consequences if prompt payment is not received within a given timeframe. — Information regarding any potential remedies, borrower's rights, or opportunities to resolve the default. — Guidance on how to respond to the notice or request a meeting to discuss the matter further. In conclusion, Allegheny County, Pennsylvania, follows a standard protocol when issuing a Notice of Default in Payment Due on Promissory Note. It applies to a range of promissory note scenarios, including residential, commercial, business, personal, and convertible notes. Attention to detail and adherence to legal requirements are crucial when drafting and issuing such notices to ensure the proper resolution of payment defaults.Allegheny County, located in the state of Pennsylvania, is a region known for its rich history, diverse culture, and thriving economy. In legal matters concerning financial transactions, specifically promissory notes, a Notice of Default in Payment Due on Promissory Note may be served to the involved parties when a borrower fails to meet their payment obligations. A Notice of Default is a legal document that notifies a borrower of their failure to fulfill the payment terms stated in a promissory note. This notice initiates a formal process to resolve the delinquency and may pertain to various types of promissory notes, such as: 1. Residential Promissory Note: This type of note involves borrowing and lending for residential properties like homes or apartment complexes. The Notice of Default alerts the borrower of their overdue payments and outlines the necessary actions to be taken. 2. Commercial Promissory Note: For loans related to commercial real estate, including office buildings, retail spaces, or industrial properties, this notice addresses the non-payment issues and provides a path towards resolution. 3. Business Promissory Note: In cases where individuals or businesses lend money to support business operations, the Notice of Default notifies the borrower of non-payment, ensuring they are aware of the consequences and potential legal actions. 4. Personal Promissory Note: Sometimes, individuals borrow money from friends, family members, or acquaintances using a personal promissory note. When payments are not made as agreed, the lender may send a Notice of Default to address the matter and seek a remedy. 5. Convertible Promissory Note: This unique type of promissory note gives the lender an option to convert the debt into equity in the borrower's company. If the payment obligation is not fulfilled, a Notice of Default serves as a first step towards potential conversion or resolution. When serving a Notice of Default in Allegheny County, Pennsylvania, the document must adhere to the county's legal requirements and include essential information such as: — Names and contact details of both parties involved in the promissory note. — Detailed description of the promissory note, including the loan amount, interest rate, and payment terms. — A clear statement of the borrower's failure to make timely payments, specifying the outstanding amount and overdue period. — An explanation of the consequences if prompt payment is not received within a given timeframe. — Information regarding any potential remedies, borrower's rights, or opportunities to resolve the default. — Guidance on how to respond to the notice or request a meeting to discuss the matter further. In conclusion, Allegheny County, Pennsylvania, follows a standard protocol when issuing a Notice of Default in Payment Due on Promissory Note. It applies to a range of promissory note scenarios, including residential, commercial, business, personal, and convertible notes. Attention to detail and adherence to legal requirements are crucial when drafting and issuing such notices to ensure the proper resolution of payment defaults.

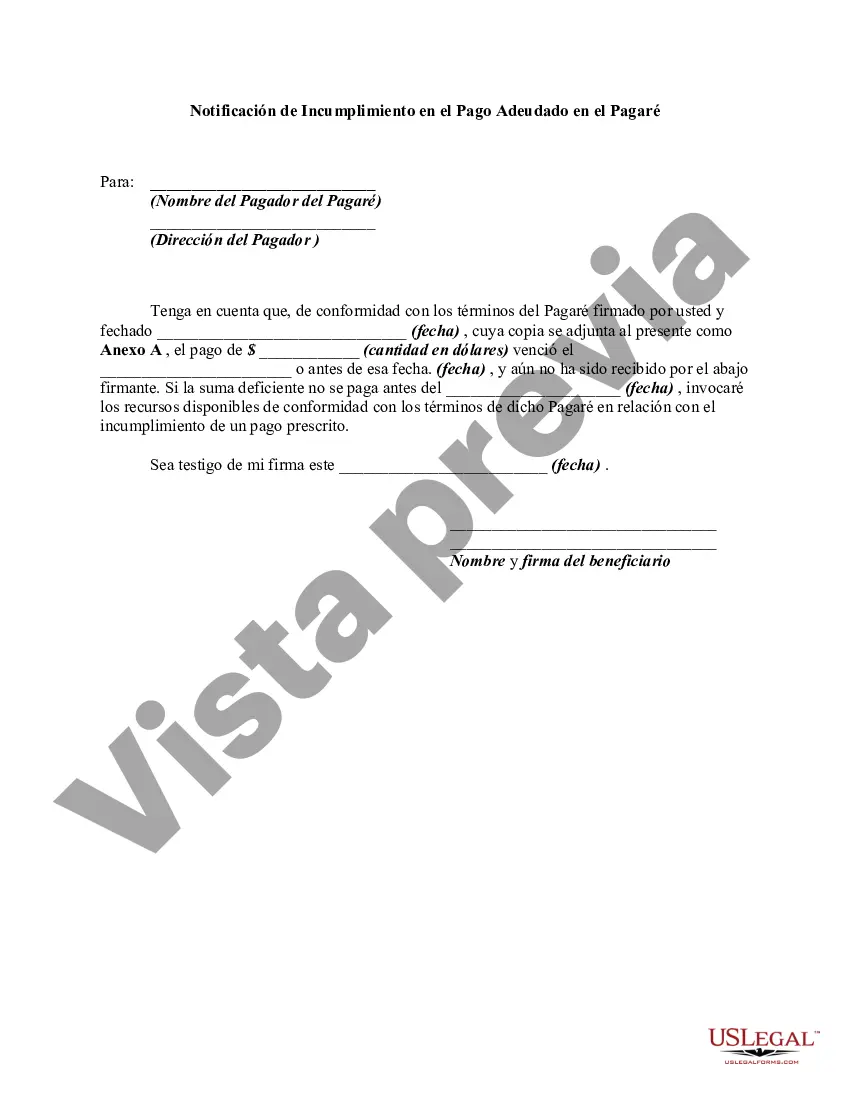

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.