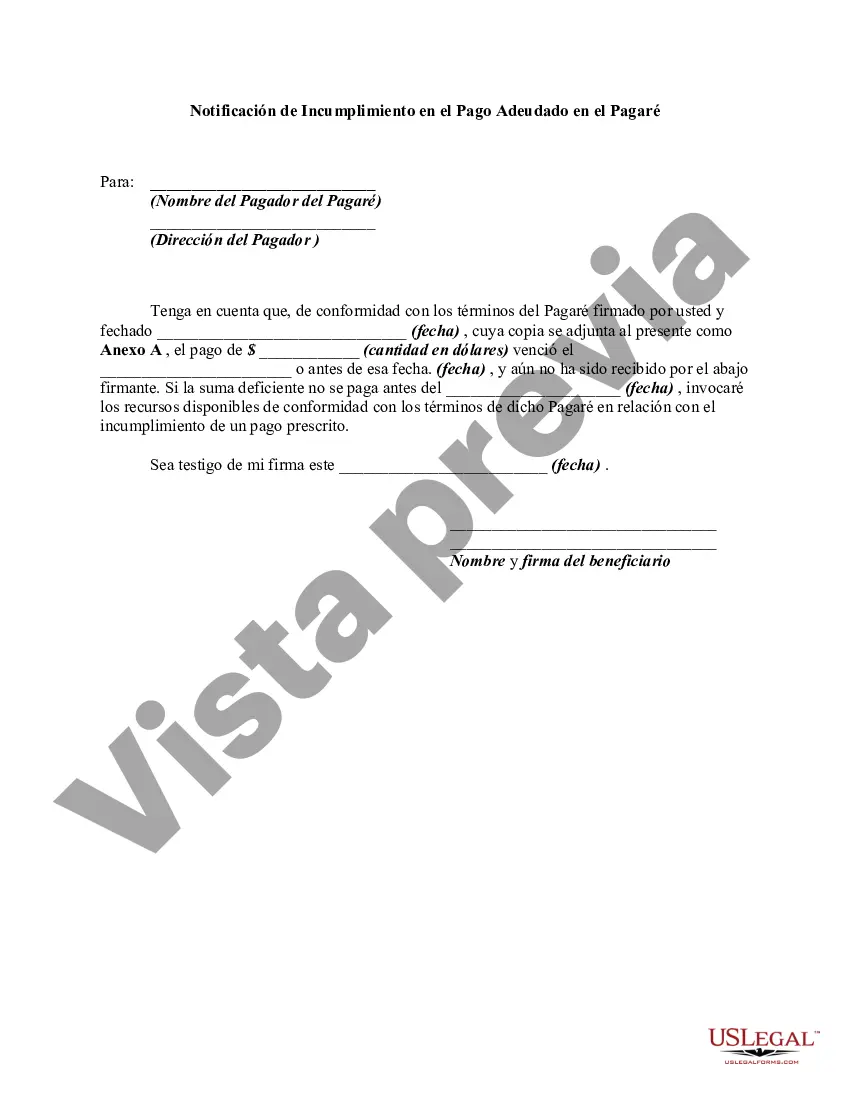

This form is a notice of a failure to make a required payment when due pursuant to a promissory note. The form also contains a warning to the breaching party that legal action will be taken unless the breach is remedied on or before a certain date. This form is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a notice in a particular jurisdiction.

The Bexar, Texas Notice of Default in Payment Due on Promissory Note is a legal document that notifies the borrower of their failure to make timely payments on a promissory note. This notice serves as a formal warning to the borrower, outlining the consequences of continued nonpayment and the potential legal actions that may be taken. A Notice of Default is typically issued by the lender or the party holding the promissory note. It highlights the specific payment(s) that have been missed, the total amount due, including any late fees or penalties, and the deadline by which payment should be made to avoid further consequences. Bexar County, located in Texas, follows state regulations and guidelines when it comes to issuing Notices of Default. These notices aim to inform borrowers about their financial obligations and provide an opportunity to rectify the situation before any further legal actions are taken. Different types of Bexar, Texas Notices of Default in Payment Due on Promissory Note may include: 1. Initial Notice of Default: This is the first notice issued to the borrower, typically after a single missed payment. It serves as a reminder of the payment due, including any late fees incurred. The borrower is given a specific period, usually 30 days, to bring their payments up to date. 2. Second Notice of Default: If the borrower fails to rectify the default within the given timeframe, a second notice is issued, indicating increasing seriousness. This notice might include a more urgent tone, emphasizing the immediate need for payment compliance to avoid further legal actions. 3. Final Notice of Default: If the borrower continues to neglect payments without adequate response, a final notice is issued. At this stage, the lender typically considers legal remedies, such as initiating foreclosure proceedings or taking legal action to recover the debt. It is important to note that every Bexar, Texas Notice of Default in Payment Due on Promissory Note should comply with the state and local laws, ensuring that all required information is included and that the notice is delivered to the borrower through the appropriate legal channels. If you have received a Bexar, Texas Notice of Default in Payment Due on Promissory Note, it is crucial to promptly address the situation by contacting the lender and discussing potential options for repayment or resolution. Seeking professional legal counsel may also be beneficial to fully understand your rights and obligations in this matter.The Bexar, Texas Notice of Default in Payment Due on Promissory Note is a legal document that notifies the borrower of their failure to make timely payments on a promissory note. This notice serves as a formal warning to the borrower, outlining the consequences of continued nonpayment and the potential legal actions that may be taken. A Notice of Default is typically issued by the lender or the party holding the promissory note. It highlights the specific payment(s) that have been missed, the total amount due, including any late fees or penalties, and the deadline by which payment should be made to avoid further consequences. Bexar County, located in Texas, follows state regulations and guidelines when it comes to issuing Notices of Default. These notices aim to inform borrowers about their financial obligations and provide an opportunity to rectify the situation before any further legal actions are taken. Different types of Bexar, Texas Notices of Default in Payment Due on Promissory Note may include: 1. Initial Notice of Default: This is the first notice issued to the borrower, typically after a single missed payment. It serves as a reminder of the payment due, including any late fees incurred. The borrower is given a specific period, usually 30 days, to bring their payments up to date. 2. Second Notice of Default: If the borrower fails to rectify the default within the given timeframe, a second notice is issued, indicating increasing seriousness. This notice might include a more urgent tone, emphasizing the immediate need for payment compliance to avoid further legal actions. 3. Final Notice of Default: If the borrower continues to neglect payments without adequate response, a final notice is issued. At this stage, the lender typically considers legal remedies, such as initiating foreclosure proceedings or taking legal action to recover the debt. It is important to note that every Bexar, Texas Notice of Default in Payment Due on Promissory Note should comply with the state and local laws, ensuring that all required information is included and that the notice is delivered to the borrower through the appropriate legal channels. If you have received a Bexar, Texas Notice of Default in Payment Due on Promissory Note, it is crucial to promptly address the situation by contacting the lender and discussing potential options for repayment or resolution. Seeking professional legal counsel may also be beneficial to fully understand your rights and obligations in this matter.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.