This form is a notice of a failure to make a required payment when due pursuant to a promissory note. The form also contains a warning to the breaching party that legal action will be taken unless the breach is remedied on or before a certain date. This form is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a notice in a particular jurisdiction.

A Bronx New York Notice of Default in Payment Due on Promissory Note is a legal document issued to notify the borrower that they have not made the required payments on a promissory note. It signifies that the borrower is in default and has failed to fulfill their financial obligation. Keywords: Bronx New York, Notice of Default, Payment Due, Promissory Note, borrower, default, financial obligation The Bronx New York Notice of Default in Payment Due on Promissory Note serves as an official communication from the lender to the borrower, outlining the specific terms and conditions of the defaulted promissory note. It provides an explicit declaration that the borrower has fallen behind on their scheduled payments. There are different types of Bronx New York Notice of Default in Payment Due on Promissory Note, categorized based on the severity and stage of delinquency: 1. Preliminary Notice of Default: This type of notice is usually mailed or delivered to the borrower when the first payment is missed or when there is a delay in making the payment. It is a formal reminder alerting the borrower of the missed payment and the consequences of continued non-payment. 2. Final Notice of Default: If the borrower does not rectify the payment default after receiving the preliminary notice, a final notice of default is issued. This serves as a more severe warning to the borrower, detailing the immediate actions required to cure the default and avoid further legal consequences. 3. Notice of Intent to Accelerate: When a borrower fails to cure the default within the specified timeframe after receiving the final notice of default, the lender may issue a Notice of Intent to Accelerate. This document informs the borrower that the entire remaining amount of the promissory note is due immediately, triggering acceleration provisions. 4. Notice of Sale: In cases where the borrower continues to default after receiving the notice of intent to accelerate, the lender may proceed with foreclosure. A Notice of Sale is then issued to inform the borrower and other interested parties about the upcoming foreclosure sale. 5. Notice of Disposition: After the foreclosure sale, if the property is sold, a Notice of Disposition is sent to inform the borrower of the outcome. This notice provides information about the sale price, any remaining balance due after applying the proceeds, and any further steps the lender intends to take. It is important to note that the specific language and legal requirements for a Bronx New York Notice of Default in Payment Due on Promissory Note can vary depending on the jurisdiction and the terms outlined in the promissory note agreement. It is recommended that borrowers seek legal advice and review the relevant documents thoroughly to understand their rights and obligations in such situations.

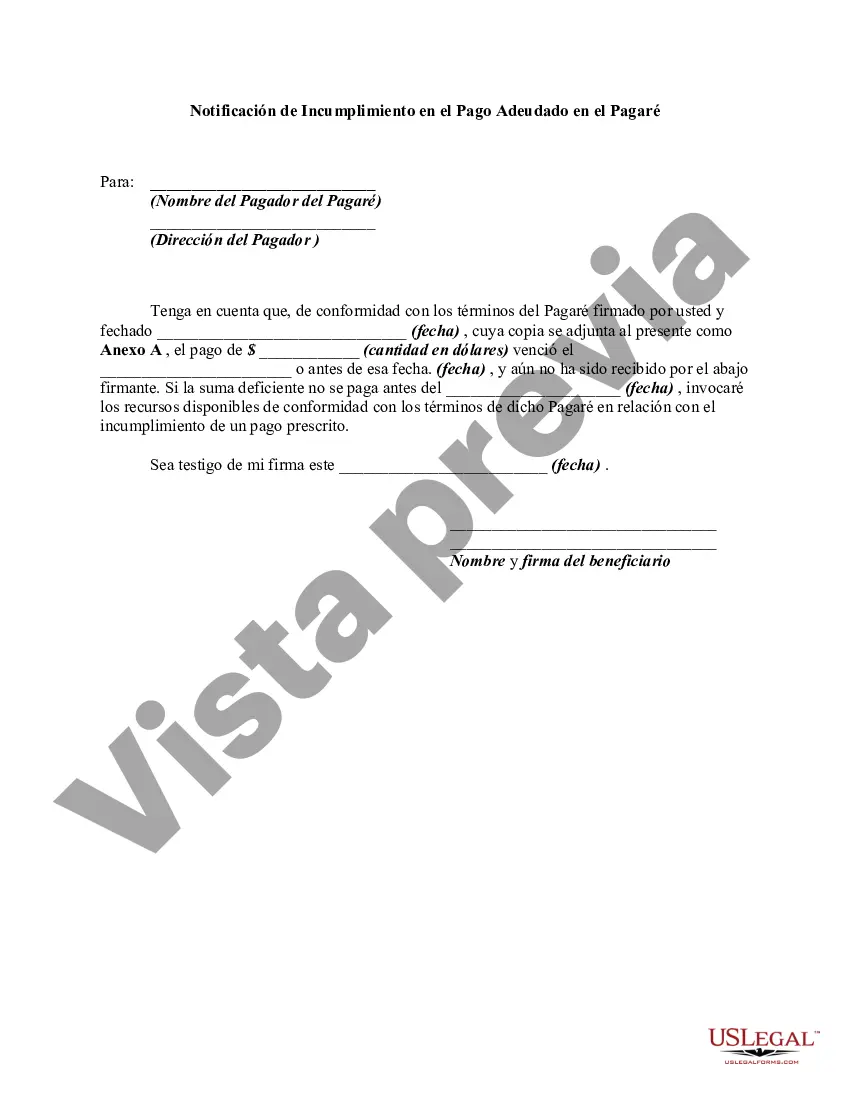

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.