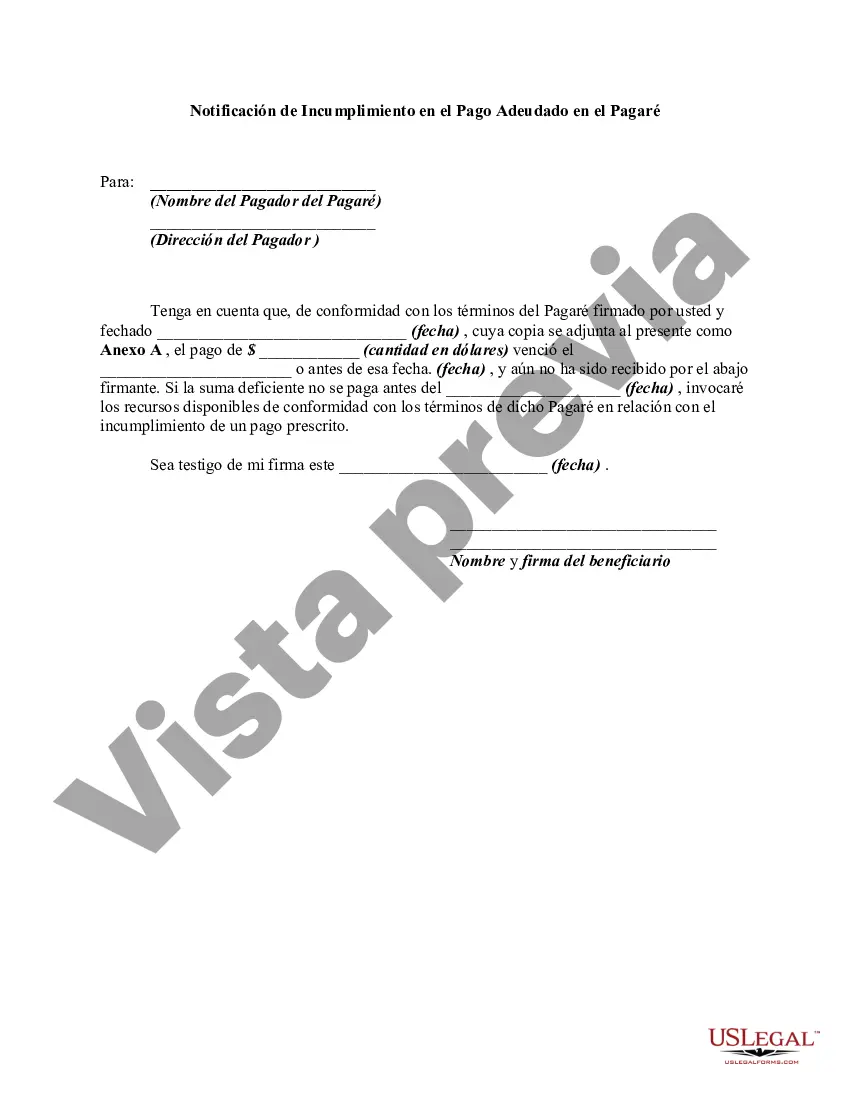

This form is a notice of a failure to make a required payment when due pursuant to a promissory note. The form also contains a warning to the breaching party that legal action will be taken unless the breach is remedied on or before a certain date. This form is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a notice in a particular jurisdiction.

A Broward Florida Notice of Default in Payment Due on Promissory Note is a formal document sent to a borrower notifying them of their failure to make a timely payment on their promissory note. It serves as a warning that further action may be taken if the payment is not settled promptly. In Broward County, Florida, there are different types of Notices of Default in Payment Due on Promissory Notes. Some common variations include: 1. Residential Mortgage Note Default Notice: This type of notice is typically issued when the borrower fails to make their scheduled mortgage payments on their residential property, such as a house or condominium, located in Broward County, Florida. 2. Commercial Promissory Note Default Notice: When a borrower defaults on their commercial loan obligations, including loans for businesses or investment properties within Broward County, Florida, a Commercial Promissory Note Default Notice is sent to the borrower. 3. Student Loan Default Notice: If a borrower neglects to make scheduled repayments on their student loan, they may receive a Student Loan Default Notice, specifically tailored to meet the requirements set by financial institutions and educational organizations in Broward County, Florida. 4. Personal Loan Default Notice: This type of Broward Florida Notice of Default applies to personal loans obtained from lenders operating in the county. It alerts borrowers about their non-payment of installment loans, payday loans, or any other form of personal financing. A Broward Florida Notice of Default in Payment Due on Promissory Note typically includes crucial details such as the borrower's information (name, address, and contact details), lender information (name, address, and contact details), the date when the default occurred, the exact amount overdue, and a deadline to fulfill the payment obligation. It may also outline the consequences of continued non-payment, which could include legal action, forfeiture of collateral, or damage to the borrower's credit score. The issuance of a Broward Florida Notice of Default in Payment Due on Promissory Note is a significant step in the borrower-lender relationship. It aims to formalize the delinquency and encourage immediate action to rectify the payment default. It is crucial for borrowers to address the default promptly to avoid further repercussions and to maintain a positive financial reputation. Lenders, on the other hand, utilize this notice as a necessary precursor to potential legal or collections actions should the default persist.A Broward Florida Notice of Default in Payment Due on Promissory Note is a formal document sent to a borrower notifying them of their failure to make a timely payment on their promissory note. It serves as a warning that further action may be taken if the payment is not settled promptly. In Broward County, Florida, there are different types of Notices of Default in Payment Due on Promissory Notes. Some common variations include: 1. Residential Mortgage Note Default Notice: This type of notice is typically issued when the borrower fails to make their scheduled mortgage payments on their residential property, such as a house or condominium, located in Broward County, Florida. 2. Commercial Promissory Note Default Notice: When a borrower defaults on their commercial loan obligations, including loans for businesses or investment properties within Broward County, Florida, a Commercial Promissory Note Default Notice is sent to the borrower. 3. Student Loan Default Notice: If a borrower neglects to make scheduled repayments on their student loan, they may receive a Student Loan Default Notice, specifically tailored to meet the requirements set by financial institutions and educational organizations in Broward County, Florida. 4. Personal Loan Default Notice: This type of Broward Florida Notice of Default applies to personal loans obtained from lenders operating in the county. It alerts borrowers about their non-payment of installment loans, payday loans, or any other form of personal financing. A Broward Florida Notice of Default in Payment Due on Promissory Note typically includes crucial details such as the borrower's information (name, address, and contact details), lender information (name, address, and contact details), the date when the default occurred, the exact amount overdue, and a deadline to fulfill the payment obligation. It may also outline the consequences of continued non-payment, which could include legal action, forfeiture of collateral, or damage to the borrower's credit score. The issuance of a Broward Florida Notice of Default in Payment Due on Promissory Note is a significant step in the borrower-lender relationship. It aims to formalize the delinquency and encourage immediate action to rectify the payment default. It is crucial for borrowers to address the default promptly to avoid further repercussions and to maintain a positive financial reputation. Lenders, on the other hand, utilize this notice as a necessary precursor to potential legal or collections actions should the default persist.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.