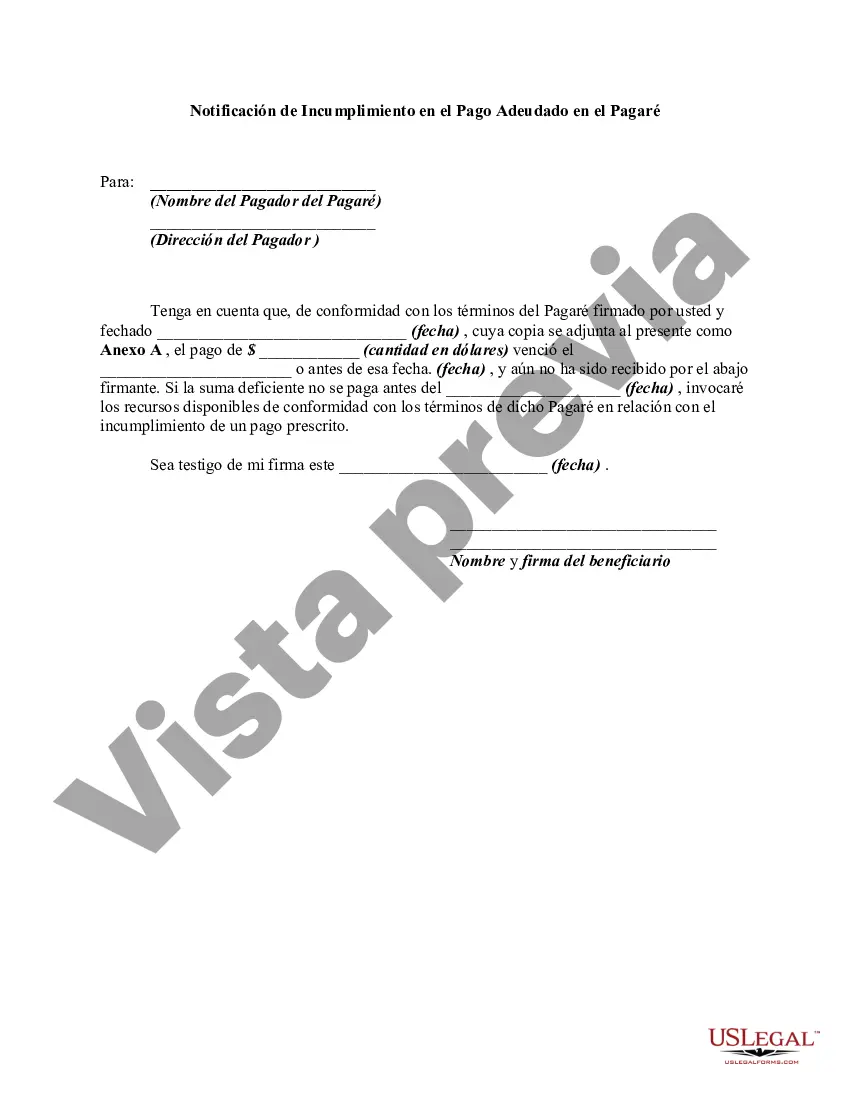

This form is a notice of a failure to make a required payment when due pursuant to a promissory note. The form also contains a warning to the breaching party that legal action will be taken unless the breach is remedied on or before a certain date. This form is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a notice in a particular jurisdiction.

The Harris Texas Notice of Default in Payment Due on Promissory Note is an official document that notifies the borrower of their failure to make timely payments on a promissory note. This legal notice serves as a warning to the borrower that they have breached the terms of the agreement. A Notice of Default in Payment Due on Promissory Note is typically issued when a borrower falls behind on their scheduled payments. It outlines the amount overdue, the date of default, and the consequences the borrower may face if the payment is not made promptly. In Harris County, Texas, different types of Notice of Default in Payment Due on Promissory Note may include: 1. Residential Mortgage Default: This type of notice is specific to defaults on residential property loans, such as home mortgages. Lenders issue this notice to inform homeowners about their failure to make payments as agreed upon. 2. Commercial Loan Default: In cases where a commercial property loan is involved, lenders issue this notice to notify borrowers of their default on payments related to commercial mortgages or business loans. 3. Promissory Note Default: This notice addresses any default on a promissory note. It typically involves unsecured loans, personal loans, or loans relating to specific assets, where no property is held as collateral. 4. Adjustable-rate Mortgage Default: This notice pertains to defaults on adjustable-rate mortgages, where the interest rates fluctuate at specific intervals. If the borrower fails to make the required payment adjustments, the lender will issue this notice. When a borrower receives a Harris Texas Notice of Default in Payment Due on Promissory Note, it is crucial to take immediate action to rectify the non-payment. Ignoring or failing to respond to such notices can lead to severe consequences, such as foreclosure, repossession, or legal action by the lender. It is advisable for borrowers who receive a Notice of Default to consult with an attorney or seek professional financial advice to explore potential solutions, such as loan modification, repayment plans, or refinancing options. Timely communication with the lender may help in resolving the default and avoiding further legal complications. In conclusion, the Harris Texas Notice of Default in Payment Due on Promissory Note is an essential legal document issued when a borrower fails to make payments as agreed upon. It serves as a warning and provides an opportunity for the borrower to rectify the default before facing more severe consequences. Prompt response and seeking appropriate professional guidance are crucial for borrowers in such situations.The Harris Texas Notice of Default in Payment Due on Promissory Note is an official document that notifies the borrower of their failure to make timely payments on a promissory note. This legal notice serves as a warning to the borrower that they have breached the terms of the agreement. A Notice of Default in Payment Due on Promissory Note is typically issued when a borrower falls behind on their scheduled payments. It outlines the amount overdue, the date of default, and the consequences the borrower may face if the payment is not made promptly. In Harris County, Texas, different types of Notice of Default in Payment Due on Promissory Note may include: 1. Residential Mortgage Default: This type of notice is specific to defaults on residential property loans, such as home mortgages. Lenders issue this notice to inform homeowners about their failure to make payments as agreed upon. 2. Commercial Loan Default: In cases where a commercial property loan is involved, lenders issue this notice to notify borrowers of their default on payments related to commercial mortgages or business loans. 3. Promissory Note Default: This notice addresses any default on a promissory note. It typically involves unsecured loans, personal loans, or loans relating to specific assets, where no property is held as collateral. 4. Adjustable-rate Mortgage Default: This notice pertains to defaults on adjustable-rate mortgages, where the interest rates fluctuate at specific intervals. If the borrower fails to make the required payment adjustments, the lender will issue this notice. When a borrower receives a Harris Texas Notice of Default in Payment Due on Promissory Note, it is crucial to take immediate action to rectify the non-payment. Ignoring or failing to respond to such notices can lead to severe consequences, such as foreclosure, repossession, or legal action by the lender. It is advisable for borrowers who receive a Notice of Default to consult with an attorney or seek professional financial advice to explore potential solutions, such as loan modification, repayment plans, or refinancing options. Timely communication with the lender may help in resolving the default and avoiding further legal complications. In conclusion, the Harris Texas Notice of Default in Payment Due on Promissory Note is an essential legal document issued when a borrower fails to make payments as agreed upon. It serves as a warning and provides an opportunity for the borrower to rectify the default before facing more severe consequences. Prompt response and seeking appropriate professional guidance are crucial for borrowers in such situations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.