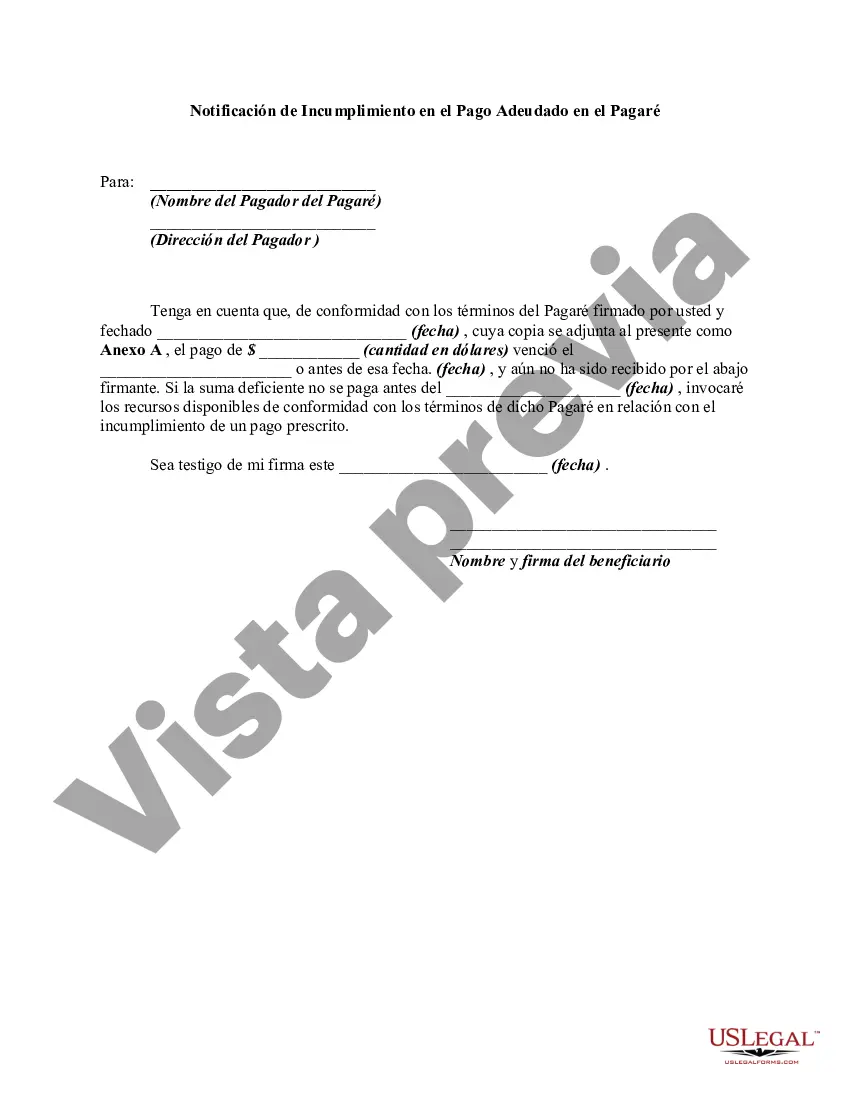

This form is a notice of a failure to make a required payment when due pursuant to a promissory note. The form also contains a warning to the breaching party that legal action will be taken unless the breach is remedied on or before a certain date. This form is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a notice in a particular jurisdiction.

A Mecklenburg North Carolina Notice of Default in Payment Due on Promissory Note is a legal document that serves as a formal notice to inform the debtor about their failure to make timely payments as specified in the promissory note. This notice is of critical importance in the process of debt collection and serves as an initial step towards resolving the issue. In Mecklenburg County, North Carolina, there are a few different types of notices of default in payment due on promissory notes, including: 1. Residential Mortgage Note Default Notice: This type of notice is specific to unpaid mortgage debts on residential properties in Mecklenburg County. It highlights the arrears payment and notifies the borrower about potential consequences if the default is not rectified within a specified timeframe. 2. Commercial Promissory Note Default Notice: Unlike the residential mortgage note default notice, this type applies to unpaid debts associated with commercial properties in Mecklenburg County, North Carolina. Typically, it outlines the amount owed, any applicable interest, penalties, and the actions necessary to resolve the default. 3. Personal Loan Promissory Note Default Notice: This notice pertains to unpaid debts resulting from personal loans between individuals or entities within Mecklenburg County. It denotes the defaulting borrower's failure to fulfill their payment obligations and outlines the next steps needed for resolution. 4. Business Loan Promissory Note Default Notice: This specific notice addresses unpaid debts originating from business loans within Mecklenburg County, North Carolina. It highlights the overdue payments, penalties, and how the default can be cured to avoid further legal actions. When a Notice of Default in Payment Due on Promissory Note is issued, it is crucial for the debtor to take immediate action to negotiate repayment terms or resolve the default. Failure to do so may result in severe consequences, including foreclosure, legal actions, or damage to one's credit rating. It is important to note that the exact content and format of a Mecklenburg North Carolina Notice of Default in Payment Due on Promissory Note may vary depending on the specific circumstances, the type of debt, and the lender involved. It is advisable to consult with a legal professional to ensure all relevant elements are adequately addressed and to determine the appropriate course of action in response to such a notice.A Mecklenburg North Carolina Notice of Default in Payment Due on Promissory Note is a legal document that serves as a formal notice to inform the debtor about their failure to make timely payments as specified in the promissory note. This notice is of critical importance in the process of debt collection and serves as an initial step towards resolving the issue. In Mecklenburg County, North Carolina, there are a few different types of notices of default in payment due on promissory notes, including: 1. Residential Mortgage Note Default Notice: This type of notice is specific to unpaid mortgage debts on residential properties in Mecklenburg County. It highlights the arrears payment and notifies the borrower about potential consequences if the default is not rectified within a specified timeframe. 2. Commercial Promissory Note Default Notice: Unlike the residential mortgage note default notice, this type applies to unpaid debts associated with commercial properties in Mecklenburg County, North Carolina. Typically, it outlines the amount owed, any applicable interest, penalties, and the actions necessary to resolve the default. 3. Personal Loan Promissory Note Default Notice: This notice pertains to unpaid debts resulting from personal loans between individuals or entities within Mecklenburg County. It denotes the defaulting borrower's failure to fulfill their payment obligations and outlines the next steps needed for resolution. 4. Business Loan Promissory Note Default Notice: This specific notice addresses unpaid debts originating from business loans within Mecklenburg County, North Carolina. It highlights the overdue payments, penalties, and how the default can be cured to avoid further legal actions. When a Notice of Default in Payment Due on Promissory Note is issued, it is crucial for the debtor to take immediate action to negotiate repayment terms or resolve the default. Failure to do so may result in severe consequences, including foreclosure, legal actions, or damage to one's credit rating. It is important to note that the exact content and format of a Mecklenburg North Carolina Notice of Default in Payment Due on Promissory Note may vary depending on the specific circumstances, the type of debt, and the lender involved. It is advisable to consult with a legal professional to ensure all relevant elements are adequately addressed and to determine the appropriate course of action in response to such a notice.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.