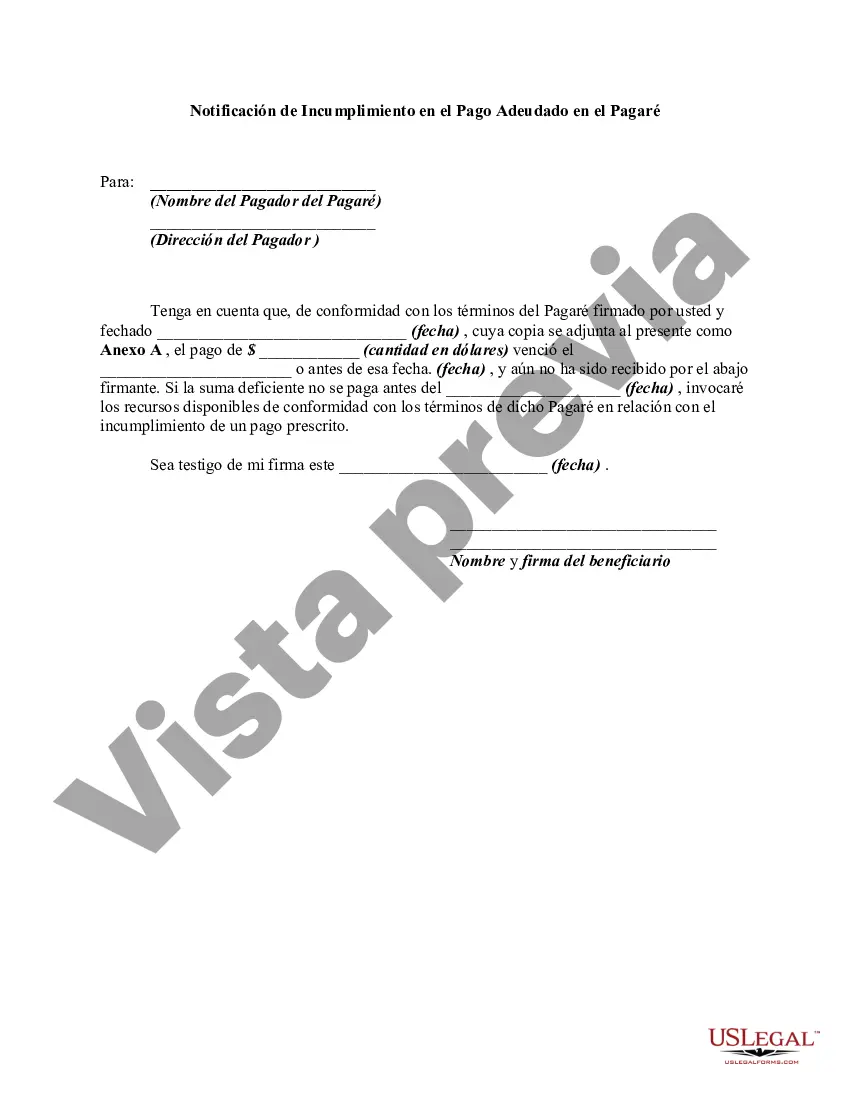

This form is a notice of a failure to make a required payment when due pursuant to a promissory note. The form also contains a warning to the breaching party that legal action will be taken unless the breach is remedied on or before a certain date. This form is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a notice in a particular jurisdiction.

Middlesex Massachusetts Notice of Default in Payment Due on Promissory Note is a legal document that serves as a formal notice to inform the borrower of their failure to make timely payments on a promissory note. This notice is typically issued by the lender or the holder of the promissory note, and it outlines the specific details of the default, including the missed payments, outstanding amount, and any applicable penalties or interest charges. In Middlesex County, Massachusetts, there are various types of Notice of Default in Payment Due on Promissory Note that may be used depending on the circumstances. Some of these variations include: 1. Residential Mortgage Notice of Default: This type of notice is commonly used when a borrower fails to make regular mortgage payments on their residential property in Middlesex County. It informs the borrower of their default and provides them with a specified timeframe to rectify the situation. 2. Commercial Loan Notice of Default: When a borrower fails to meet the payment obligations outlined in a commercial loan agreement, the lender may issue a Commercial Loan Notice of Default. This notice highlights the default, outstanding balance, and the consequences of non-payment for commercial real estate properties or business loans in Middlesex County. 3. Loan Modification Notice of Default: If a borrower fails to adhere to the terms of a loan modification agreement, the lender may issue this type of notice. It notifies the borrower that they have defaulted on the payment terms agreed upon during the loan modification process. 4. Promissory Note Default Notice: This notice is generally used when a borrower fails to make payments on any type of unsecured loan that was established through a promissory note. It highlights the default and outlines any penalties or actions that the lender may take if the borrower fails to cure the default. Middlesex Massachusetts Notice of Default in Payment Due on Promissory Note is a crucial legal document that protects the rights of lenders and ensures borrowers are aware of their default status. It is essential for both parties to understand the content of such notices and seek legal advice if necessary to navigate through the complex legal procedures involved in resolving defaults.Middlesex Massachusetts Notice of Default in Payment Due on Promissory Note is a legal document that serves as a formal notice to inform the borrower of their failure to make timely payments on a promissory note. This notice is typically issued by the lender or the holder of the promissory note, and it outlines the specific details of the default, including the missed payments, outstanding amount, and any applicable penalties or interest charges. In Middlesex County, Massachusetts, there are various types of Notice of Default in Payment Due on Promissory Note that may be used depending on the circumstances. Some of these variations include: 1. Residential Mortgage Notice of Default: This type of notice is commonly used when a borrower fails to make regular mortgage payments on their residential property in Middlesex County. It informs the borrower of their default and provides them with a specified timeframe to rectify the situation. 2. Commercial Loan Notice of Default: When a borrower fails to meet the payment obligations outlined in a commercial loan agreement, the lender may issue a Commercial Loan Notice of Default. This notice highlights the default, outstanding balance, and the consequences of non-payment for commercial real estate properties or business loans in Middlesex County. 3. Loan Modification Notice of Default: If a borrower fails to adhere to the terms of a loan modification agreement, the lender may issue this type of notice. It notifies the borrower that they have defaulted on the payment terms agreed upon during the loan modification process. 4. Promissory Note Default Notice: This notice is generally used when a borrower fails to make payments on any type of unsecured loan that was established through a promissory note. It highlights the default and outlines any penalties or actions that the lender may take if the borrower fails to cure the default. Middlesex Massachusetts Notice of Default in Payment Due on Promissory Note is a crucial legal document that protects the rights of lenders and ensures borrowers are aware of their default status. It is essential for both parties to understand the content of such notices and seek legal advice if necessary to navigate through the complex legal procedures involved in resolving defaults.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.