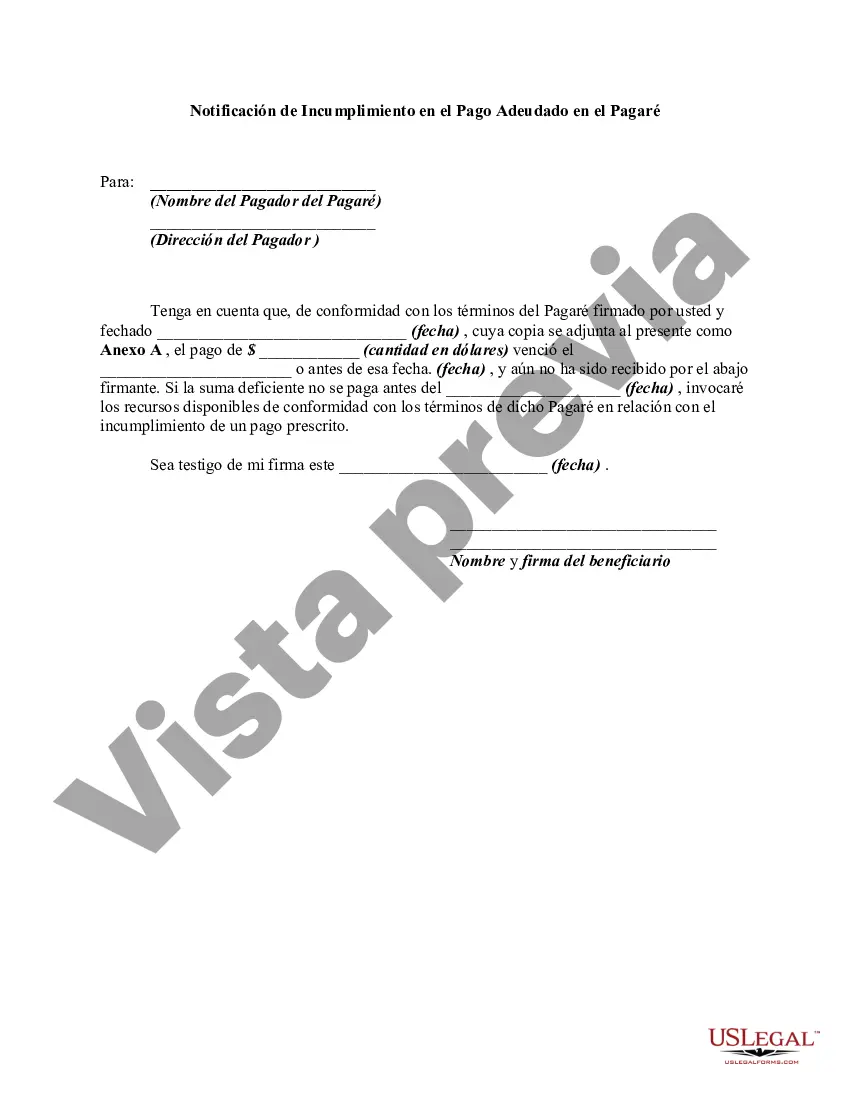

This form is a notice of a failure to make a required payment when due pursuant to a promissory note. The form also contains a warning to the breaching party that legal action will be taken unless the breach is remedied on or before a certain date. This form is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a notice in a particular jurisdiction.

Nassau County, located in the state of New York, has specific laws and regulations regarding promissory notes and defaults on payments. In the event that a borrower fails to make timely payments as agreed upon in a promissory note, a Nassau New York Notice of Default in Payment Due on Promissory Note may be issued. This legal document serves as a formal notification to the borrower that they have defaulted on their payment obligations and that immediate action is required to rectify the situation. Generally, a Notice of Default will include details such as the borrower's name, address, and contact information, as well as the lender's information and the specific terms of the promissory note. There are two main types of Nassau New York Notices of Default in Payment Due on Promissory Note: 1. Cure Notice: This type of notice is sent to the borrower when they have missed a payment and provides them with an opportunity to cure the default by making the overdue payment within a specific timeframe. The notice will typically state the exact amount due, the deadline for payment, and any additional fees or penalties that may apply if the default is not remedied. 2. Acceleration Notice: In cases where the borrower has consistently failed to make payments or has violated other terms of the promissory note, the lender may issue an acceleration notice. This notice demands immediate payment of the entire remaining loan balance, often with an abbreviated timeframe for compliance. If the borrower fails to settle the debt according to the acceleration notice, the lender may initiate legal proceedings to recover the outstanding amount. It is essential for both borrowers and lenders to understand the legal implications and consequences of receiving or issuing a Nassau New York Notice of Default. Seeking legal advice or consulting an attorney specializing in debt collection and foreclosure can provide valuable guidance on how to proceed in such situations. Remember, this content is for informational purposes only, and it is advisable to consult with legal professionals regarding specific cases or concerns related to Nassau New York Notices of Default in Payment Due on Promissory Note.Nassau County, located in the state of New York, has specific laws and regulations regarding promissory notes and defaults on payments. In the event that a borrower fails to make timely payments as agreed upon in a promissory note, a Nassau New York Notice of Default in Payment Due on Promissory Note may be issued. This legal document serves as a formal notification to the borrower that they have defaulted on their payment obligations and that immediate action is required to rectify the situation. Generally, a Notice of Default will include details such as the borrower's name, address, and contact information, as well as the lender's information and the specific terms of the promissory note. There are two main types of Nassau New York Notices of Default in Payment Due on Promissory Note: 1. Cure Notice: This type of notice is sent to the borrower when they have missed a payment and provides them with an opportunity to cure the default by making the overdue payment within a specific timeframe. The notice will typically state the exact amount due, the deadline for payment, and any additional fees or penalties that may apply if the default is not remedied. 2. Acceleration Notice: In cases where the borrower has consistently failed to make payments or has violated other terms of the promissory note, the lender may issue an acceleration notice. This notice demands immediate payment of the entire remaining loan balance, often with an abbreviated timeframe for compliance. If the borrower fails to settle the debt according to the acceleration notice, the lender may initiate legal proceedings to recover the outstanding amount. It is essential for both borrowers and lenders to understand the legal implications and consequences of receiving or issuing a Nassau New York Notice of Default. Seeking legal advice or consulting an attorney specializing in debt collection and foreclosure can provide valuable guidance on how to proceed in such situations. Remember, this content is for informational purposes only, and it is advisable to consult with legal professionals regarding specific cases or concerns related to Nassau New York Notices of Default in Payment Due on Promissory Note.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.