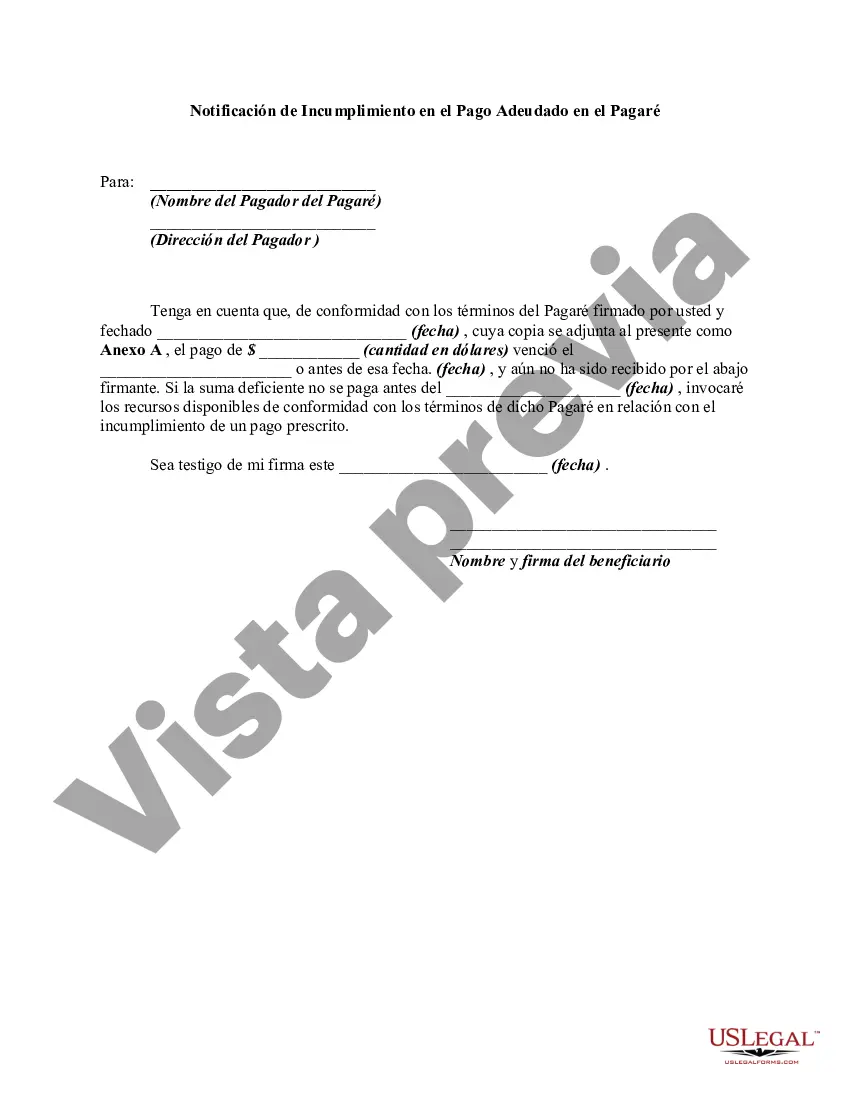

This form is a notice of a failure to make a required payment when due pursuant to a promissory note. The form also contains a warning to the breaching party that legal action will be taken unless the breach is remedied on or before a certain date. This form is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a notice in a particular jurisdiction.

San Bernardino, California is a city located in the Inland Empire region of Southern California. It is the county seat of San Bernardino County and is known for its rich history, diverse culture, and scenic beauty. A San Bernardino California Notice of Default in Payment Due on Promissory Note is a legal document that notifies the borrower of a promissory note that they have defaulted on their payment obligations. This notice is typically sent by the lender or creditor when the borrower fails to make the required payments as outlined in the agreement. There are several types of San Bernardino California Notice of Default in Payment Due on Promissory Note, including: 1. Residential Notice of Default: This type of notice is specific to residential properties, such as single-family homes, condominiums, or townhouses. 2. Commercial Notice of Default: This notice pertains to commercial properties, including retail spaces, office buildings, industrial warehouses, and other non-residential real estate. 3. Mortgage Notice of Default: This notice is issued when the default occurs on a mortgage loan, which is often used to finance the purchase of a property. 4. Deed of Trust Notice of Default: This notice is specific to transactions involving a deed of trust, which is a type of security instrument used to secure a loan on real property. 5. Promissory Note Notice of Default: This notice is issued when the default occurs on a promissory note, which is a legal document that outlines the terms and conditions of a loan between a borrower and a lender. It is important to note that each type of San Bernardino California Notice of Default in Payment Due on Promissory Note may have specific requirements and procedures that must be followed by the lender or creditor. Additionally, the borrower may have certain rights and options available to them to rectify the default or negotiate alternative payment arrangements. It is advisable for both parties to seek legal advice to understand their rights and obligations in such situations.San Bernardino, California is a city located in the Inland Empire region of Southern California. It is the county seat of San Bernardino County and is known for its rich history, diverse culture, and scenic beauty. A San Bernardino California Notice of Default in Payment Due on Promissory Note is a legal document that notifies the borrower of a promissory note that they have defaulted on their payment obligations. This notice is typically sent by the lender or creditor when the borrower fails to make the required payments as outlined in the agreement. There are several types of San Bernardino California Notice of Default in Payment Due on Promissory Note, including: 1. Residential Notice of Default: This type of notice is specific to residential properties, such as single-family homes, condominiums, or townhouses. 2. Commercial Notice of Default: This notice pertains to commercial properties, including retail spaces, office buildings, industrial warehouses, and other non-residential real estate. 3. Mortgage Notice of Default: This notice is issued when the default occurs on a mortgage loan, which is often used to finance the purchase of a property. 4. Deed of Trust Notice of Default: This notice is specific to transactions involving a deed of trust, which is a type of security instrument used to secure a loan on real property. 5. Promissory Note Notice of Default: This notice is issued when the default occurs on a promissory note, which is a legal document that outlines the terms and conditions of a loan between a borrower and a lender. It is important to note that each type of San Bernardino California Notice of Default in Payment Due on Promissory Note may have specific requirements and procedures that must be followed by the lender or creditor. Additionally, the borrower may have certain rights and options available to them to rectify the default or negotiate alternative payment arrangements. It is advisable for both parties to seek legal advice to understand their rights and obligations in such situations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.