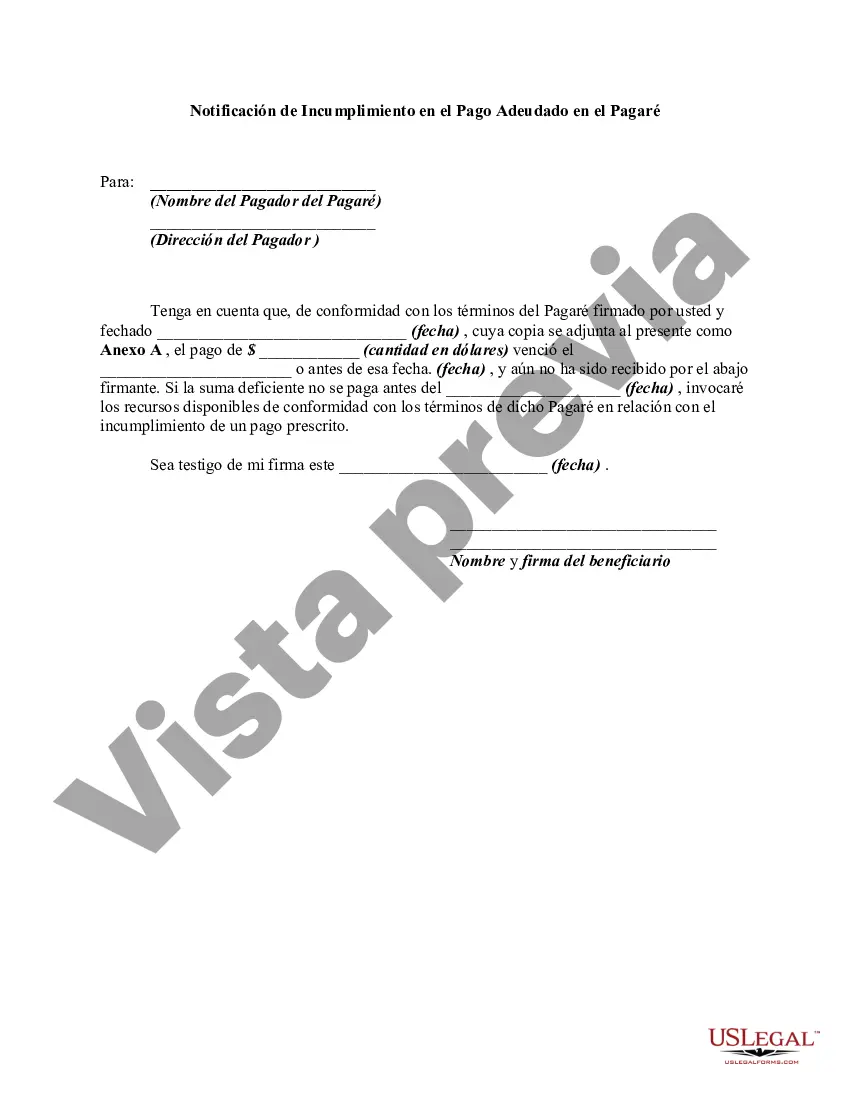

This form is a notice of a failure to make a required payment when due pursuant to a promissory note. The form also contains a warning to the breaching party that legal action will be taken unless the breach is remedied on or before a certain date. This form is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a notice in a particular jurisdiction.

San Diego, California, Notice of Default in Payment Due on Promissory Note is a legal document issued to notify a borrower of their failure to make timely repayments on a loan. This notice serves as a formal declaration that the borrower has defaulted on their financial obligations according to the terms and conditions agreed upon in the promissory note. The San Diego Notice of Default (NOD) is an important step in the foreclosure process initiated by the lender. It indicates that the borrower has fallen behind on repayments and has a specific timeframe to rectify the default. Failure to do so may result in the lender commencing foreclosure proceedings to recover the outstanding loan balance. Key phrases relevant to this topic may include: 1. San Diego Notice of Default: Refers to the official notification sent to borrowers informing them about their payment default and outlining the consequences if no action is taken. 2. Payment Due on Promissory Note: Highlights the financial obligation the borrower has to repay the loan amount, interest, and any other charges as stipulated in the signed promissory note. 3. Foreclosure Process: The legal procedure taken by a lender to recover their investment when a borrower fails to make the required payments on time. 4. Defaulted Loan: Represents the loan that is now in a state of non-payment due to the borrower's failure to meet their repayment obligations. 5. Loan Modification: A potential solution where the lender and borrower restructure the terms of the loan agreement to avoid foreclosure. It could involve renegotiating interest rates, extending loan duration, etc. 6. Remedies for Default: Refers to the options available to the borrower to cure the default, which might include catching up on missed payments, engaging in a repayment plan, or seeking refinancing. 7. Public Auction: A stage after the NOD is filed where the property securing the loan may be sold to the highest bidder to recover the outstanding debt. 8. Trustee's Sale: The actual process of selling the mortgaged property through an auction, where the lender appoints a trustee to oversee the transaction. It's important to note that the specific types of San Diego California Notice of Default on Payment Due on Promissory Note may vary depending on the lender or the nature of the loan agreement. However, the keywords and concepts mentioned above generally encompass the fundamental aspects of this legal process in San Diego, California.San Diego, California, Notice of Default in Payment Due on Promissory Note is a legal document issued to notify a borrower of their failure to make timely repayments on a loan. This notice serves as a formal declaration that the borrower has defaulted on their financial obligations according to the terms and conditions agreed upon in the promissory note. The San Diego Notice of Default (NOD) is an important step in the foreclosure process initiated by the lender. It indicates that the borrower has fallen behind on repayments and has a specific timeframe to rectify the default. Failure to do so may result in the lender commencing foreclosure proceedings to recover the outstanding loan balance. Key phrases relevant to this topic may include: 1. San Diego Notice of Default: Refers to the official notification sent to borrowers informing them about their payment default and outlining the consequences if no action is taken. 2. Payment Due on Promissory Note: Highlights the financial obligation the borrower has to repay the loan amount, interest, and any other charges as stipulated in the signed promissory note. 3. Foreclosure Process: The legal procedure taken by a lender to recover their investment when a borrower fails to make the required payments on time. 4. Defaulted Loan: Represents the loan that is now in a state of non-payment due to the borrower's failure to meet their repayment obligations. 5. Loan Modification: A potential solution where the lender and borrower restructure the terms of the loan agreement to avoid foreclosure. It could involve renegotiating interest rates, extending loan duration, etc. 6. Remedies for Default: Refers to the options available to the borrower to cure the default, which might include catching up on missed payments, engaging in a repayment plan, or seeking refinancing. 7. Public Auction: A stage after the NOD is filed where the property securing the loan may be sold to the highest bidder to recover the outstanding debt. 8. Trustee's Sale: The actual process of selling the mortgaged property through an auction, where the lender appoints a trustee to oversee the transaction. It's important to note that the specific types of San Diego California Notice of Default on Payment Due on Promissory Note may vary depending on the lender or the nature of the loan agreement. However, the keywords and concepts mentioned above generally encompass the fundamental aspects of this legal process in San Diego, California.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.