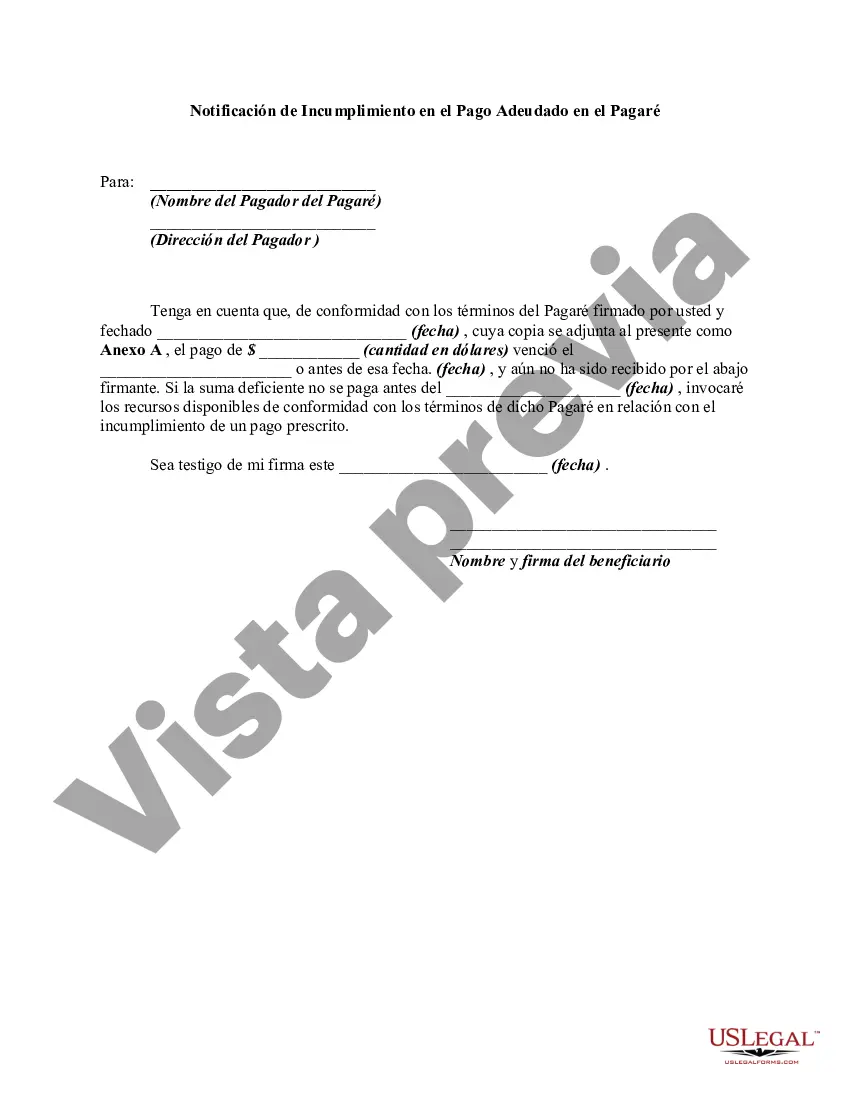

This form is a notice of a failure to make a required payment when due pursuant to a promissory note. The form also contains a warning to the breaching party that legal action will be taken unless the breach is remedied on or before a certain date. This form is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a notice in a particular jurisdiction.

A Wake North Carolina Notice of Default in Payment Due on Promissory Note is a legal document that notifies a borrower about their failure to make timely payments on a promissory note. It serves as a formal communication to inform the borrower of their default status and the consequences they may face as a result. In Wake County, North Carolina, there are different types of Notice of Default in Payment Due on Promissory Note that can be issued: 1. Residential Property Notice of Default: This type of notice is used when the defaulting borrower is a homeowner who has failed to make mortgage payments on their residential property in Wake County. 2. Commercial Property Notice of Default: When a borrower defaults on a commercial property loan, such as a commercial building or office space, a Notice of Default in Payment Due on Promissory Note specific to commercial properties is issued. 3. Construction Loan Notice of Default: In case of default on a construction loan where the borrower fails to make scheduled payments for the construction of a property, a specialized Notice of Default in Payment Due on Promissory Note for construction loans is used. 4. Business Loan Notice of Default: For borrowers who default on a business loan, whether it is for the operation of their business or to expand their business, a tailored Notice of Default in Payment Due on Promissory Note is issued. Regardless of the type of Wake North Carolina Notice of Default in Payment Due on Promissory Note, the document typically includes essential information such as: — The borrower's name, address, and contact details. — The lender's name, address, and contact details. — Details of the promissory note, including the loan amount, interest rate, and repayment terms. — Specific payment(s) missed or delayed and the amount(s) owed. — The date on which the borrower must cure the default by making the required payment(s) in full. — Consequences of further non-payment or failure to cure the default (such as foreclosure or legal action). — Instructions on how the borrower can resolve the default situation (e.g., contacting the lender, seeking legal advice). — Contact information for the lender or their representative who can provide further assistance or clarification. It is crucial to note that Wake North Carolina Notice of Default in Payment Due on Promissory Note is a legal document and should be taken seriously by both the borrower and lender. Seeking legal advice is highly recommended for borrowers to understand their rights and options in such situations.A Wake North Carolina Notice of Default in Payment Due on Promissory Note is a legal document that notifies a borrower about their failure to make timely payments on a promissory note. It serves as a formal communication to inform the borrower of their default status and the consequences they may face as a result. In Wake County, North Carolina, there are different types of Notice of Default in Payment Due on Promissory Note that can be issued: 1. Residential Property Notice of Default: This type of notice is used when the defaulting borrower is a homeowner who has failed to make mortgage payments on their residential property in Wake County. 2. Commercial Property Notice of Default: When a borrower defaults on a commercial property loan, such as a commercial building or office space, a Notice of Default in Payment Due on Promissory Note specific to commercial properties is issued. 3. Construction Loan Notice of Default: In case of default on a construction loan where the borrower fails to make scheduled payments for the construction of a property, a specialized Notice of Default in Payment Due on Promissory Note for construction loans is used. 4. Business Loan Notice of Default: For borrowers who default on a business loan, whether it is for the operation of their business or to expand their business, a tailored Notice of Default in Payment Due on Promissory Note is issued. Regardless of the type of Wake North Carolina Notice of Default in Payment Due on Promissory Note, the document typically includes essential information such as: — The borrower's name, address, and contact details. — The lender's name, address, and contact details. — Details of the promissory note, including the loan amount, interest rate, and repayment terms. — Specific payment(s) missed or delayed and the amount(s) owed. — The date on which the borrower must cure the default by making the required payment(s) in full. — Consequences of further non-payment or failure to cure the default (such as foreclosure or legal action). — Instructions on how the borrower can resolve the default situation (e.g., contacting the lender, seeking legal advice). — Contact information for the lender or their representative who can provide further assistance or clarification. It is crucial to note that Wake North Carolina Notice of Default in Payment Due on Promissory Note is a legal document and should be taken seriously by both the borrower and lender. Seeking legal advice is highly recommended for borrowers to understand their rights and options in such situations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.