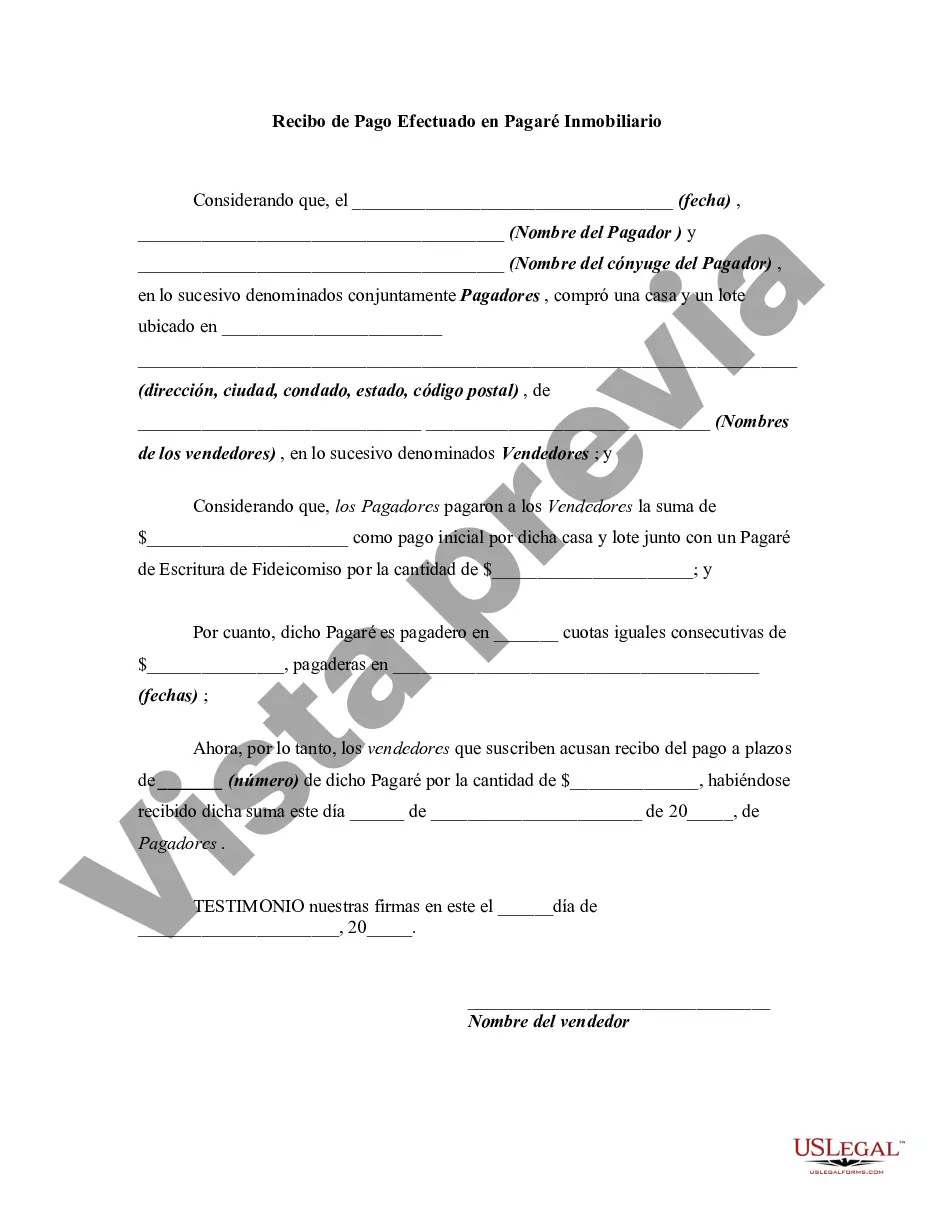

This form is a generic sample of a receipt for an installment payment for an owner financed real estate sale/purchase.

The Bexar Texas Receipt for Payment Made on Real Estate Promissory Note is a legal document used to acknowledge the receipt of payment made towards a promissory note related to a real estate transaction in Bexar County, Texas. This receipt provides evidence that a payment has been received and serves as a crucial record for both parties involved in the transaction. Keywords: Bexar Texas, receipt for payment, real estate, promissory note, legal document, acknowledgment, evidence, transaction, parties, record Different types of Bexar Texas Receipt for Payment Made on Real Estate Promissory Note can differ based on specific circumstances or details associated with the transaction. Some possible variations or categories may include: 1. Partial Payment Receipt: This type of receipt is issued when only a portion of the total amount due on the real estate promissory note is paid. It clearly states the amount received and may mention any remaining balance. 2. Final Payment Receipt: This receipt is provided when the entire balance of the promissory note is settled, signifying the completion of the payment obligation. It confirms the full payment and may include additional details about the transaction's closure. 3. Lump Sum Payment Receipt: In cases where the debtor chooses to make a single payment to satisfy the promissory note instead of periodic installments, a lump sum payment receipt is issued. This receipt highlights the paid amount and may outline any terms or conditions related to this form of payment. 4. Installment Payment Receipt: When the borrower makes multiple payments over a specific period to meet the requirements of the promissory note, an installment payment receipt is issued. This receipt acknowledges each payment received, along with details such as the payment dates and amounts. 5. Late Payment Receipt: In situations where the payment is received after the agreed-upon due date, a late payment receipt is issued. It indicates the late payment and might include information regarding any penalties or additional fees associated with the delay. 6. Electronic Payment Receipt: With modern advancements in technology, electronic payment modes have become common. An electronic payment receipt acknowledges payments made through platforms such as online banking, wire transfers, or digital wallets, providing a record of the transaction. It is important to note that the exact naming conventions or categories of Bexar Texas Receipts for Payment Made on Real Estate Promissory Note may vary, and the list above is not exhaustive. It is advisable to consult legal professionals or local authorities in Bexar County for specific guidance on the appropriate receipt terminology and documentation required.The Bexar Texas Receipt for Payment Made on Real Estate Promissory Note is a legal document used to acknowledge the receipt of payment made towards a promissory note related to a real estate transaction in Bexar County, Texas. This receipt provides evidence that a payment has been received and serves as a crucial record for both parties involved in the transaction. Keywords: Bexar Texas, receipt for payment, real estate, promissory note, legal document, acknowledgment, evidence, transaction, parties, record Different types of Bexar Texas Receipt for Payment Made on Real Estate Promissory Note can differ based on specific circumstances or details associated with the transaction. Some possible variations or categories may include: 1. Partial Payment Receipt: This type of receipt is issued when only a portion of the total amount due on the real estate promissory note is paid. It clearly states the amount received and may mention any remaining balance. 2. Final Payment Receipt: This receipt is provided when the entire balance of the promissory note is settled, signifying the completion of the payment obligation. It confirms the full payment and may include additional details about the transaction's closure. 3. Lump Sum Payment Receipt: In cases where the debtor chooses to make a single payment to satisfy the promissory note instead of periodic installments, a lump sum payment receipt is issued. This receipt highlights the paid amount and may outline any terms or conditions related to this form of payment. 4. Installment Payment Receipt: When the borrower makes multiple payments over a specific period to meet the requirements of the promissory note, an installment payment receipt is issued. This receipt acknowledges each payment received, along with details such as the payment dates and amounts. 5. Late Payment Receipt: In situations where the payment is received after the agreed-upon due date, a late payment receipt is issued. It indicates the late payment and might include information regarding any penalties or additional fees associated with the delay. 6. Electronic Payment Receipt: With modern advancements in technology, electronic payment modes have become common. An electronic payment receipt acknowledges payments made through platforms such as online banking, wire transfers, or digital wallets, providing a record of the transaction. It is important to note that the exact naming conventions or categories of Bexar Texas Receipts for Payment Made on Real Estate Promissory Note may vary, and the list above is not exhaustive. It is advisable to consult legal professionals or local authorities in Bexar County for specific guidance on the appropriate receipt terminology and documentation required.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.