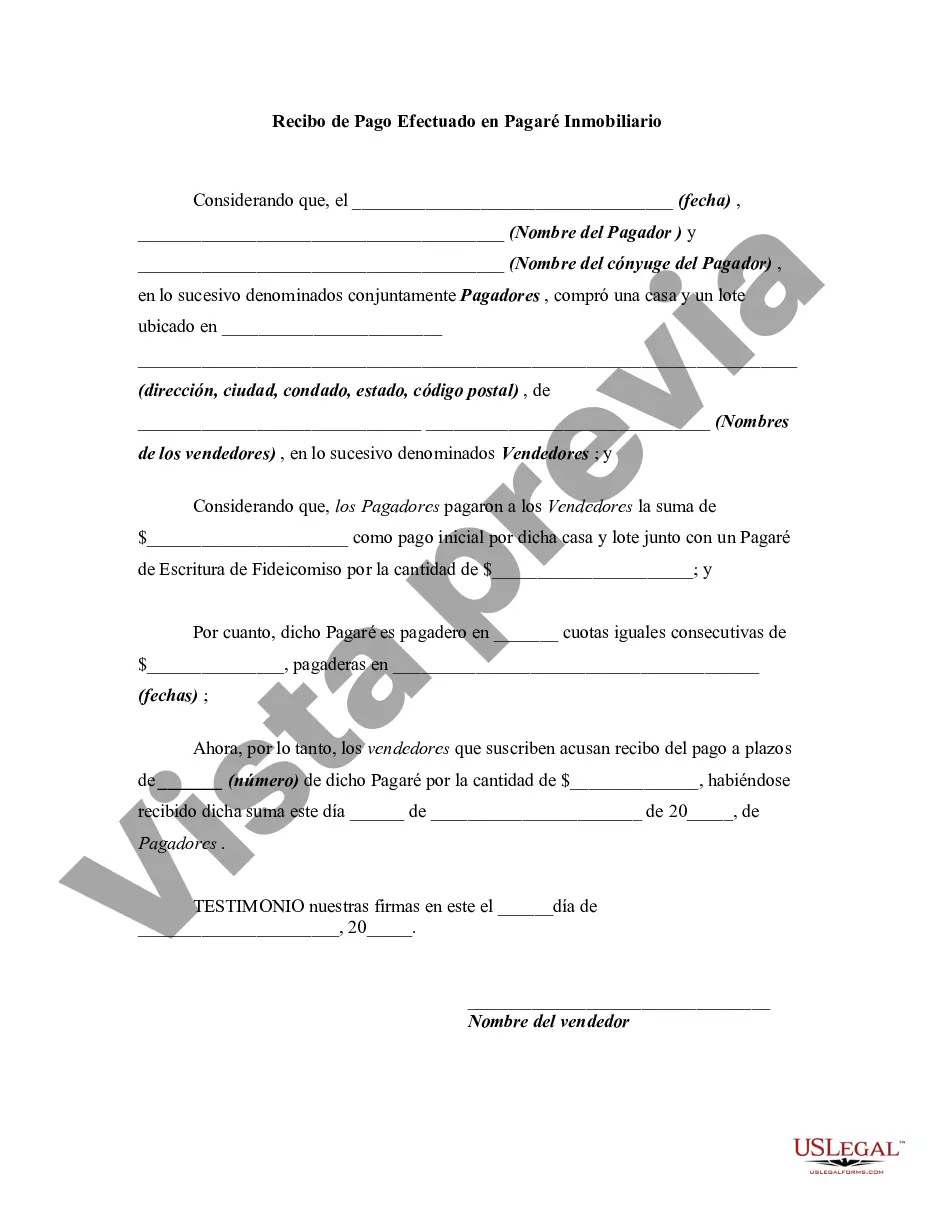

This form is a generic sample of a receipt for an installment payment for an owner financed real estate sale/purchase.

Collin Texas Receipt for Payment Made on Real Estate Promissory Note serves as a formal document acknowledging that a payment has been made against a promissory note related to real estate. This receipt is essential for maintaining records and confirming the transfer of funds. Here, we will explore the different types of receipts for payment made on a real estate promissory note in Collin, Texas. 1. Full Payment Receipt: This type of receipt is issued when the borrower has made the complete payment on the real estate promissory note. It states the total amount paid, the promissory note details, and the date of payment. 2. Partial Payment Receipt: When the borrower makes a partial payment on the real estate promissory note, a partial payment receipt is issued. It details the amount paid, the remaining balance, the promissory note information, and the date of payment. 3. Lump Sum Payment Receipt: This type of receipt is utilized when the borrower decides to make a single large payment to satisfy a substantial portion of the real estate promissory note. The receipt clearly states the lump sum amount, relevant promissory note details, and the date of payment. 4. Installment Payment Receipt: In cases where the real estate promissory note allows for installment payments, an installment payment receipt is generated. This receipt keeps a record of each installment payment made, including the amount paid, remaining balance, promissory note details, and corresponding payment date. 5. Late Payment Receipt: When a borrower fails to make a payment on time, a late payment receipt is issued upon receipt of the overdue payment. This receipt emphasizes the late nature of the payment, mentions any applicable penalties or fees, and includes the promissory note information and the payment date. 6. Prepayment Receipt: If the borrower chooses to make an early payment to settle the real estate promissory note before the agreed-upon term, a prepayment receipt is issued. It confirms the amount paid, the remaining balance after prepayment, the relevant promissory note details, and the date of payment. These various types of Collin Texas Receipt for Payment Made on Real Estate Promissory Note documents help ensure transparency, accountability, and a comprehensive record of all transactions related to the real estate promissory note. By accurately documenting each payment made, both lenders and borrowers can maintain clear financial records and avoid any potential disputes in the future.Collin Texas Receipt for Payment Made on Real Estate Promissory Note serves as a formal document acknowledging that a payment has been made against a promissory note related to real estate. This receipt is essential for maintaining records and confirming the transfer of funds. Here, we will explore the different types of receipts for payment made on a real estate promissory note in Collin, Texas. 1. Full Payment Receipt: This type of receipt is issued when the borrower has made the complete payment on the real estate promissory note. It states the total amount paid, the promissory note details, and the date of payment. 2. Partial Payment Receipt: When the borrower makes a partial payment on the real estate promissory note, a partial payment receipt is issued. It details the amount paid, the remaining balance, the promissory note information, and the date of payment. 3. Lump Sum Payment Receipt: This type of receipt is utilized when the borrower decides to make a single large payment to satisfy a substantial portion of the real estate promissory note. The receipt clearly states the lump sum amount, relevant promissory note details, and the date of payment. 4. Installment Payment Receipt: In cases where the real estate promissory note allows for installment payments, an installment payment receipt is generated. This receipt keeps a record of each installment payment made, including the amount paid, remaining balance, promissory note details, and corresponding payment date. 5. Late Payment Receipt: When a borrower fails to make a payment on time, a late payment receipt is issued upon receipt of the overdue payment. This receipt emphasizes the late nature of the payment, mentions any applicable penalties or fees, and includes the promissory note information and the payment date. 6. Prepayment Receipt: If the borrower chooses to make an early payment to settle the real estate promissory note before the agreed-upon term, a prepayment receipt is issued. It confirms the amount paid, the remaining balance after prepayment, the relevant promissory note details, and the date of payment. These various types of Collin Texas Receipt for Payment Made on Real Estate Promissory Note documents help ensure transparency, accountability, and a comprehensive record of all transactions related to the real estate promissory note. By accurately documenting each payment made, both lenders and borrowers can maintain clear financial records and avoid any potential disputes in the future.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.