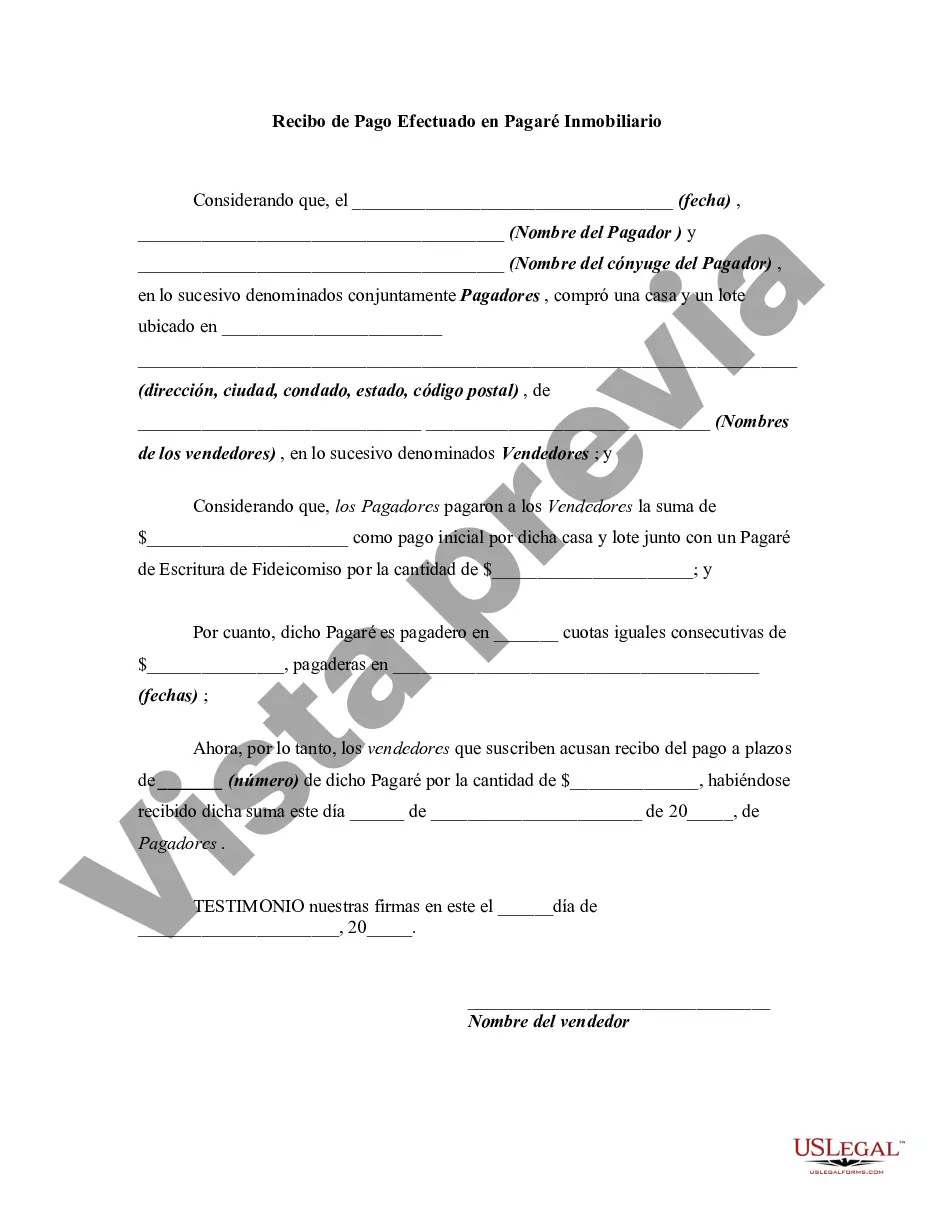

This form is a generic sample of a receipt for an installment payment for an owner financed real estate sale/purchase.

Cook Illinois Receipt for Payment Made on Real Estate Promissory Note is a document used in real estate transactions to confirm the payment made by the borrower towards a promissory note. It serves as proof of payment and ensures that both parties are in agreement regarding the amount and date of payment. The Cook Illinois Receipt for Payment Made on Real Estate Promissory Note includes various essential details such as the names and contact information of the borrower and the lender, the date of payment, the amount paid, the purpose of the payment, and any additional terms or conditions related to the promissory note. Different types of Cook Illinois Receipt for Payment Made on Real Estate Promissory Note can be categorized based on the nature of the transaction. Some common types include: 1. Residential Property Payment Receipt: This type of receipt is used when the transaction involves the purchase or repayment of a residential property. It outlines the specific details of the property and any associated terms. 2. Commercial Property Payment Receipt: When the transaction involves a commercial property, this type of receipt is utilized. It includes information about the commercial property and may include additional clauses related to leasing or business agreements. 3. Installment Payment Receipt: This type of receipt is issued when the borrower makes partial payments towards the promissory note instead of a lump-sum amount. It keeps a record of each installment paid, ensuring transparency and accountability. 4. Property Tax Payment Receipt: In certain cases, a portion of the payment made on a real estate promissory note may go towards property taxes. This receipt specifically acknowledges the tax payment amount and provides the necessary details for tax record-keeping. In conclusion, a Cook Illinois Receipt for Payment Made on Real Estate Promissory Note is a crucial document in real estate transactions. It ensures that both the borrower and the lender are on the same page regarding payment terms and serves as evidence of payment. Different types of receipts exist to cater to various situations such as residential or commercial property payments, installment payments, or property tax payments.Cook Illinois Receipt for Payment Made on Real Estate Promissory Note is a document used in real estate transactions to confirm the payment made by the borrower towards a promissory note. It serves as proof of payment and ensures that both parties are in agreement regarding the amount and date of payment. The Cook Illinois Receipt for Payment Made on Real Estate Promissory Note includes various essential details such as the names and contact information of the borrower and the lender, the date of payment, the amount paid, the purpose of the payment, and any additional terms or conditions related to the promissory note. Different types of Cook Illinois Receipt for Payment Made on Real Estate Promissory Note can be categorized based on the nature of the transaction. Some common types include: 1. Residential Property Payment Receipt: This type of receipt is used when the transaction involves the purchase or repayment of a residential property. It outlines the specific details of the property and any associated terms. 2. Commercial Property Payment Receipt: When the transaction involves a commercial property, this type of receipt is utilized. It includes information about the commercial property and may include additional clauses related to leasing or business agreements. 3. Installment Payment Receipt: This type of receipt is issued when the borrower makes partial payments towards the promissory note instead of a lump-sum amount. It keeps a record of each installment paid, ensuring transparency and accountability. 4. Property Tax Payment Receipt: In certain cases, a portion of the payment made on a real estate promissory note may go towards property taxes. This receipt specifically acknowledges the tax payment amount and provides the necessary details for tax record-keeping. In conclusion, a Cook Illinois Receipt for Payment Made on Real Estate Promissory Note is a crucial document in real estate transactions. It ensures that both the borrower and the lender are on the same page regarding payment terms and serves as evidence of payment. Different types of receipts exist to cater to various situations such as residential or commercial property payments, installment payments, or property tax payments.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.