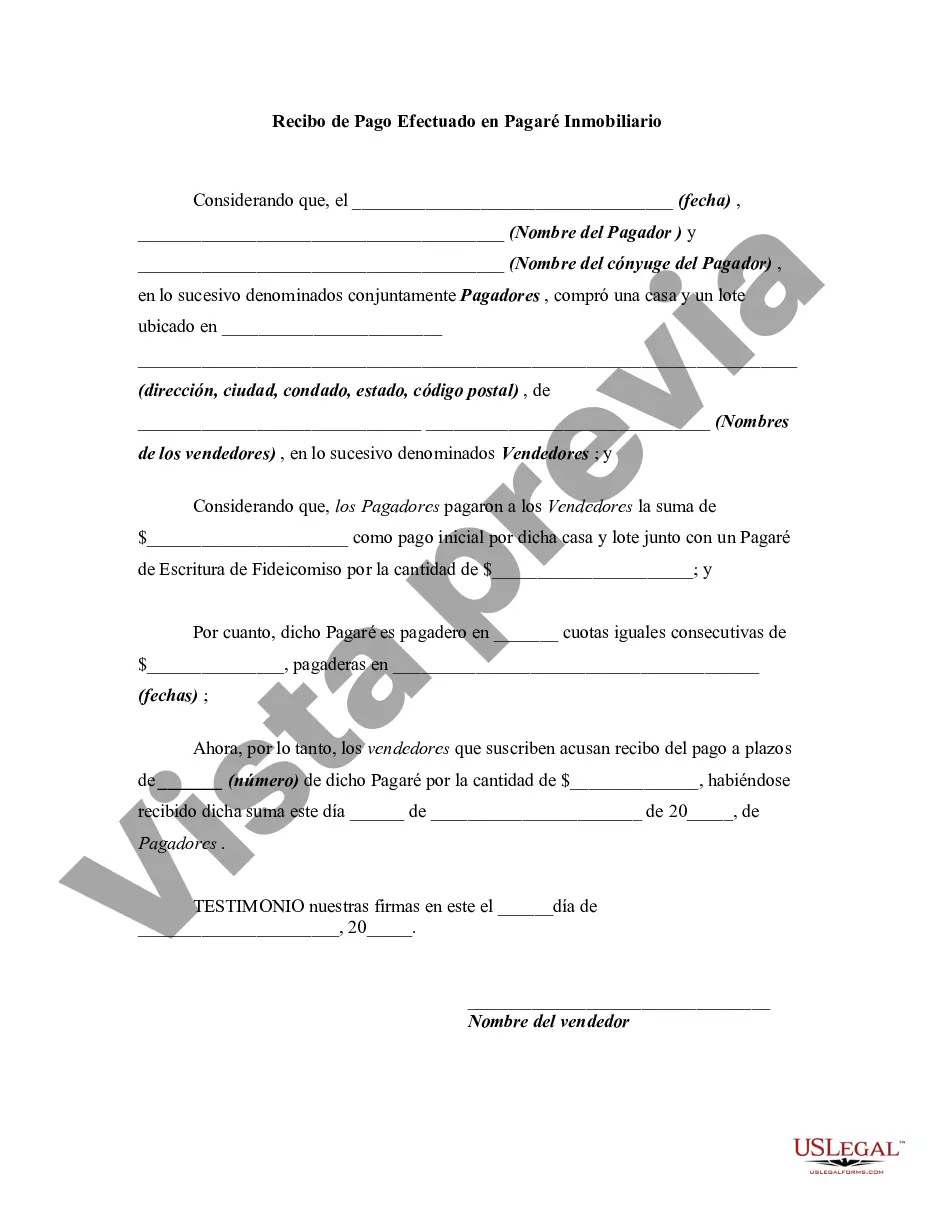

This form is a generic sample of a receipt for an installment payment for an owner financed real estate sale/purchase.

Title: Exploring the Harris Texas Receipt for Payment Made on Real Estate Promissory Note Introduction: In Harris County, Texas, the Receipt for Payment Made on Real Estate Promissory Note is an essential document in the realm of real estate transactions. This comprehensive receipt acts as proof of payment made towards a promissory note related to a property. In this article, we will delve deep into the details of the Harris Texas Receipt for Payment Made on Real Estate Promissory Note, exploring its purpose, significance, and potential variations. 1. Definition of the Harris Texas Receipt for Payment Made on Real Estate Promissory Note: The Harris Texas Receipt for Payment Made on Real Estate Promissory Note is a legal document that acknowledges the receipt of payment made by a borrower to a lender or note holder. This payment is typically associated with a promissory note used in the purchase, sale, or financing of real estate properties in Harris County, Texas. 2. Purpose and Importance of the Receipt: The primary purpose of the Harris Texas Receipt for Payment Made on Real Estate Promissory Note is to provide a formal acknowledgment of the payment made towards the promissory note. This receipt holds immense significance for both the borrower and the lender. It serves as evidence of payment made, safeguards against future disputes, and helps ensure transparency and accountability in real estate transactions. 3. Key Elements of the Receipt: — Names and contact details of the borrower (buyer) and the lender (seller or note holder) — Date of the payment and the receipt issuance — Description of the property covered by the promissory note — Payment amount, method, ancurrentnc— - Signature and contact information of the individual receiving the payment 4. Types of Harris Texas Receipt for Payment Made on Real Estate Promissory Note: While the basic structure of the receipt remains consistent, there can be specific variations based on the nature of the real estate transaction. Some commonly encountered types may include: a) Partial Payment Receipt: Acknowledges a partial payment made towards the promissory note, providing details of the amount paid and the remaining balance. b) Lump Sum Payment Receipt: Confirms the receipt of a complete payment for the outstanding promissory note, indicating the final settlement of the debt. c) Installment Payment Receipt: Records periodic payments made by the borrower over a specified duration until the full amount is paid off. d) Interest Payment Receipt: Acknowledges the payment of interest on the promissory note, particularly applicable to loans or financing arrangements involving interest charges. Conclusion: The Harris Texas Receipt for Payment Made on Real Estate Promissory Note is an indispensable document that plays a vital role in real estate transactions across Harris County, Texas. By adequately documenting payments made towards promissory notes, this receipt ensures transparency, mitigates risks of disputes, and fosters trust between the parties involved. Understanding the various types of this receipt allows both borrowers and lenders to navigate the complex world of real estate transactions with clarity and confidence.Title: Exploring the Harris Texas Receipt for Payment Made on Real Estate Promissory Note Introduction: In Harris County, Texas, the Receipt for Payment Made on Real Estate Promissory Note is an essential document in the realm of real estate transactions. This comprehensive receipt acts as proof of payment made towards a promissory note related to a property. In this article, we will delve deep into the details of the Harris Texas Receipt for Payment Made on Real Estate Promissory Note, exploring its purpose, significance, and potential variations. 1. Definition of the Harris Texas Receipt for Payment Made on Real Estate Promissory Note: The Harris Texas Receipt for Payment Made on Real Estate Promissory Note is a legal document that acknowledges the receipt of payment made by a borrower to a lender or note holder. This payment is typically associated with a promissory note used in the purchase, sale, or financing of real estate properties in Harris County, Texas. 2. Purpose and Importance of the Receipt: The primary purpose of the Harris Texas Receipt for Payment Made on Real Estate Promissory Note is to provide a formal acknowledgment of the payment made towards the promissory note. This receipt holds immense significance for both the borrower and the lender. It serves as evidence of payment made, safeguards against future disputes, and helps ensure transparency and accountability in real estate transactions. 3. Key Elements of the Receipt: — Names and contact details of the borrower (buyer) and the lender (seller or note holder) — Date of the payment and the receipt issuance — Description of the property covered by the promissory note — Payment amount, method, ancurrentnc— - Signature and contact information of the individual receiving the payment 4. Types of Harris Texas Receipt for Payment Made on Real Estate Promissory Note: While the basic structure of the receipt remains consistent, there can be specific variations based on the nature of the real estate transaction. Some commonly encountered types may include: a) Partial Payment Receipt: Acknowledges a partial payment made towards the promissory note, providing details of the amount paid and the remaining balance. b) Lump Sum Payment Receipt: Confirms the receipt of a complete payment for the outstanding promissory note, indicating the final settlement of the debt. c) Installment Payment Receipt: Records periodic payments made by the borrower over a specified duration until the full amount is paid off. d) Interest Payment Receipt: Acknowledges the payment of interest on the promissory note, particularly applicable to loans or financing arrangements involving interest charges. Conclusion: The Harris Texas Receipt for Payment Made on Real Estate Promissory Note is an indispensable document that plays a vital role in real estate transactions across Harris County, Texas. By adequately documenting payments made towards promissory notes, this receipt ensures transparency, mitigates risks of disputes, and fosters trust between the parties involved. Understanding the various types of this receipt allows both borrowers and lenders to navigate the complex world of real estate transactions with clarity and confidence.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.