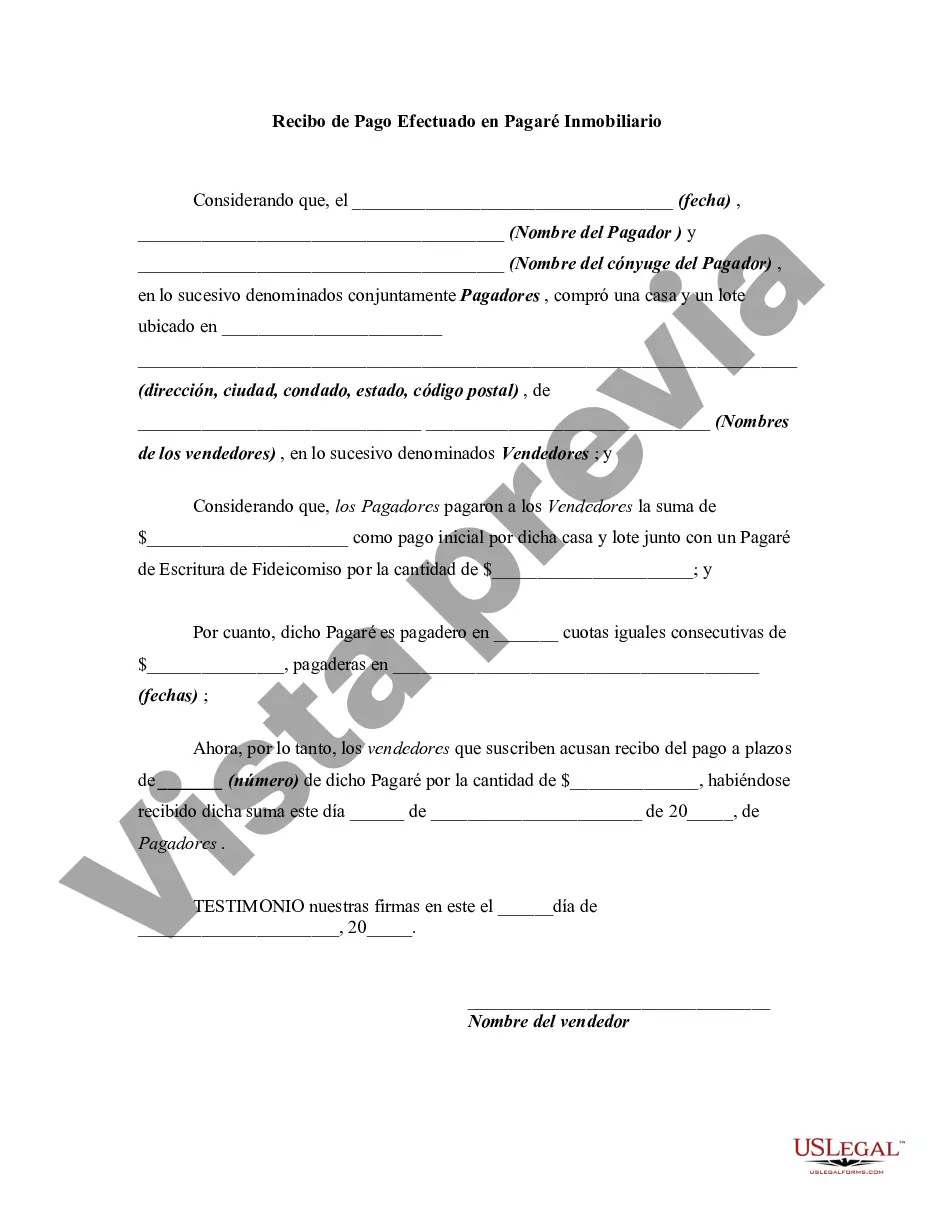

This form is a generic sample of a receipt for an installment payment for an owner financed real estate sale/purchase.

Title: A Comprehensive Guide to Hennepin Minnesota Receipt for Payment Made on Real Estate Promissory Note Introduction: In Hennepin County, Minnesota, the receipt for payment made on a real estate promissory note plays a crucial role in documenting and confirming financial transactions between parties involved in a real estate transaction. This article aims to provide a detailed description of Hennepin Minnesota Receipt for Payment Made on Real Estate Promissory Note, outlining its purpose, importance, and various types if applicable. Section 1: Understanding the Hennepin Minnesota Receipt for Payment Made on Real Estate Promissory Note 1.1 What is a Promissory Note? 1.2 Importance of Receipt for Payment Made on a Promissory Note in Real Estate Transactions. 1.3 Role of Hennepin Minnesota Receipt for Payment Made on Real Estate Promissory Note. Section 2: Components of Hennepin Minnesota Receipt for Payment Made on Real Estate Promissory Note 2.1 Date and Identification Details 2.2 Parties Involved 2.3 Property and Real Estate Transaction Details 2.4 Payment Details 2.5 Signatures and Notary Stamps Section 3: Types of Hennepin Minnesota Receipt for Payment Made on Real Estate Promissory Note 3.1 Installment Receipts 3.2 Lump-Sum Payment Receipts 3.3 Partial Payment Receipts 3.4 Final Payment Receipts Section 4: Legal Aspects of Hennepin Minnesota Receipt for Payment Made on Real Estate Promissory Note 4.1 Adherence to Hennepin County Regulations and Laws 4.2 Notary Public Requirements 4.3 Recording the Receipt for Payment Made on Real Estate Promissory Note Section 5: Key Points to Include in a Receipt for Payment Made on Real Estate Promissory Note 5.1 Accurate Information and Documentation 5.2 Clear Language and Formatting 5.3 Include Relevant Dates and Specifics 5.4 Confirmation of Payment Conclusion: The Hennepin Minnesota Receipt for Payment Made on Real Estate Promissory Note serves as a vital acknowledgment and evidence of payment between parties involved in a real estate transaction. It ensures transparency, legal compliance, and documentation accuracy. By understanding the nuances and types of Hennepin Minnesota receipt for payment made on the real estate promissory note, individuals can facilitate seamless transactions while safeguarding their interests. Remember to consult legal professionals or experienced real estate agents for expert advice when filling out these documents to ensure compliance with Hennepin County regulations.Title: A Comprehensive Guide to Hennepin Minnesota Receipt for Payment Made on Real Estate Promissory Note Introduction: In Hennepin County, Minnesota, the receipt for payment made on a real estate promissory note plays a crucial role in documenting and confirming financial transactions between parties involved in a real estate transaction. This article aims to provide a detailed description of Hennepin Minnesota Receipt for Payment Made on Real Estate Promissory Note, outlining its purpose, importance, and various types if applicable. Section 1: Understanding the Hennepin Minnesota Receipt for Payment Made on Real Estate Promissory Note 1.1 What is a Promissory Note? 1.2 Importance of Receipt for Payment Made on a Promissory Note in Real Estate Transactions. 1.3 Role of Hennepin Minnesota Receipt for Payment Made on Real Estate Promissory Note. Section 2: Components of Hennepin Minnesota Receipt for Payment Made on Real Estate Promissory Note 2.1 Date and Identification Details 2.2 Parties Involved 2.3 Property and Real Estate Transaction Details 2.4 Payment Details 2.5 Signatures and Notary Stamps Section 3: Types of Hennepin Minnesota Receipt for Payment Made on Real Estate Promissory Note 3.1 Installment Receipts 3.2 Lump-Sum Payment Receipts 3.3 Partial Payment Receipts 3.4 Final Payment Receipts Section 4: Legal Aspects of Hennepin Minnesota Receipt for Payment Made on Real Estate Promissory Note 4.1 Adherence to Hennepin County Regulations and Laws 4.2 Notary Public Requirements 4.3 Recording the Receipt for Payment Made on Real Estate Promissory Note Section 5: Key Points to Include in a Receipt for Payment Made on Real Estate Promissory Note 5.1 Accurate Information and Documentation 5.2 Clear Language and Formatting 5.3 Include Relevant Dates and Specifics 5.4 Confirmation of Payment Conclusion: The Hennepin Minnesota Receipt for Payment Made on Real Estate Promissory Note serves as a vital acknowledgment and evidence of payment between parties involved in a real estate transaction. It ensures transparency, legal compliance, and documentation accuracy. By understanding the nuances and types of Hennepin Minnesota receipt for payment made on the real estate promissory note, individuals can facilitate seamless transactions while safeguarding their interests. Remember to consult legal professionals or experienced real estate agents for expert advice when filling out these documents to ensure compliance with Hennepin County regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.