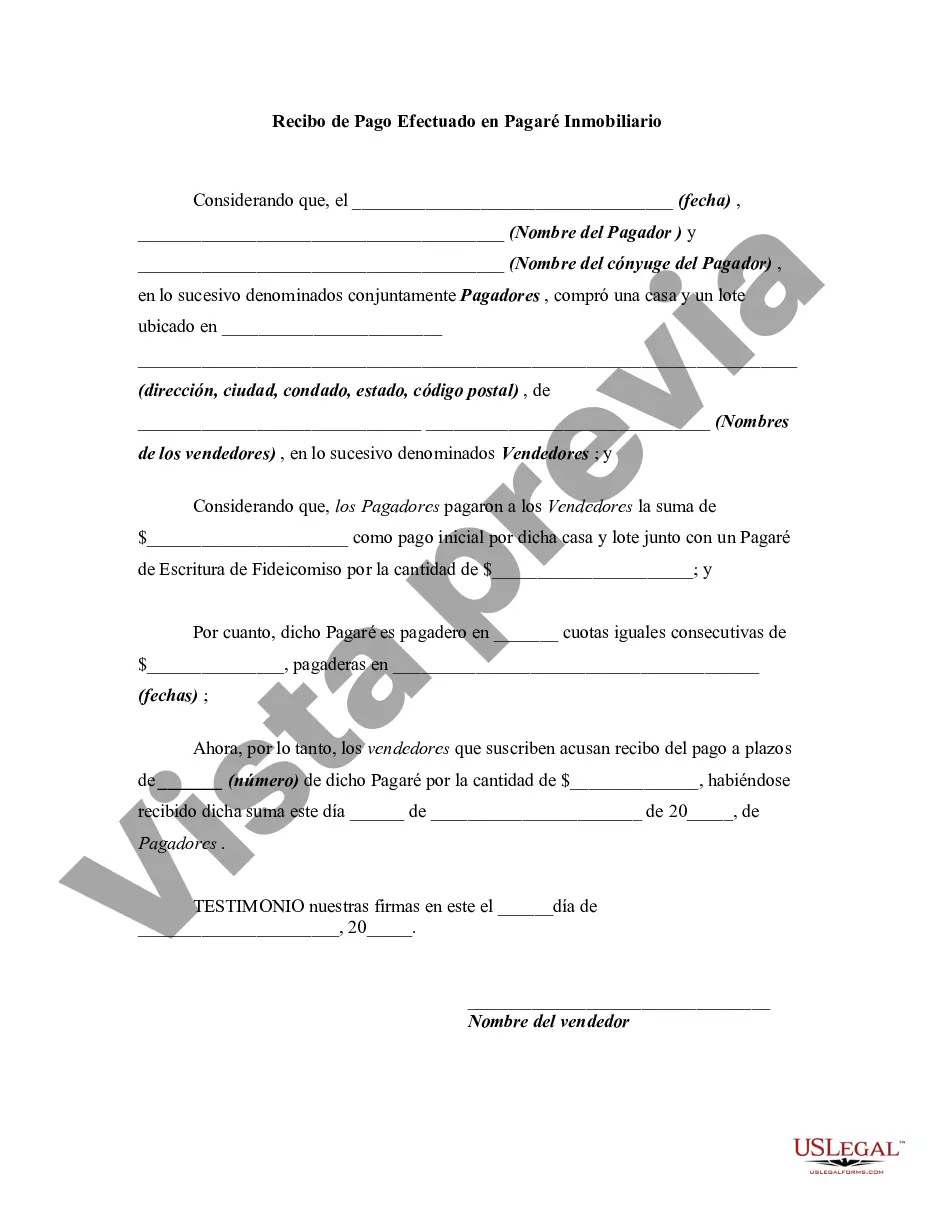

This form is a generic sample of a receipt for an installment payment for an owner financed real estate sale/purchase.

Miami-Dade Florida Receipt for Payment Made on Real Estate Promissory Note serves as a legally binding document that acknowledges the receipt of payment towards a real estate promissory note in the Miami-Dade County area of Florida. This receipt is an essential part of documenting the transaction between the borrower and the lender, ensuring transparency and accountability. The Miami-Dade Florida Receipt for Payment Made on Real Estate Promissory Note outlines crucial details such as the date on which the receipt is issued, the parties involved (borrower and lender), the amount of payment received, and the purpose of the payment (towards a real estate promissory note). Different types of Miami-Dade Florida Receipts for Payment Made on Real Estate Promissory Note may vary based on the specific terms and conditions of the promissory note. Some such variations could include: 1. Partial Payment Receipt: This type of receipt is issued when the borrower makes a partial payment towards the principal amount of the real estate promissory note. It clearly states the partial amount received and deducts it from the total outstanding balance. 2. Full Payment Receipt: When the borrower makes a complete payment towards the real estate promissory note, a full payment receipt is issued. This receipt confirms that the entire outstanding balance has been paid in full, thereby releasing the borrower from any further obligations. 3. Late Payment Receipt: In cases where the borrower fails to make the payment within the specified timeframe, a late payment receipt is issued. This receipt acknowledges the payment made after the due date and may include additional penalty fees or interest charges. 4. Prepayment Receipt: If the borrower decides to pay off the real estate promissory note before the agreed-upon maturity date, a prepayment receipt is issued. This receipt acknowledges the early payment made and may outline any applicable prepayment penalties or adjustments. 5. Interest Payment Receipt: Apart from the principal amount, real estate promissory notes often include interest payments. In such cases, an interest payment receipt is issued to document the interest amount received separately from the principal payment. It is crucial to ensure that the Miami-Dade Florida Receipt for Payment Made on Real Estate Promissory Note includes accurate information, such as the names and contact details of the borrower and lender, the specific terms of the promissory note, the payment amount, and the agreed-upon deadlines. This receipt serves as a proof of payment and can be used for record-keeping, tax purposes, or as evidence in case of any disputes.Miami-Dade Florida Receipt for Payment Made on Real Estate Promissory Note serves as a legally binding document that acknowledges the receipt of payment towards a real estate promissory note in the Miami-Dade County area of Florida. This receipt is an essential part of documenting the transaction between the borrower and the lender, ensuring transparency and accountability. The Miami-Dade Florida Receipt for Payment Made on Real Estate Promissory Note outlines crucial details such as the date on which the receipt is issued, the parties involved (borrower and lender), the amount of payment received, and the purpose of the payment (towards a real estate promissory note). Different types of Miami-Dade Florida Receipts for Payment Made on Real Estate Promissory Note may vary based on the specific terms and conditions of the promissory note. Some such variations could include: 1. Partial Payment Receipt: This type of receipt is issued when the borrower makes a partial payment towards the principal amount of the real estate promissory note. It clearly states the partial amount received and deducts it from the total outstanding balance. 2. Full Payment Receipt: When the borrower makes a complete payment towards the real estate promissory note, a full payment receipt is issued. This receipt confirms that the entire outstanding balance has been paid in full, thereby releasing the borrower from any further obligations. 3. Late Payment Receipt: In cases where the borrower fails to make the payment within the specified timeframe, a late payment receipt is issued. This receipt acknowledges the payment made after the due date and may include additional penalty fees or interest charges. 4. Prepayment Receipt: If the borrower decides to pay off the real estate promissory note before the agreed-upon maturity date, a prepayment receipt is issued. This receipt acknowledges the early payment made and may outline any applicable prepayment penalties or adjustments. 5. Interest Payment Receipt: Apart from the principal amount, real estate promissory notes often include interest payments. In such cases, an interest payment receipt is issued to document the interest amount received separately from the principal payment. It is crucial to ensure that the Miami-Dade Florida Receipt for Payment Made on Real Estate Promissory Note includes accurate information, such as the names and contact details of the borrower and lender, the specific terms of the promissory note, the payment amount, and the agreed-upon deadlines. This receipt serves as a proof of payment and can be used for record-keeping, tax purposes, or as evidence in case of any disputes.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.