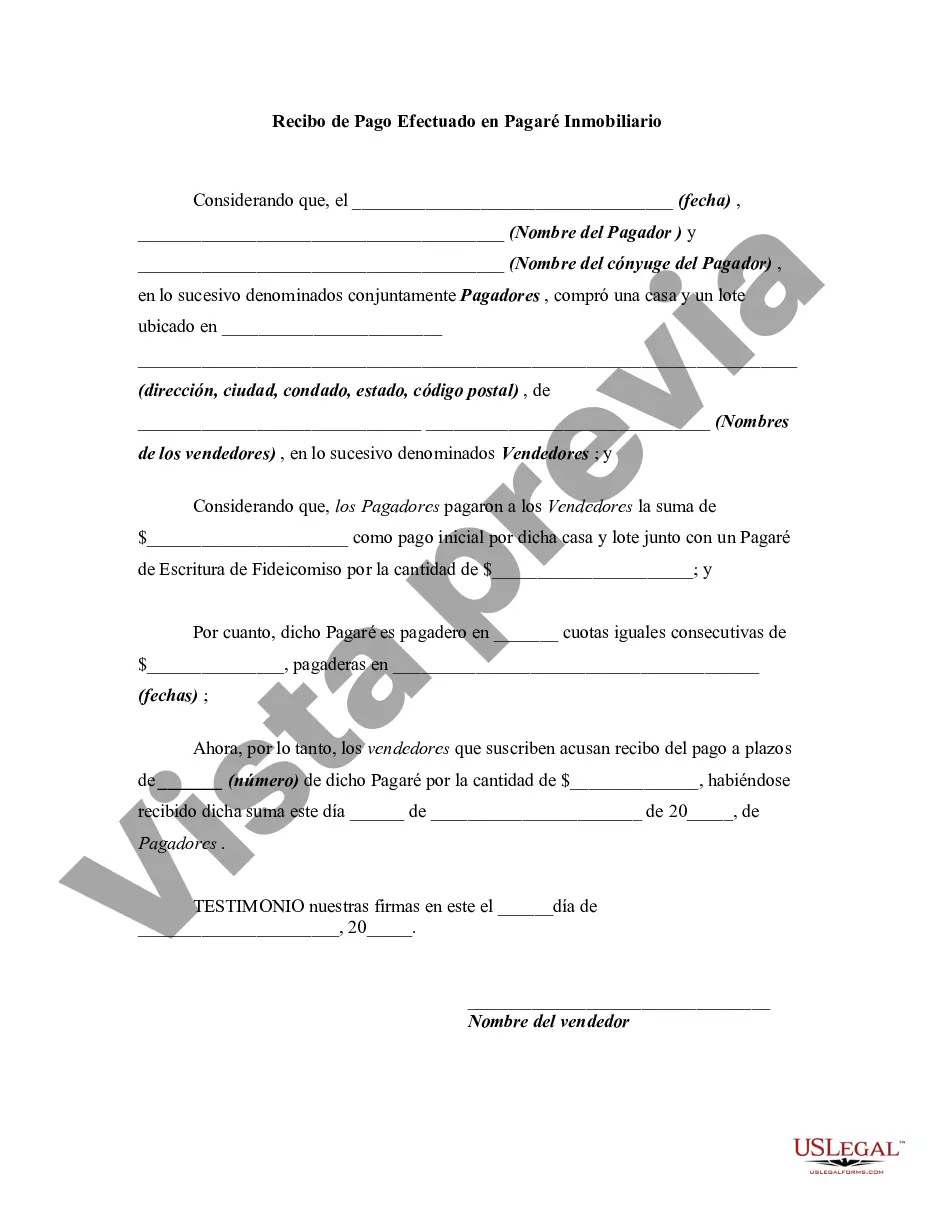

This form is a generic sample of a receipt for an installment payment for an owner financed real estate sale/purchase.

A Montgomery Maryland Receipt for Payment Made on Real Estate Promissory Note is a legal document used to acknowledge the receipt of a payment made towards a real estate transaction that involves a promissory note. This receipt validates the completion of a financial transaction and serves as evidence of payment for both parties involved. The receipt typically includes essential information pertaining to the real estate transaction, such as the names of the parties involved (buyer/seller), property address, date of payment, and the amount received. It also includes details specific to the promissory note, such as the loan terms, interest rate, and repayment schedule. Different types of Montgomery Maryland Receipts for Payment Made on Real Estate Promissory Note may vary based on the nature of the transaction or additional clauses included. Some variations may include: 1. Simple Receipt: This type of receipt is a straightforward acknowledgment of payment made towards a real estate promissory note. It includes standard information about the transaction and the amount received. 2. Conditional Receipt: In some cases, a receipt may be conditional, meaning that it acknowledges the payment made but is contingent upon certain conditions being fulfilled, such as the completion of property inspections or the removal of contingencies in the sales contract. 3. Amended Receipt: If any changes or modifications are made to the real estate promissory note after the initial payment, an amended receipt might be issued to reflect these updates. This helps to ensure transparency and keeps both parties informed about the changes. 4. Final Installment Receipt: If the real estate transaction involves multiple installment payments, a final installment receipt may be issued to acknowledge the last payment made towards the promissory note. This signifies the completion of the payment terms. 5. Partial Payment Receipt: If the buyer makes a partial payment towards the promissory note, a receipt may be issued to acknowledge the amount received. This type of receipt will state the outstanding balance remaining on the promissory note. It is important to note that each state and jurisdiction may have specific requirements and regulations regarding the format and content of a Montgomery Maryland Receipt for Payment Made on Real Estate Promissory Note. Therefore, it is advisable to consult with a local legal professional or real estate expert to ensure compliance with local laws.A Montgomery Maryland Receipt for Payment Made on Real Estate Promissory Note is a legal document used to acknowledge the receipt of a payment made towards a real estate transaction that involves a promissory note. This receipt validates the completion of a financial transaction and serves as evidence of payment for both parties involved. The receipt typically includes essential information pertaining to the real estate transaction, such as the names of the parties involved (buyer/seller), property address, date of payment, and the amount received. It also includes details specific to the promissory note, such as the loan terms, interest rate, and repayment schedule. Different types of Montgomery Maryland Receipts for Payment Made on Real Estate Promissory Note may vary based on the nature of the transaction or additional clauses included. Some variations may include: 1. Simple Receipt: This type of receipt is a straightforward acknowledgment of payment made towards a real estate promissory note. It includes standard information about the transaction and the amount received. 2. Conditional Receipt: In some cases, a receipt may be conditional, meaning that it acknowledges the payment made but is contingent upon certain conditions being fulfilled, such as the completion of property inspections or the removal of contingencies in the sales contract. 3. Amended Receipt: If any changes or modifications are made to the real estate promissory note after the initial payment, an amended receipt might be issued to reflect these updates. This helps to ensure transparency and keeps both parties informed about the changes. 4. Final Installment Receipt: If the real estate transaction involves multiple installment payments, a final installment receipt may be issued to acknowledge the last payment made towards the promissory note. This signifies the completion of the payment terms. 5. Partial Payment Receipt: If the buyer makes a partial payment towards the promissory note, a receipt may be issued to acknowledge the amount received. This type of receipt will state the outstanding balance remaining on the promissory note. It is important to note that each state and jurisdiction may have specific requirements and regulations regarding the format and content of a Montgomery Maryland Receipt for Payment Made on Real Estate Promissory Note. Therefore, it is advisable to consult with a local legal professional or real estate expert to ensure compliance with local laws.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.