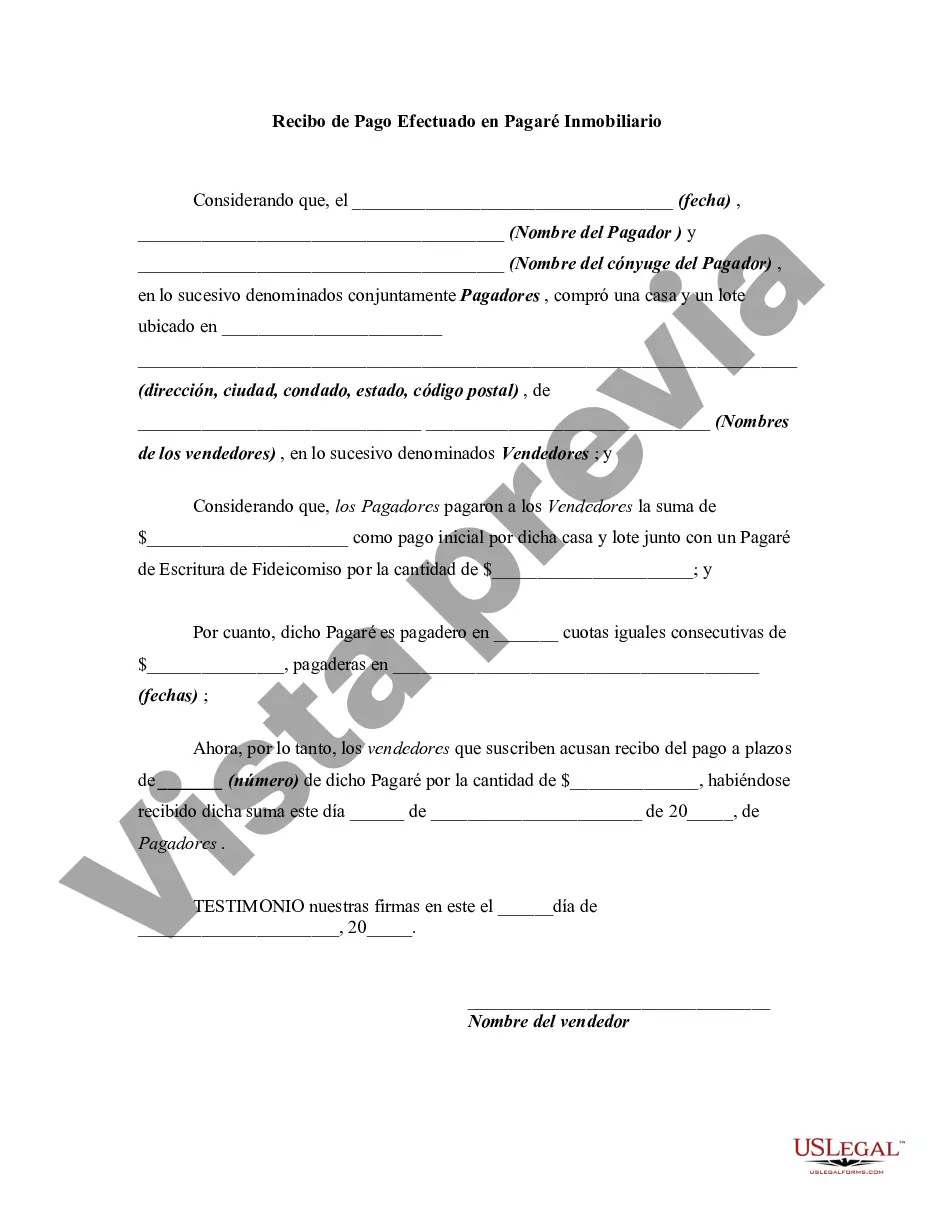

This form is a generic sample of a receipt for an installment payment for an owner financed real estate sale/purchase.

Title: Understanding Nassau New York Receipts for Payment Made on Real Estate Promissory Note Introduction: Nassau County, located within the state of New York, has specific guidelines and requirements in place when it comes to issuing receipts for payments made on real estate promissory notes. These receipts are essential legal documents that provide proof of payment and protect the interests of both the borrower and the lender. In this article, we will delve into the details of Nassau New York receipts for payment made on real estate promissory notes, their importance, and any different types that may exist. 1. What is a Nassau New York Receipt for Payment Made on Real Estate Promissory Note? A Nassau New York Receipt for Payment Made on Real Estate Promissory Note is a written acknowledgement issued by the lender or their authorized representative to the borrower. It serves as proof of payment made towards the promissory note, detailing the date, amount, and specific terms of the transaction. 2. Importance of Nassau New York Receipts for Payment Made on Real Estate Promissory Note: a. Legal Protection: Receipts protect both parties involved, ensuring that the lender can authenticate received payments, while the borrower has evidence of fulfilling their financial obligations. b. Tax and Accounting: Receipts are crucial for tax purposes and accounting, providing accurate records of payments made towards the promissory note's principal and interest. c. Dispute Resolution: Receipts help resolve any potential disputes by providing an indisputable record of payments made. 3. Contents of a Nassau New York Receipt for Payment Made on Real Estate Promissory Note: a. Contact Information: The names and contact details of the borrower and lender. b. Date of Payment: The exact date when the payment was made. c. Payment Amount: The total sum paid, including principal and any interest. d. Promissory Note Details: Reference to the promissory note agreement, specifying the associated terms and conditions. e. Signature and Notary: Receipt should ideally be signed by both parties or their representatives. Notary public verification adds a layer of authenticity. 4. Different Types of Nassau New York Receipts for Payment Made on Real Estate Promissory Note: a. Partial Payment Receipt: Issued when the borrower makes a partial payment towards the promissory note, acknowledging the reduced balance due. b. Full Payment Receipt: Issued when the borrower completes payment in full, confirming the discharge of the promissory note obligation. c. Late Payment Receipt: Issued when the borrower makes a payment after the due date, acknowledging the delay and any associated penalties. d. Prepayment Receipt: Issued when the borrower makes an early payment, acknowledging the reduction in the outstanding balance and any interest adjustments. Conclusion: Nassau New York receipts for payment made on real estate promissory notes play a vital role in documenting financial transactions, protecting the interests of borrowers and lenders alike. By familiarizing yourself with the different types of receipts and their importance, you can ensure compliance with legal and financial obligations while maintaining transparent and effective communication.Title: Understanding Nassau New York Receipts for Payment Made on Real Estate Promissory Note Introduction: Nassau County, located within the state of New York, has specific guidelines and requirements in place when it comes to issuing receipts for payments made on real estate promissory notes. These receipts are essential legal documents that provide proof of payment and protect the interests of both the borrower and the lender. In this article, we will delve into the details of Nassau New York receipts for payment made on real estate promissory notes, their importance, and any different types that may exist. 1. What is a Nassau New York Receipt for Payment Made on Real Estate Promissory Note? A Nassau New York Receipt for Payment Made on Real Estate Promissory Note is a written acknowledgement issued by the lender or their authorized representative to the borrower. It serves as proof of payment made towards the promissory note, detailing the date, amount, and specific terms of the transaction. 2. Importance of Nassau New York Receipts for Payment Made on Real Estate Promissory Note: a. Legal Protection: Receipts protect both parties involved, ensuring that the lender can authenticate received payments, while the borrower has evidence of fulfilling their financial obligations. b. Tax and Accounting: Receipts are crucial for tax purposes and accounting, providing accurate records of payments made towards the promissory note's principal and interest. c. Dispute Resolution: Receipts help resolve any potential disputes by providing an indisputable record of payments made. 3. Contents of a Nassau New York Receipt for Payment Made on Real Estate Promissory Note: a. Contact Information: The names and contact details of the borrower and lender. b. Date of Payment: The exact date when the payment was made. c. Payment Amount: The total sum paid, including principal and any interest. d. Promissory Note Details: Reference to the promissory note agreement, specifying the associated terms and conditions. e. Signature and Notary: Receipt should ideally be signed by both parties or their representatives. Notary public verification adds a layer of authenticity. 4. Different Types of Nassau New York Receipts for Payment Made on Real Estate Promissory Note: a. Partial Payment Receipt: Issued when the borrower makes a partial payment towards the promissory note, acknowledging the reduced balance due. b. Full Payment Receipt: Issued when the borrower completes payment in full, confirming the discharge of the promissory note obligation. c. Late Payment Receipt: Issued when the borrower makes a payment after the due date, acknowledging the delay and any associated penalties. d. Prepayment Receipt: Issued when the borrower makes an early payment, acknowledging the reduction in the outstanding balance and any interest adjustments. Conclusion: Nassau New York receipts for payment made on real estate promissory notes play a vital role in documenting financial transactions, protecting the interests of borrowers and lenders alike. By familiarizing yourself with the different types of receipts and their importance, you can ensure compliance with legal and financial obligations while maintaining transparent and effective communication.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.