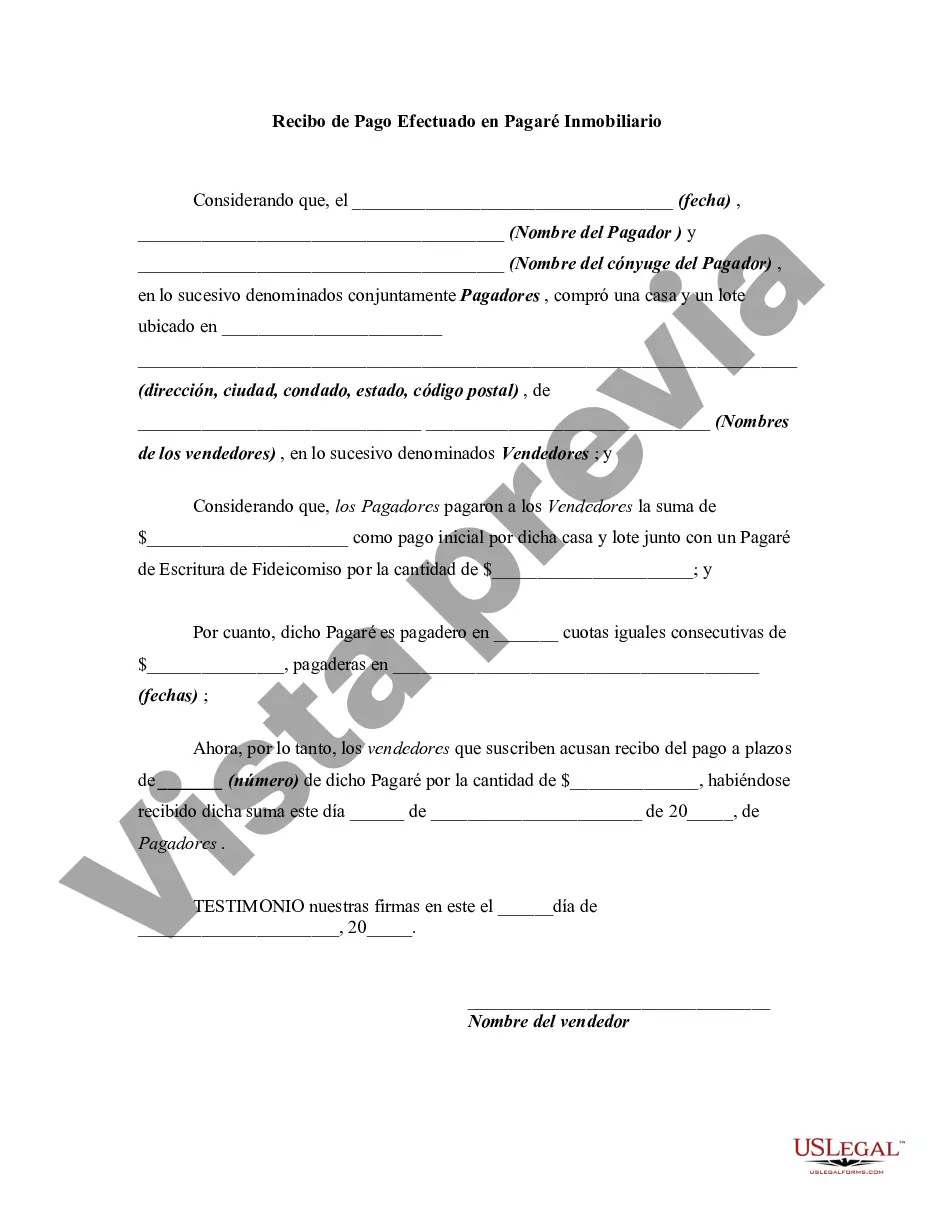

This form is a generic sample of a receipt for an installment payment for an owner financed real estate sale/purchase.

A Palm Beach Florida Receipt for Payment Made on Real Estate Promissory Note serves as a legally binding document that acknowledges the receipt of funds related to a real estate promissory note. It ensures transparency and accountability between the parties involved in a real estate transaction. The receipt includes essential information such as the date the payment was made, the amount received, and the names of the payee and payer. Additionally, it should mention the details of the promissory note, including the loan amount, interest rate, and the agreed-upon terms and conditions. Palm Beach Florida offers various types of receipts for payment made on real estate promissory notes, which cater to different scenarios and requirements: 1. Standard Palm Beach Florida Receipt for Payment Made on Real Estate Promissory Note: This receipt template is commonly used for regular payments made under a promissory note, detailing the payment and specific terms. 2. Partial Payment Receipt: This type of receipt acknowledges a partial payment received on the promissory note. It specifies the remaining balance and any adjustments in terms or interest as a result of the partial payment. 3. Lump Sum Payment Receipt: When the borrower decides to repay the entire loan amount at once, a lump sum payment receipt is used. It validates the closing of the promissory note and documents the full repayment made. 4. Balloon Payment Receipt: In some cases, a promissory note might have a balloon payment structure, where a significant final payment is due at the end of the term. This receipt acknowledges the balloon payment made by the borrower. 5. Adjusted Payment Receipt: If there are any modifications to the original promissory note, such as changes in interest rate, extension of repayment period, or adjustments to the loan terms, an adjusted payment receipt is useful. It reflects the altered terms and confirms the payment received accordingly. It is crucial to accurately document payment transactions related to real estate promissory notes in Palm Beach Florida. Using the appropriate receipt template demonstrates professionalism, helps avoid disputes, and ensures compliance with legal requirements.A Palm Beach Florida Receipt for Payment Made on Real Estate Promissory Note serves as a legally binding document that acknowledges the receipt of funds related to a real estate promissory note. It ensures transparency and accountability between the parties involved in a real estate transaction. The receipt includes essential information such as the date the payment was made, the amount received, and the names of the payee and payer. Additionally, it should mention the details of the promissory note, including the loan amount, interest rate, and the agreed-upon terms and conditions. Palm Beach Florida offers various types of receipts for payment made on real estate promissory notes, which cater to different scenarios and requirements: 1. Standard Palm Beach Florida Receipt for Payment Made on Real Estate Promissory Note: This receipt template is commonly used for regular payments made under a promissory note, detailing the payment and specific terms. 2. Partial Payment Receipt: This type of receipt acknowledges a partial payment received on the promissory note. It specifies the remaining balance and any adjustments in terms or interest as a result of the partial payment. 3. Lump Sum Payment Receipt: When the borrower decides to repay the entire loan amount at once, a lump sum payment receipt is used. It validates the closing of the promissory note and documents the full repayment made. 4. Balloon Payment Receipt: In some cases, a promissory note might have a balloon payment structure, where a significant final payment is due at the end of the term. This receipt acknowledges the balloon payment made by the borrower. 5. Adjusted Payment Receipt: If there are any modifications to the original promissory note, such as changes in interest rate, extension of repayment period, or adjustments to the loan terms, an adjusted payment receipt is useful. It reflects the altered terms and confirms the payment received accordingly. It is crucial to accurately document payment transactions related to real estate promissory notes in Palm Beach Florida. Using the appropriate receipt template demonstrates professionalism, helps avoid disputes, and ensures compliance with legal requirements.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.