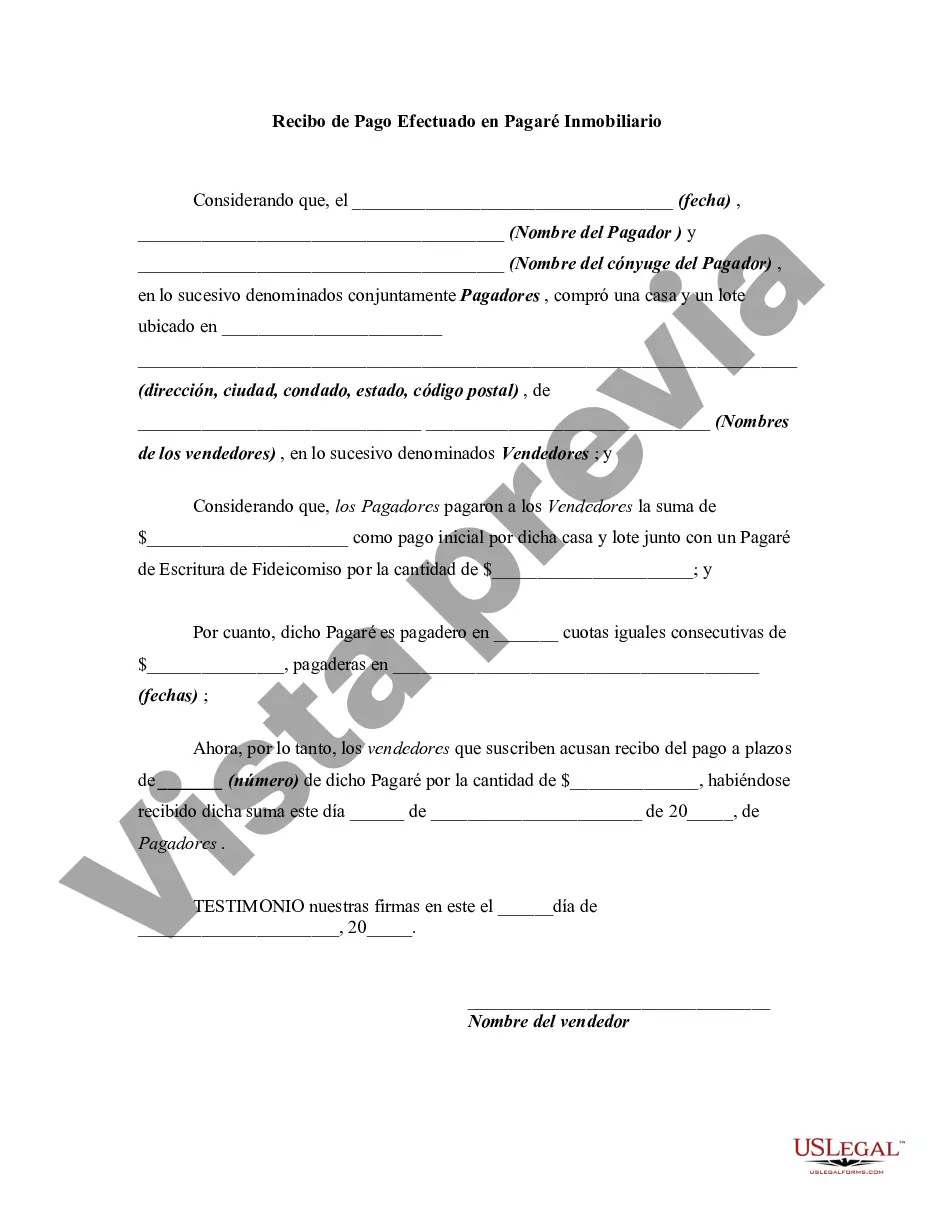

This form is a generic sample of a receipt for an installment payment for an owner financed real estate sale/purchase.

A Phoenix Arizona Receipt for Payment Made on Real Estate Promissory Note serves as a financial document acknowledging the receipt of payment towards a promissory note related to real estate transactions. It is an essential record that outlines the details of the payment made for legal and accounting purposes. The receipt contains crucial information such as the parties involved, payment amount, date of payment, and specific terms related to the promissory note. In Phoenix, Arizona, different types of receipts for payment made on real estate promissory notes can be categorized based on the purpose or nature of the transaction. Some common types include: 1. Purchase Agreement Receipt: This type of receipt is issued upon receiving a payment made towards a real estate purchase agreement. It serves as evidence of the initial payment and outlines the terms and conditions of the purchase agreement. 2. Rental Receipt: If the promissory note is related to a rental property, a rental receipt is issued when the tenant makes a payment towards rent or any other related charges. This receipt confirms the payment received, the rental period, and any additional details specific to the rental agreement. 3. Loan Payment Receipt: When the promissory note is associated with a loan extended for real estate purposes, a loan payment receipt is issued for each installment payment made. This receipt includes the payment amount, installment number, and any interest or fees associated with the loan. 4. Mortgage Payment Receipt: For individuals who have obtained a mortgage loan, a mortgage payment receipt is issued when regular payments are made towards the loan. This receipt verifies the payment made, the outstanding balance, and any additional charges incurred. 5. Promissory Note Modification Receipt: In the case of modifications made to an existing promissory note, a receipt is issued to acknowledge the payment made for the modification process. It outlines the modification details and any impact on payment terms. 6. Prepayment Receipt: If the borrower decides to make a prepayment towards the outstanding balance of the promissory note before the scheduled due date, a prepayment receipt is issued. This receipt acknowledges the prepayment made and any adjustments to the remaining balance and interest. Ensuring accurate record-keeping is vital in real estate transactions, and the use of receipt for payment made on real estate promissory notes is crucial for transparency and accountability. These receipts provide a clear trail of payments made and assist in resolving any potential disputes or misunderstandings that may arise during the course of the transaction.A Phoenix Arizona Receipt for Payment Made on Real Estate Promissory Note serves as a financial document acknowledging the receipt of payment towards a promissory note related to real estate transactions. It is an essential record that outlines the details of the payment made for legal and accounting purposes. The receipt contains crucial information such as the parties involved, payment amount, date of payment, and specific terms related to the promissory note. In Phoenix, Arizona, different types of receipts for payment made on real estate promissory notes can be categorized based on the purpose or nature of the transaction. Some common types include: 1. Purchase Agreement Receipt: This type of receipt is issued upon receiving a payment made towards a real estate purchase agreement. It serves as evidence of the initial payment and outlines the terms and conditions of the purchase agreement. 2. Rental Receipt: If the promissory note is related to a rental property, a rental receipt is issued when the tenant makes a payment towards rent or any other related charges. This receipt confirms the payment received, the rental period, and any additional details specific to the rental agreement. 3. Loan Payment Receipt: When the promissory note is associated with a loan extended for real estate purposes, a loan payment receipt is issued for each installment payment made. This receipt includes the payment amount, installment number, and any interest or fees associated with the loan. 4. Mortgage Payment Receipt: For individuals who have obtained a mortgage loan, a mortgage payment receipt is issued when regular payments are made towards the loan. This receipt verifies the payment made, the outstanding balance, and any additional charges incurred. 5. Promissory Note Modification Receipt: In the case of modifications made to an existing promissory note, a receipt is issued to acknowledge the payment made for the modification process. It outlines the modification details and any impact on payment terms. 6. Prepayment Receipt: If the borrower decides to make a prepayment towards the outstanding balance of the promissory note before the scheduled due date, a prepayment receipt is issued. This receipt acknowledges the prepayment made and any adjustments to the remaining balance and interest. Ensuring accurate record-keeping is vital in real estate transactions, and the use of receipt for payment made on real estate promissory notes is crucial for transparency and accountability. These receipts provide a clear trail of payments made and assist in resolving any potential disputes or misunderstandings that may arise during the course of the transaction.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.