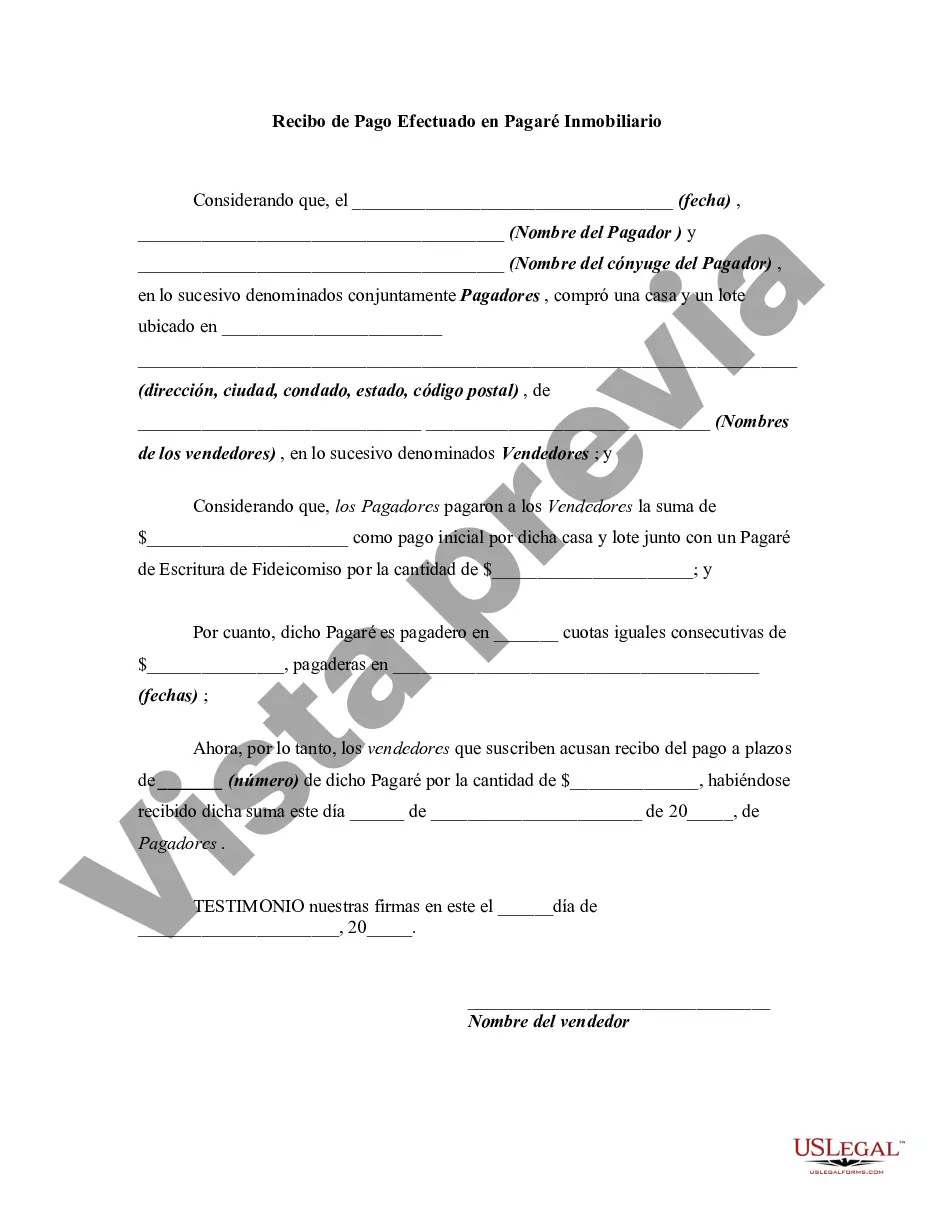

This form is a generic sample of a receipt for an installment payment for an owner financed real estate sale/purchase.

Travis Texas Receipt for Payment Made on Real Estate Promissory Note is a legally-binding document that serves as proof of payment made by a borrower to a lender regarding a real estate transaction. This receipt provides pertinent information about the payment, including the amount, date, and method of payment, ensuring an accurate record is maintained. Types of Travis Texas Receipts for Payment Made on Real Estate Promissory Note may vary based on various factors such as loan terms, payment schedules, or specific agreements between the parties involved. Here are a few possible types: 1. Monthly Payment Receipt: This type of receipt is issued every month when the borrower makes a payment towards the real estate promissory note. It contains information about the monthly installment amount, repayment period, and other relevant details. 2. Lump-Sum Payment Receipt: Sometimes, borrowers may choose to make a lump-sum payment, either to satisfy the remaining balance or accelerate the repayment process. A lump-sum payment receipt highlights the total amount paid and includes details about the promissory note being satisfied. 3. Partial Payment Receipt: In some cases, borrowers may face temporary financial difficulties and may be unable to make the full payment. In such situations, a partial payment receipt is issued, specifying the amount paid and any outstanding balance remaining. 4. Prepayment Receipt: If a borrower decides to pay off the promissory note before the agreed-upon term, a prepayment receipt is generated. This receipt acknowledges the early payment and may include information on any prepayment penalties or discounts applicable, if any. 5. Late Payment Receipt: In situations where a borrower fails to make payments within the specified due date, a late payment receipt is issued when the payment is eventually made. This receipt typically includes any late fees or interest charges that may apply. 6. Payment Confirmation Receipt: This type of receipt confirms the successful receipt of a payment made electronically or through alternative methods like wire transfers, online banking, or mobile payment apps, ensuring that the payment has been received and documented. It is essential to carefully document each payment made on a real estate promissory note using Travis Texas Receipts for Payment. These receipts serve as essential evidence should any disputes arise, also providing a clear record of the borrower's repayment history.Travis Texas Receipt for Payment Made on Real Estate Promissory Note is a legally-binding document that serves as proof of payment made by a borrower to a lender regarding a real estate transaction. This receipt provides pertinent information about the payment, including the amount, date, and method of payment, ensuring an accurate record is maintained. Types of Travis Texas Receipts for Payment Made on Real Estate Promissory Note may vary based on various factors such as loan terms, payment schedules, or specific agreements between the parties involved. Here are a few possible types: 1. Monthly Payment Receipt: This type of receipt is issued every month when the borrower makes a payment towards the real estate promissory note. It contains information about the monthly installment amount, repayment period, and other relevant details. 2. Lump-Sum Payment Receipt: Sometimes, borrowers may choose to make a lump-sum payment, either to satisfy the remaining balance or accelerate the repayment process. A lump-sum payment receipt highlights the total amount paid and includes details about the promissory note being satisfied. 3. Partial Payment Receipt: In some cases, borrowers may face temporary financial difficulties and may be unable to make the full payment. In such situations, a partial payment receipt is issued, specifying the amount paid and any outstanding balance remaining. 4. Prepayment Receipt: If a borrower decides to pay off the promissory note before the agreed-upon term, a prepayment receipt is generated. This receipt acknowledges the early payment and may include information on any prepayment penalties or discounts applicable, if any. 5. Late Payment Receipt: In situations where a borrower fails to make payments within the specified due date, a late payment receipt is issued when the payment is eventually made. This receipt typically includes any late fees or interest charges that may apply. 6. Payment Confirmation Receipt: This type of receipt confirms the successful receipt of a payment made electronically or through alternative methods like wire transfers, online banking, or mobile payment apps, ensuring that the payment has been received and documented. It is essential to carefully document each payment made on a real estate promissory note using Travis Texas Receipts for Payment. These receipts serve as essential evidence should any disputes arise, also providing a clear record of the borrower's repayment history.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.