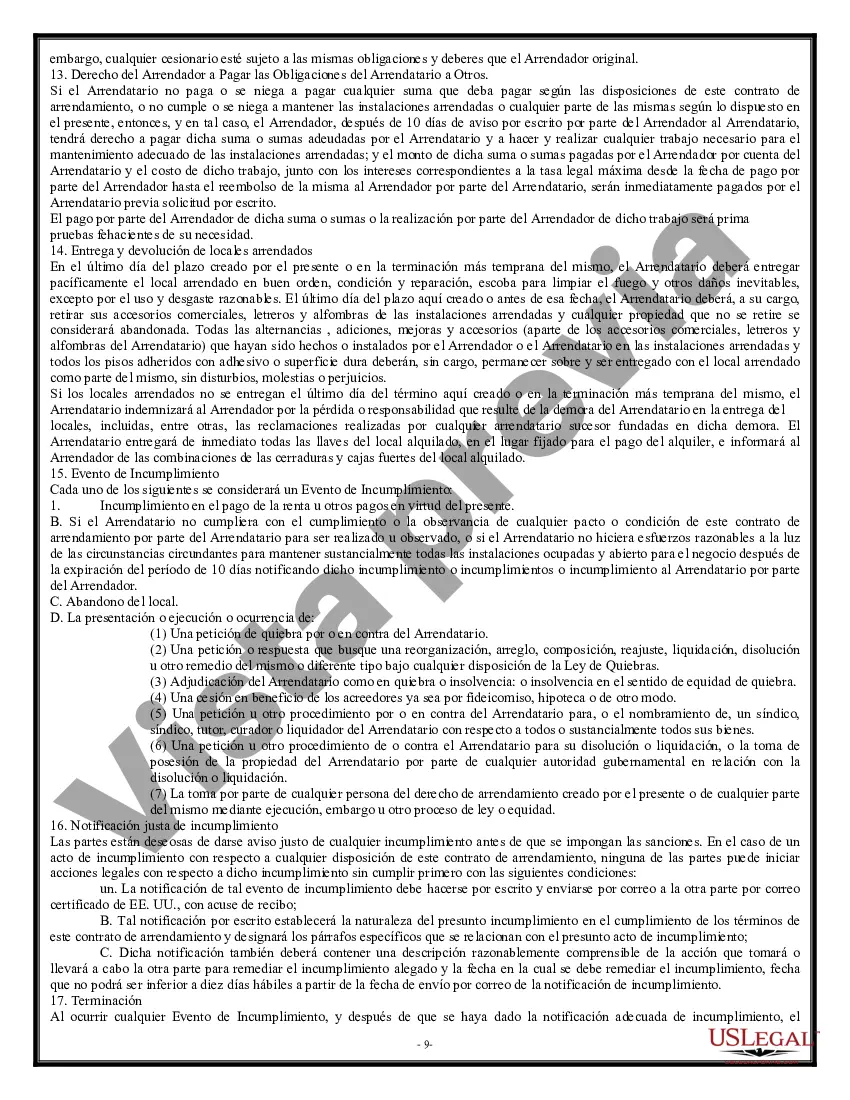

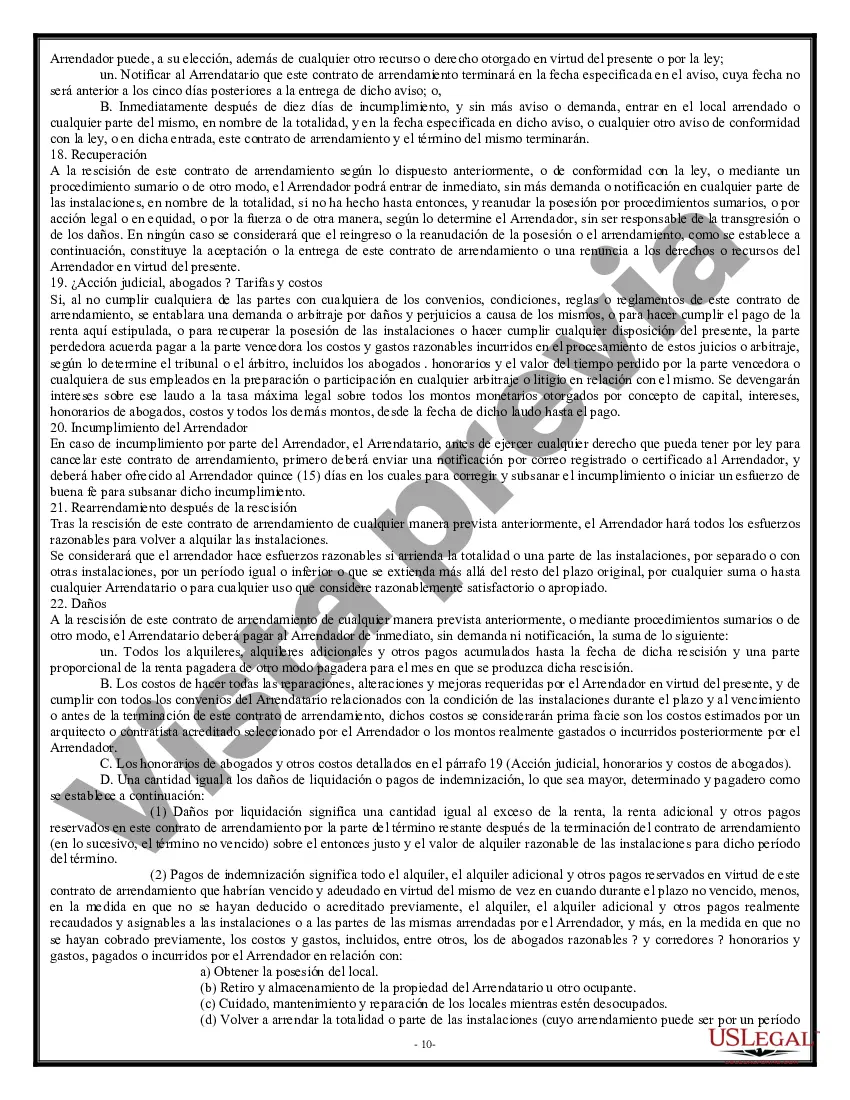

Middlesex Massachusetts Triple Net Lease for Industrial Property is a legal agreement between a landlord and tenant in which the tenant assumes responsibility for all operating expenses, including taxes, insurance, and maintenance costs, in addition to the base rent. This type of lease is commonly used for industrial properties in Middlesex Massachusetts. Triple Net Lease for Industrial Property in Middlesex Massachusetts is primarily designed to transfer significant financial and operational obligations from the landlord to the tenant. Under this arrangement, the tenant becomes responsible for property taxes, insurance premiums, and all maintenance expenses, including repairs, replacements, and general upkeep of the industrial property. This transfer of expenses aims to alleviate the financial burden on the landlord and provide a stable income stream. Industrial properties in Middlesex Massachusetts that typically have Triple Net Leases include warehouses, manufacturing facilities, distribution centers, and other similar commercial spaces. These properties often require specialized infrastructure and usually have long-term lease agreements due to the substantial investment involved in setting up and maintaining such facilities. There are variations of Triple Net Lease for Industrial Property in Middlesex Massachusetts based on the responsibilities assumed by the tenant. Some subtypes include: 1. Single Net Lease: In this version, the tenant is responsible only for one of the three major expenses, typically property taxes. 2. Double Net Lease: Under this arrangement, the tenant assumes responsibility for two of the major expenses, usually property taxes and insurance premiums. The landlord remains responsible for maintenance costs. 3. Triple Net Lease: This is the most common form, where the tenant is liable for all three major expenses — property taxes, insurance premiums, and maintenance costs. Middlesex Massachusetts Triple Net Lease for Industrial Property provides numerous benefits for both landlords and tenants. Landlords can eliminate the day-to-day management of the property and focus solely on receiving rental income while tenants gain greater control and flexibility over the property's operations. Overall, Middlesex Massachusetts Triple Net Lease for Industrial Property is an agreement that transfers significant financial and operational responsibilities to the tenant, allowing for a mutually beneficial arrangement for both parties involved in the industrial property leasing process.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Middlesex Massachusetts Arrendamiento Triple Neto de Propiedad Industrial - Triple Net Lease for Industrial Property

Description

How to fill out Middlesex Massachusetts Arrendamiento Triple Neto De Propiedad Industrial?

Dealing with legal forms is a necessity in today's world. Nevertheless, you don't always need to look for qualified assistance to create some of them from scratch, including Middlesex Triple Net Lease for Industrial Property, with a service like US Legal Forms.

US Legal Forms has more than 85,000 forms to pick from in different categories varying from living wills to real estate paperwork to divorce documents. All forms are organized based on their valid state, making the searching experience less overwhelming. You can also find information resources and tutorials on the website to make any tasks related to document completion straightforward.

Here's how you can find and download Middlesex Triple Net Lease for Industrial Property.

- Go over the document's preview and outline (if provided) to get a basic information on what you’ll get after downloading the form.

- Ensure that the document of your choice is adapted to your state/county/area since state regulations can impact the legality of some records.

- Check the similar document templates or start the search over to find the right file.

- Hit Buy now and create your account. If you already have an existing one, select to log in.

- Pick the option, then a needed payment gateway, and purchase Middlesex Triple Net Lease for Industrial Property.

- Select to save the form template in any offered file format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the needed Middlesex Triple Net Lease for Industrial Property, log in to your account, and download it. Needless to say, our platform can’t take the place of a lawyer entirely. If you need to deal with an extremely challenging case, we advise using the services of a lawyer to review your form before signing and filing it.

With over 25 years on the market, US Legal Forms became a go-to platform for various legal forms for millions of customers. Become one of them today and get your state-compliant paperwork with ease!

Form popularity

Interesting Questions

More info

Industrial buildings should be built as high as possible and with wide-open floor plan. This has a tendency to minimize the floor area and maximize height. A factory that is only partially enclosed in concrete and steel is a “gargantuan” building. The building is still going to need good ventilation in the building and should have great circulation through the building such that in the middle of a workday, if it's windy outside while the building is being used and being cooled in open rooms, that it can be cool to the core. Commercial buildings should be set back from the street because when you are right on the street there is less parking space and more pedestrians. When you are down by the block the street can have very fast traffic, pedestrians and cars. There are a lot of other factors (geography, building type, etc.) a commercial building has to consider, but I think the above is enough of an overview to give a basic sense of what goes on in a warehouse these days. 9.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.