Wayne, Michigan Triple Net Lease for Industrial Property: A Comprehensive Guide If you are considering investing in industrial property in Wayne, Michigan, understanding the concept of a triple net lease (NNN lease) is crucial. A triple net lease is a commercial leasing arrangement where the tenant is responsible for paying three components of the property's operating expenses: taxes, insurance, and maintenance costs. This lease structure shifts a significant burden from the property owner to the tenant, who assumes these additional financial responsibilities. In Wayne, Michigan, the triple net lease for industrial properties offers numerous advantages for both landlords and tenants. Landlords benefit from a predictable income stream, as tenants assume direct responsibility for property-related costs. On the other hand, tenants gain greater control over the property's day-to-day operations and often have the flexibility to customize their space to suit their specific needs. There are several types of triple net leases for industrial properties available in Wayne, Michigan, depending on the nature of the property and the negotiation terms: 1. Absolute Triple Net Lease: In this type of lease, tenants assume all responsibilities for costs associated with the property, including structural repairs, insurance, property taxes, and general maintenance. Landlords have minimal involvement in maintenance or unforeseen expenses, making it a popular choice for landlords seeking limited liability. 2. Modified Net Lease: This lease structure allows for shared responsibilities between the landlord and tenant. While the tenant remains responsible for property taxes, insurance, and certain maintenance tasks, the landlord may bear some responsibility for major structural repairs or other high-cost maintenance issues. 3. Double Net Lease: Although not strictly a triple net lease, the double net lease places financial responsibility on the tenant for property taxes and insurance, leaving the landlord with maintenance and repairs. This type of lease arrangement shares some similarities with a true triple net lease, making it more attractive to tenants seeking reduced financial obligations. 4. Bendable Triple Net Lease: This lease structure is most common in scenarios where a tenant is unable to provide the necessary financial guarantees. In such cases, a bond company guarantees the tenant's lease payments, thus ensuring the landlord's financial security. When considering entering into a triple net lease for industrial property in Wayne, Michigan, it is essential to thoroughly review the lease agreement to understand the specific terms and obligations placed upon both parties. Engaging the services of a knowledgeable real estate attorney or trusted property management professional is highly recommended ensuring a fair and equitable lease arrangement. In conclusion, Wayne, Michigan provides a variety of triple net lease options for industrial property, including absolute triple net leases, modified net leases, double net leases, and bendable triple net leases. These leases offer landlords stable income streams while providing tenants with greater control over property operations. Conducting thorough research and seeking professional advice will ensure a successful and mutually beneficial leasing experience in Wayne, Michigan's industrial property market.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wayne Michigan Arrendamiento Triple Neto de Propiedad Industrial - Triple Net Lease for Industrial Property

Description

How to fill out Wayne Michigan Arrendamiento Triple Neto De Propiedad Industrial?

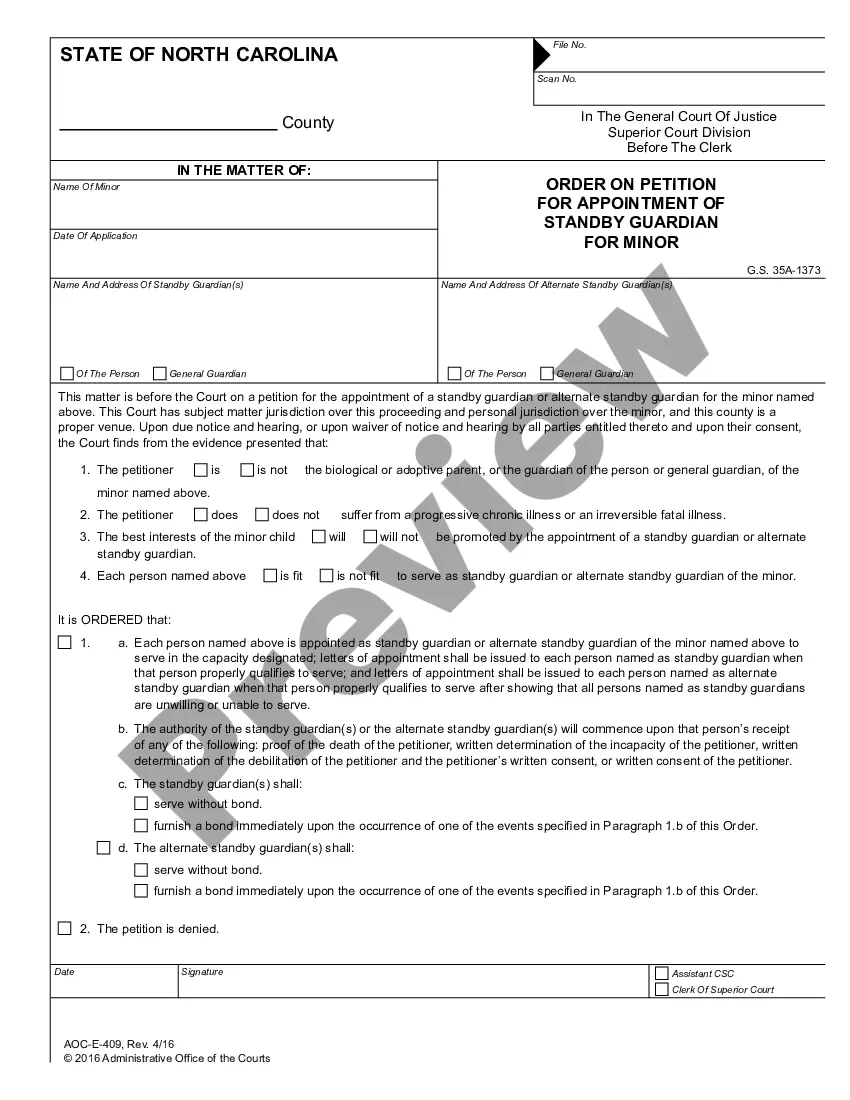

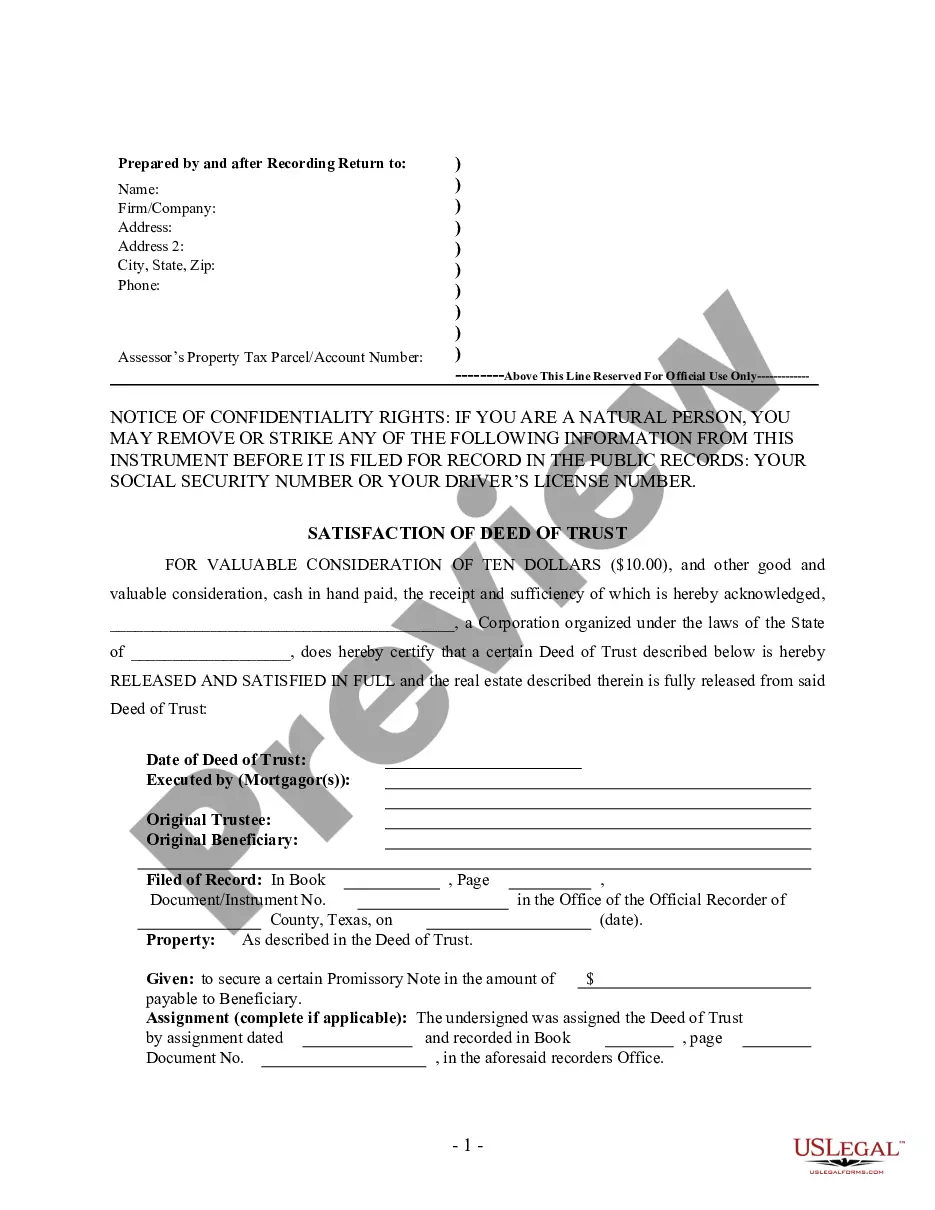

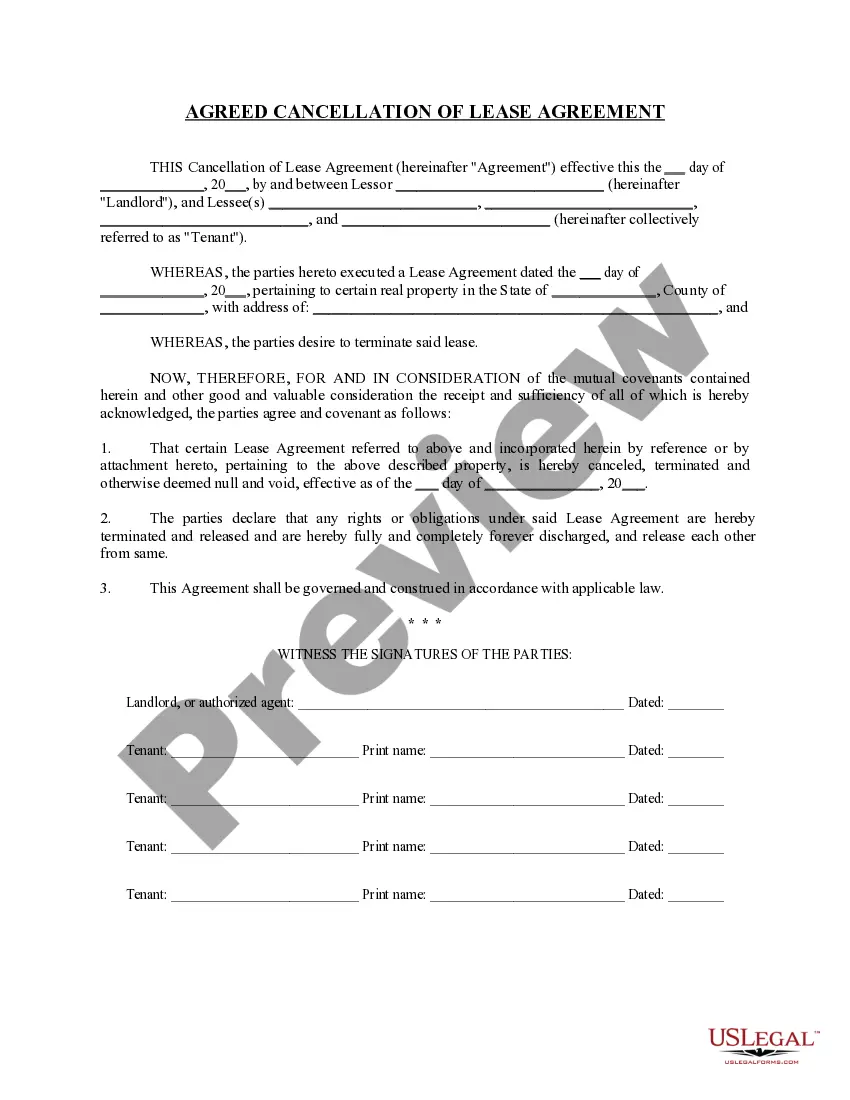

Preparing legal paperwork can be difficult. Besides, if you decide to ask a lawyer to draft a commercial contract, papers for proprietorship transfer, pre-marital agreement, divorce papers, or the Wayne Triple Net Lease for Industrial Property, it may cost you a fortune. So what is the most reasonable way to save time and money and create legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is an excellent solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is the most extensive online collection of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any use case gathered all in one place. Consequently, if you need the latest version of the Wayne Triple Net Lease for Industrial Property, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample with the Download button. If you haven't subscribed yet, here's how you can get the Wayne Triple Net Lease for Industrial Property:

- Look through the page and verify there is a sample for your area.

- Examine the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - look for the right one in the header.

- Click Buy Now when you find the needed sample and choose the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a transaction with a credit card or through PayPal.

- Opt for the file format for your Wayne Triple Net Lease for Industrial Property and download it.

When finished, you can print it out and complete it on paper or import the samples to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the paperwork ever purchased multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!