Allegheny Pennsylvania Triple Net Lease for Commercial Real Estate A triple net lease (NNN lease) is a popular type of commercial lease agreement in Allegheny County, Pennsylvania. This lease structure is commonly used for commercial real estate properties, providing benefits for both landlords and tenants. In this detailed description, we will explore the concept of a triple net lease in Allegheny, Pennsylvania, its advantages, and the different types available in the area. Allegheny County, located in western Pennsylvania, is home to a vibrant commercial real estate market. With its diverse industries and bustling economy, the county offers multiple opportunities for businesses to establish a presence. Whether it's office spaces, retail establishments, or industrial buildings, the triple net lease structure is often sought after by both landlords and tenants due to its distinct advantages. A triple net lease is a lease agreement where the tenant is responsible for paying not only the base rent but also additional expenses associated with the property. These expenses typically include property taxes, insurance premiums, and maintenance costs. By shifting these financial responsibilities to the tenant, landlords benefit from a reduced burden of managing these aspects, while tenants gain more control over the property. There are different types of triple net leases available in Allegheny, Pennsylvania, each with its own variations and considerations: 1. Single Net Lease: In a single net lease, the tenant is responsible for paying property taxes associated with the commercial property. The landlord usually covers insurance and maintenance costs. 2. Double Net Lease: In a double net lease, the tenant assumes responsibility for property taxes and insurance premiums, while the landlord remains responsible for maintenance costs. 3. Triple Net Lease: A triple net lease, also known as a true NNN lease, is the most common and comprehensive type. In this arrangement, the tenant is responsible for property taxes, insurance premiums, and maintenance costs of the commercial property. This type of lease places a significant financial burden on the tenant but provides them with greater control and flexibility over the property. 4. Absolute Triple Net Lease: An absolute triple net lease is similar to a triple net lease, with the added responsibility for structural repairs and improvements falling on the tenant. This type of lease is more common for long-term leases involving freestanding properties, such as single-tenant retail buildings or stand-alone office complexes. When entering into a triple net lease agreement in Allegheny, Pennsylvania, both landlords and tenants must thoroughly evaluate the lease terms, including costs, obligations, and any specific provisions unique to the county or city regulations. Additionally, it is crucial to seek legal and financial advice to ensure the agreement aligns with their objectives and mitigates potential risks. In conclusion, a triple net lease for commercial real estate is a popular lease structure in Allegheny, Pennsylvania, providing benefits for both landlords and tenants. With different types of NNN leases available, businesses and property owners can choose the arrangement that best suits their needs. It is essential to carefully consider the lease terms and seek professional guidance to ensure a successful and mutually beneficial agreement.

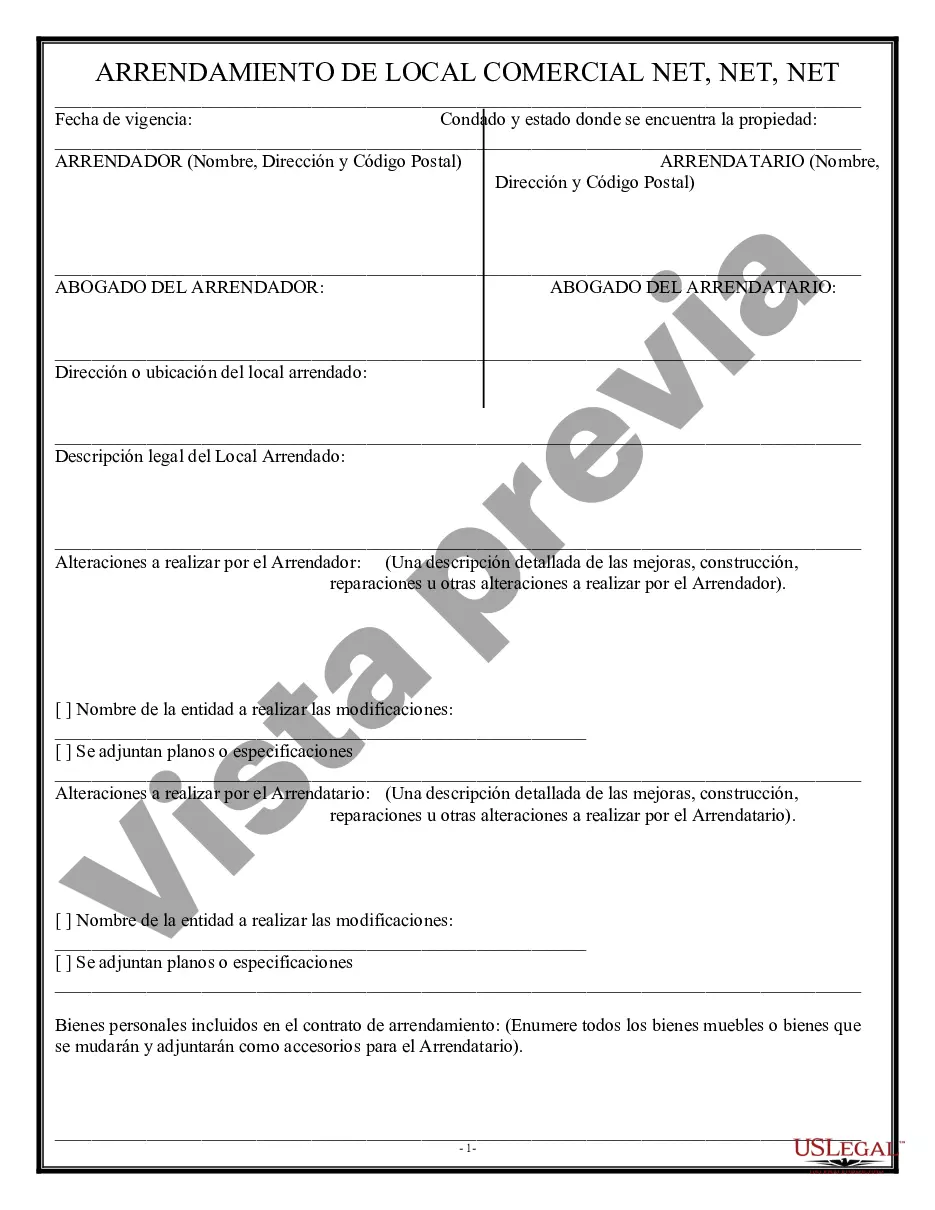

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Allegheny Pennsylvania Arrendamiento neto triple para bienes raíces comerciales - Triple Net Lease for Commercial Real Estate

Description

How to fill out Allegheny Pennsylvania Arrendamiento Neto Triple Para Bienes Raíces Comerciales?

If you need to find a reliable legal form provider to find the Allegheny Triple Net Lease for Commercial Real Estate, look no further than US Legal Forms. No matter if you need to launch your LLC business or manage your belongings distribution, we got you covered. You don't need to be knowledgeable about in law to locate and download the needed template.

- You can search from over 85,000 forms arranged by state/county and case.

- The intuitive interface, variety of learning resources, and dedicated support make it simple to locate and execute various paperwork.

- US Legal Forms is a reliable service offering legal forms to millions of customers since 1997.

You can simply type to look for or browse Allegheny Triple Net Lease for Commercial Real Estate, either by a keyword or by the state/county the document is created for. After locating required template, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's effortless to get started! Simply find the Allegheny Triple Net Lease for Commercial Real Estate template and check the form's preview and description (if available). If you're comfortable with the template’s language, go ahead and click Buy now. Create an account and select a subscription option. The template will be immediately available for download once the payment is completed. Now you can execute the form.

Taking care of your legal affairs doesn’t have to be expensive or time-consuming. US Legal Forms is here to demonstrate it. Our rich collection of legal forms makes this experience less costly and more affordable. Create your first business, arrange your advance care planning, create a real estate agreement, or execute the Allegheny Triple Net Lease for Commercial Real Estate - all from the comfort of your home.

Join US Legal Forms now!