Chicago, Illinois Triple Net Lease for Commercial Real Estate: A Comprehensive Guide Overview: A Triple Net Lease (NNN Lease) is a popular type of lease agreement in the commercial real estate sector that places most of the financial responsibilities on the tenant. In the case of Chicago, Illinois, Triple Net Leases are commonly used for commercial spaces, offering various benefits to both landlords and tenants. This detailed description will explore the topic by providing an overview, explaining its key features, advantages, and different types of Triple Net Leases available in Chicago, Illinois. Key Features: A Triple Net Lease in Chicago, Illinois shifts several financial obligations onto the tenant that would typically fall upon the landlord in a standard lease agreement. Under this arrangement, the tenant assumes responsibility for property taxes, insurance, and maintenance costs associated with the commercial property. The monthly rental charge typically includes the base rent along with reimbursements for these expenses, making it highly predictable for both parties. Advantages: Triple Net Leases offer numerous advantages for both landlords and tenants. Landlords can enjoy a steady income stream without the hassle of managing additional expenses, as tenants assume the responsibility for taxes, insurance, and maintenance. Moreover, these leases provide long-term stability, as tenants are often more invested in maintaining the property they lease. On the other hand, tenants benefit from having control over the property, as they can customize the space to suit their specific business needs and operations. Types of Triple Net Leases in Chicago, Illinois: 1. Single-Tenant Triple Net Lease: Under this arrangement, a commercial property is leased to a single tenant who operates their business exclusively in the space. This type of lease is common for standalone retail buildings, warehouses, or corporate offices. The tenant is responsible for all expenses, including property taxes, insurance, utility costs, and maintenance. 2. Multi-Tenant Triple Net Lease: In a multi-tenant Triple Net Lease, a commercial property is divided into multiple units, each leased to different tenants. Each tenant is responsible for their unit's expenses, including property taxes, insurance, and common area maintenance. This type of lease is often used for shopping centers, office parks, or industrial complexes. 3. Ground Lease with Triple Net: A ground lease involves leasing only the land to a tenant who develops and constructs a building or structure on the property. In this case, the tenant assumes full responsibility for property taxes, insurance, and maintenance. Ground leases with Triple Net provisions are commonly used for long-term development projects and offer flexibility for both parties. Conclusion: Chicago, Illinois Triple Net Leases for Commercial Real Estate provide an attractive option for both landlords and tenants. By shifting most financial obligations to the tenant, these leases offer stability, predictable income, and long-term efficiency in various commercial property sectors. Single-tenant, multi-tenant, and ground lease with Triple Net provisions are the common types of Triple Net Leases found in Chicago, Illinois. Before entering into any lease agreement, it is advised to consult legal professionals who specialize in commercial real estate to ensure the terms align with the specific needs and objectives of all parties involved.

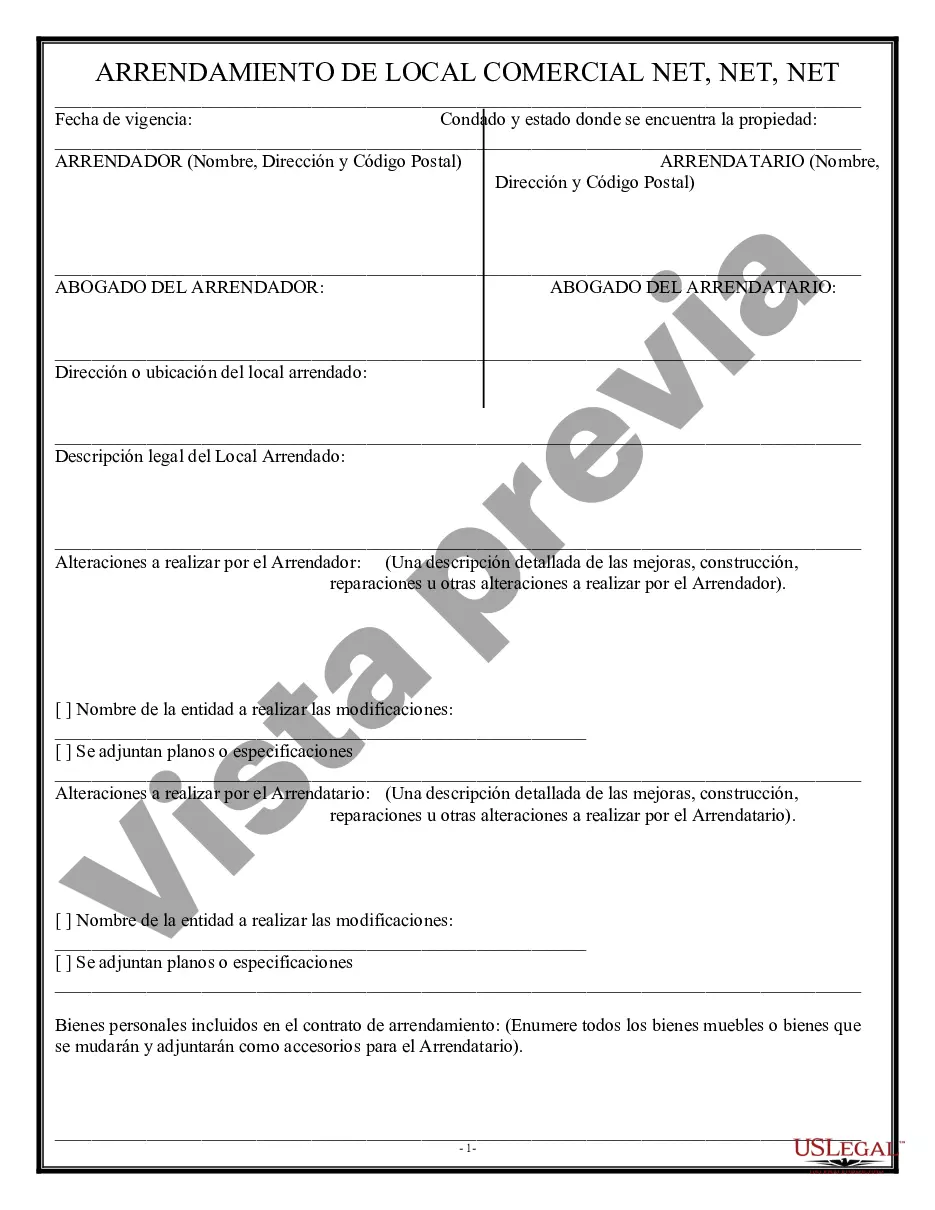

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Chicago Illinois Arrendamiento neto triple para bienes raíces comerciales - Triple Net Lease for Commercial Real Estate

Description

How to fill out Chicago Illinois Arrendamiento Neto Triple Para Bienes Raíces Comerciales?

A document routine always accompanies any legal activity you make. Creating a company, applying or accepting a job offer, transferring property, and lots of other life situations demand you prepare official documentation that varies throughout the country. That's why having it all accumulated in one place is so helpful.

US Legal Forms is the biggest online library of up-to-date federal and state-specific legal forms. Here, you can easily locate and get a document for any individual or business purpose utilized in your county, including the Chicago Triple Net Lease for Commercial Real Estate.

Locating samples on the platform is extremely straightforward. If you already have a subscription to our library, log in to your account, find the sample through the search bar, and click Download to save it on your device. Afterward, the Chicago Triple Net Lease for Commercial Real Estate will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this simple guide to obtain the Chicago Triple Net Lease for Commercial Real Estate:

- Ensure you have opened the right page with your localised form.

- Use the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the form satisfies your requirements.

- Search for another document using the search option if the sample doesn't fit you.

- Click Buy Now when you locate the necessary template.

- Decide on the suitable subscription plan, then sign in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and download the Chicago Triple Net Lease for Commercial Real Estate on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most reliable way to obtain legal documents. All the samples available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs efficiently with the US Legal Forms!