Fairfax Virginia Triple Net Lease for Commercial Real Estate: A Comprehensive Overview A Triple Net Lease (NNN Lease), commonly used in commercial real estate transactions, is a lease agreement where the tenant is responsible for paying property taxes, insurance, and maintenance costs in addition to the base rent. This type of lease places substantial financial responsibilities on the tenant, making it a popular option for long-term commercial property deals, including those in Fairfax, Virginia. In Fairfax, Virginia, known for its thriving business community and proximity to Washington, D.C., numerous variations of Triple Net Leases cater to the diverse needs of commercial real estate stakeholders. These variations include: 1. Triple Net Lease (NNN): Under this lease structure, the tenant is responsible for all property taxes, insurance premiums, and maintenance expenses, including repairs and replacements. This type of lease relieves the landlord of these obligations, allowing them to focus on other aspects of property management. 2. Double Net Lease (IN Lease): In a Double Net Lease, also known as a Net-Net Lease (IN Lease), the tenant assumes responsibility for property taxes and insurance. However, the landlord remains responsible for structural and major maintenance expenses. This lease offers a slight reduction in tenant obligations compared to a Triple Net Lease. 3. Single Net Lease (N Lease): In this type of lease, the tenant is responsible for paying property taxes only. The landlord retains responsibility for insurance and maintenance costs. Single Net Leases are relatively less burdensome for tenants but shift a portion of the financial obligations onto them. 4. Absolute Triple Net Lease: Often seen in high-quality commercial real estate properties, an Absolute Triple Net Lease places the highest level of financial responsibility on the tenant. It requires them to cover all property taxes, insurance costs, maintenance expenses, repairs, and even capital improvements. This type of lease allows the landlord to have a truly "hands-off" approach since the tenant becomes responsible for virtually all property-related expenditures. 5. Modified Gross Lease: While not precisely a Triple Net Lease, a Modified Gross Lease involves splitting the expenses between the landlord and tenant. Typically, the tenant pays a base rent amount, while the landlord assumes certain expenses such as property taxes or structural maintenance. The specific breakdown of costs is negotiated and detailed in the lease agreement. It is crucial for both landlords and tenants in Fairfax, Virginia, to carefully consider their financial capabilities and responsibilities when entering into a Triple Net Lease. Evaluating market conditions, property condition, and projected expenses is essential to determine the most suitable lease type and negotiate favorable lease terms. In conclusion, a Triple Net Lease in Fairfax, Virginia, and its various types offer commercial real estate investors and tenants flexible options for property ownership or occupancy. Whether opting for a Triple Net, Double Net, Single Net, Absolute Triple Net Lease, or a Modified Gross Lease, proper understanding and consideration of all associated costs and obligations are vital for a mutually beneficial lease agreement.

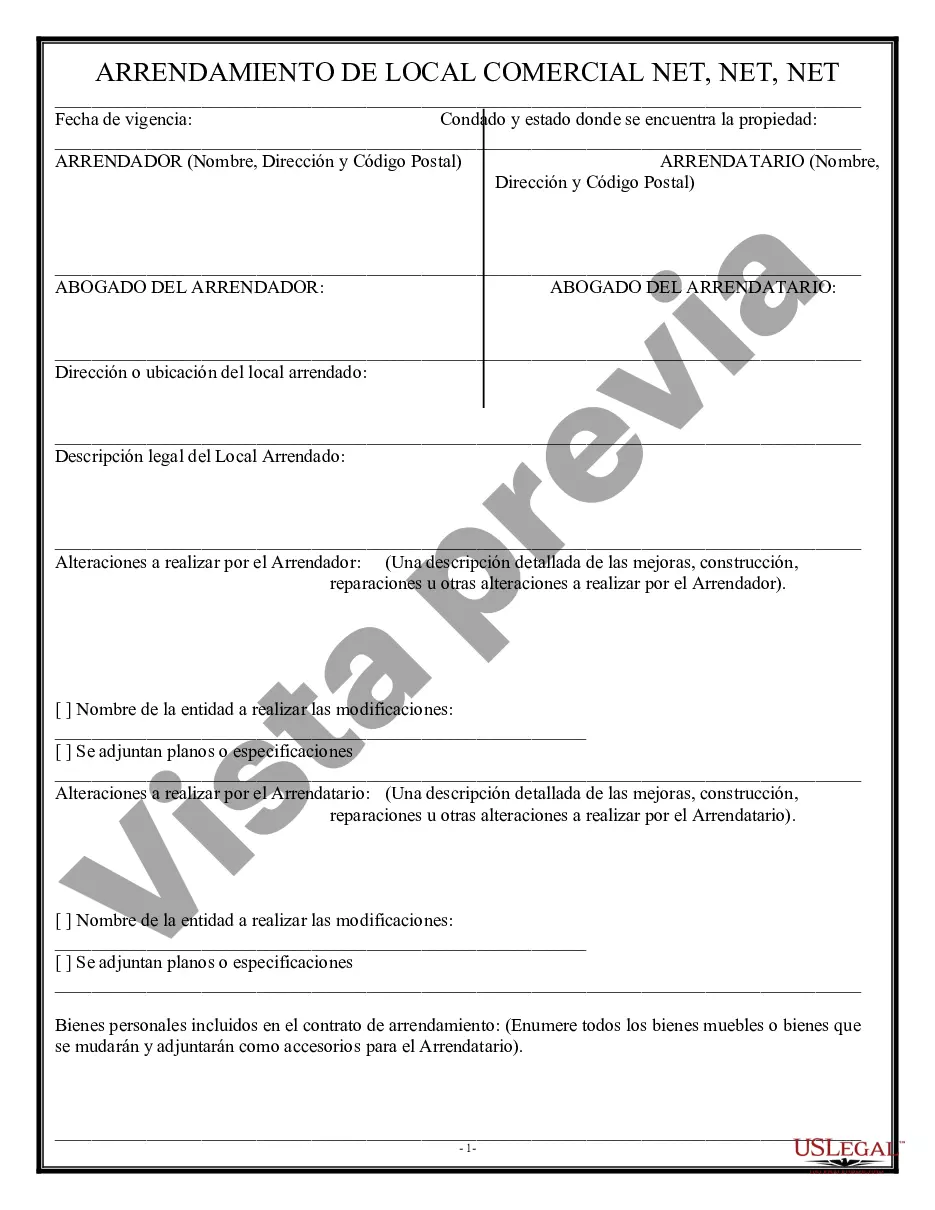

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Fairfax Virginia Arrendamiento neto triple para bienes raíces comerciales - Triple Net Lease for Commercial Real Estate

Description

How to fill out Fairfax Virginia Arrendamiento Neto Triple Para Bienes Raíces Comerciales?

Creating paperwork, like Fairfax Triple Net Lease for Commercial Real Estate, to manage your legal affairs is a challenging and time-consumming process. Many circumstances require an attorney’s participation, which also makes this task not really affordable. Nevertheless, you can take your legal matters into your own hands and manage them yourself. US Legal Forms is here to save the day. Our website features more than 85,000 legal forms crafted for a variety of scenarios and life circumstances. We ensure each form is in adherence with the regulations of each state, so you don’t have to worry about potential legal issues compliance-wise.

If you're already aware of our website and have a subscription with US, you know how straightforward it is to get the Fairfax Triple Net Lease for Commercial Real Estate template. Go ahead and log in to your account, download the template, and personalize it to your needs. Have you lost your form? Don’t worry. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new customers is fairly simple! Here’s what you need to do before downloading Fairfax Triple Net Lease for Commercial Real Estate:

- Ensure that your form is compliant with your state/county since the regulations for creating legal papers may differ from one state another.

- Discover more information about the form by previewing it or reading a brief intro. If the Fairfax Triple Net Lease for Commercial Real Estate isn’t something you were hoping to find, then use the header to find another one.

- Sign in or register an account to begin utilizing our website and get the form.

- Everything looks good on your side? Hit the Buy now button and select the subscription plan.

- Pick the payment gateway and enter your payment details.

- Your form is good to go. You can go ahead and download it.

It’s easy to find and buy the needed document with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our rich library. Sign up for it now if you want to check what other perks you can get with US Legal Forms!