A Harris Texas Triple Net Lease for commercial real estate is a type of lease agreement that shifts a significant portion of expenses and responsibilities from the landlord to the tenant. Under this arrangement, the tenant is responsible for paying the base rent, as well as the property taxes, insurance premiums, and maintenance costs associated with the property. The Harris Texas Triple Net Lease is structured to alleviate the burden of property management and allow property owners to receive a consistent rental income without having to worry about day-to-day operational costs. This agreement is commonly used in commercial real estate transactions, particularly for retail, office spaces, or industrial properties. There are several variations of the Harris Texas Triple Net Lease, which provide different levels of responsibility for the tenant. These variations include: 1. Single Net Lease: In this type of lease, the tenant is responsible for paying property taxes in addition to the base rent. The landlord typically retains responsibility for insurance and maintenance costs. 2. Double Net Lease: With a double net lease, the tenant is responsible for paying property taxes and insurance premiums, in addition to the base rent. The landlord remains responsible for maintenance expenses. 3. Triple Net Lease: This is the most common type of Harris Texas Triple Net Lease. Under this agreement, the tenant assumes responsibility for all three components: property taxes, insurance premiums, and maintenance costs, in addition to the base rent. The landlord's involvement is generally limited to major structural repairs and replacements. 4. Absolute Triple Net Lease: This lease places almost all the responsibility on the tenant, including structural repairs and replacements. The tenant is essentially responsible for all expenses related to the property, including taxes, insurance, maintenance, and improvements. By utilizing a Harris Texas Triple Net Lease, landlords can ensure a predictable income stream, while tenants have the opportunity to control their operational costs and maintain flexibility in managing the property as per their business needs. It is essential for both parties to carefully review and negotiate the lease terms, including the allocation of expenses, to clarify responsibilities and avoid any potential disputes.

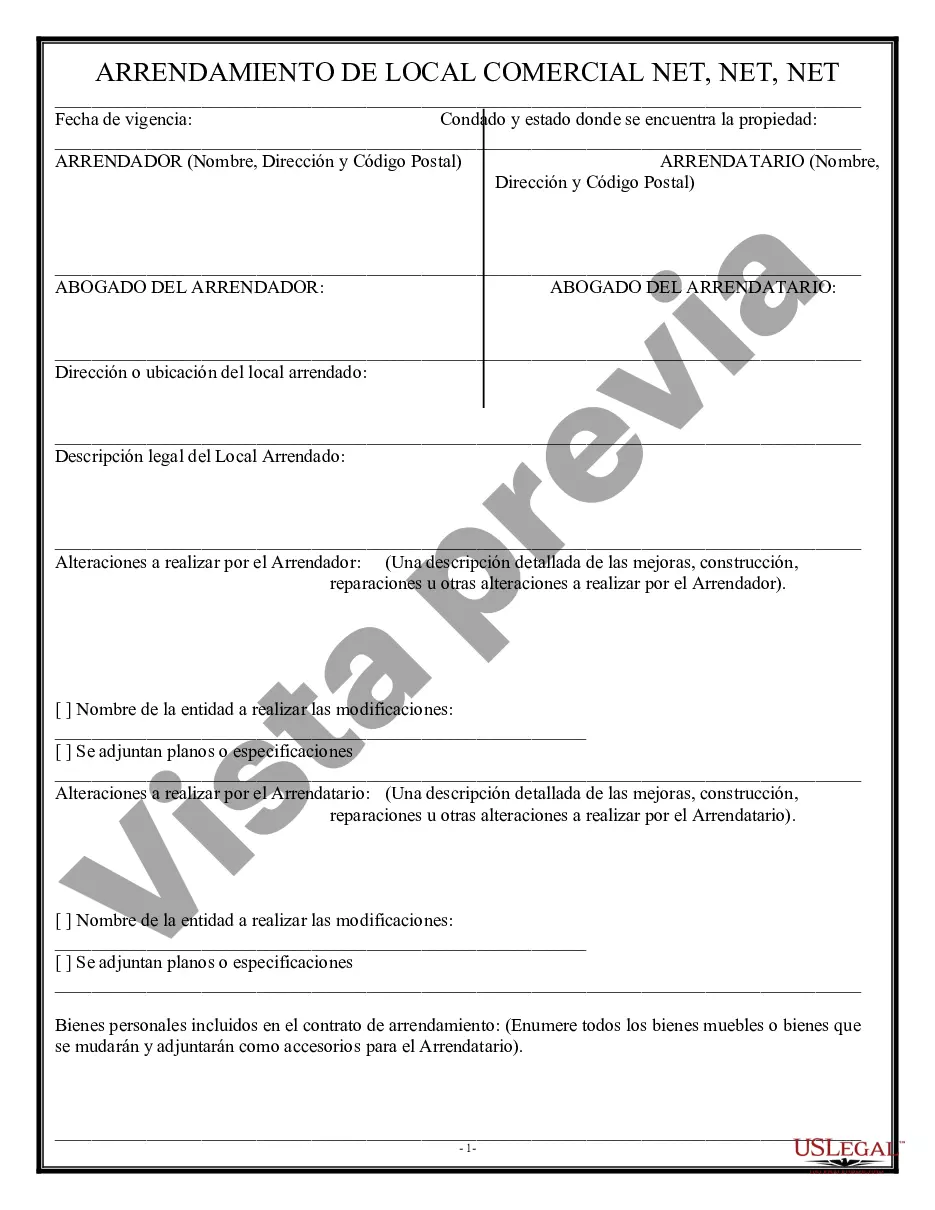

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Harris Texas Arrendamiento neto triple para bienes raíces comerciales - Triple Net Lease for Commercial Real Estate

Description

How to fill out Harris Texas Arrendamiento Neto Triple Para Bienes Raíces Comerciales?

Creating legal forms is a must in today's world. Nevertheless, you don't always need to seek qualified assistance to draft some of them from the ground up, including Harris Triple Net Lease for Commercial Real Estate, with a service like US Legal Forms.

US Legal Forms has more than 85,000 templates to pick from in various categories varying from living wills to real estate papers to divorce papers. All forms are arranged based on their valid state, making the searching experience less overwhelming. You can also find information materials and guides on the website to make any activities related to paperwork completion simple.

Here's how you can purchase and download Harris Triple Net Lease for Commercial Real Estate.

- Take a look at the document's preview and outline (if provided) to get a general information on what you’ll get after downloading the document.

- Ensure that the document of your choice is specific to your state/county/area since state laws can impact the legality of some records.

- Check the related document templates or start the search over to find the appropriate document.

- Hit Buy now and register your account. If you already have an existing one, choose to log in.

- Pick the pricing {plan, then a suitable payment method, and purchase Harris Triple Net Lease for Commercial Real Estate.

- Choose to save the form template in any available format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the needed Harris Triple Net Lease for Commercial Real Estate, log in to your account, and download it. Needless to say, our platform can’t replace an attorney completely. If you have to cope with an extremely challenging situation, we advise getting a lawyer to check your form before signing and filing it.

With more than 25 years on the market, US Legal Forms proved to be a go-to provider for various legal forms for millions of customers. Join them today and purchase your state-specific paperwork with ease!