Houston Texas Arrendamiento neto triple para bienes raíces comerciales - Triple Net Lease for Commercial Real Estate

Description

How to fill out Arrendamiento Neto Triple Para Bienes Raíces Comerciales?

A document protocol invariably accompanies every legal action you undertake.

Establishing a business, submitting or accepting an employment proposal, conveying real estate, and numerous other life circumstances necessitate the preparation of official documents that differ from one jurisdiction to another.

That is why having everything consolidated in a single location is extremely advantageous.

US Legal Forms is the largest online repository of current federal and state-specific legal documents.

Use it as necessary: print it or complete it electronically, sign it, and file it where required. This is the easiest and most reliable manner to secure legal documents. All samples offered in our collection are expertly crafted and validated for conformity to local laws and rules. Prepare your documents and oversee your legal matters effectively with US Legal Forms!

- Here, you can effortlessly search for and download a document for any personal or commercial purpose applicable in your county, including the Houston Triple Net Lease for Commercial Real Estate.

- Finding templates on the platform is remarkably straightforward.

- If you already possess a subscription to our service, Log In to your account, locate the sample via the search bar, and click Download to save it on your device.

- Subsequently, the Houston Triple Net Lease for Commercial Real Estate will be available for your subsequent use in the My documents section of your profile.

- If you are engaging with US Legal Forms for the first time, adhere to this uncomplicated guide to retrieve the Houston Triple Net Lease for Commercial Real Estate.

- Ensure you have accessed the correct page with your localized form.

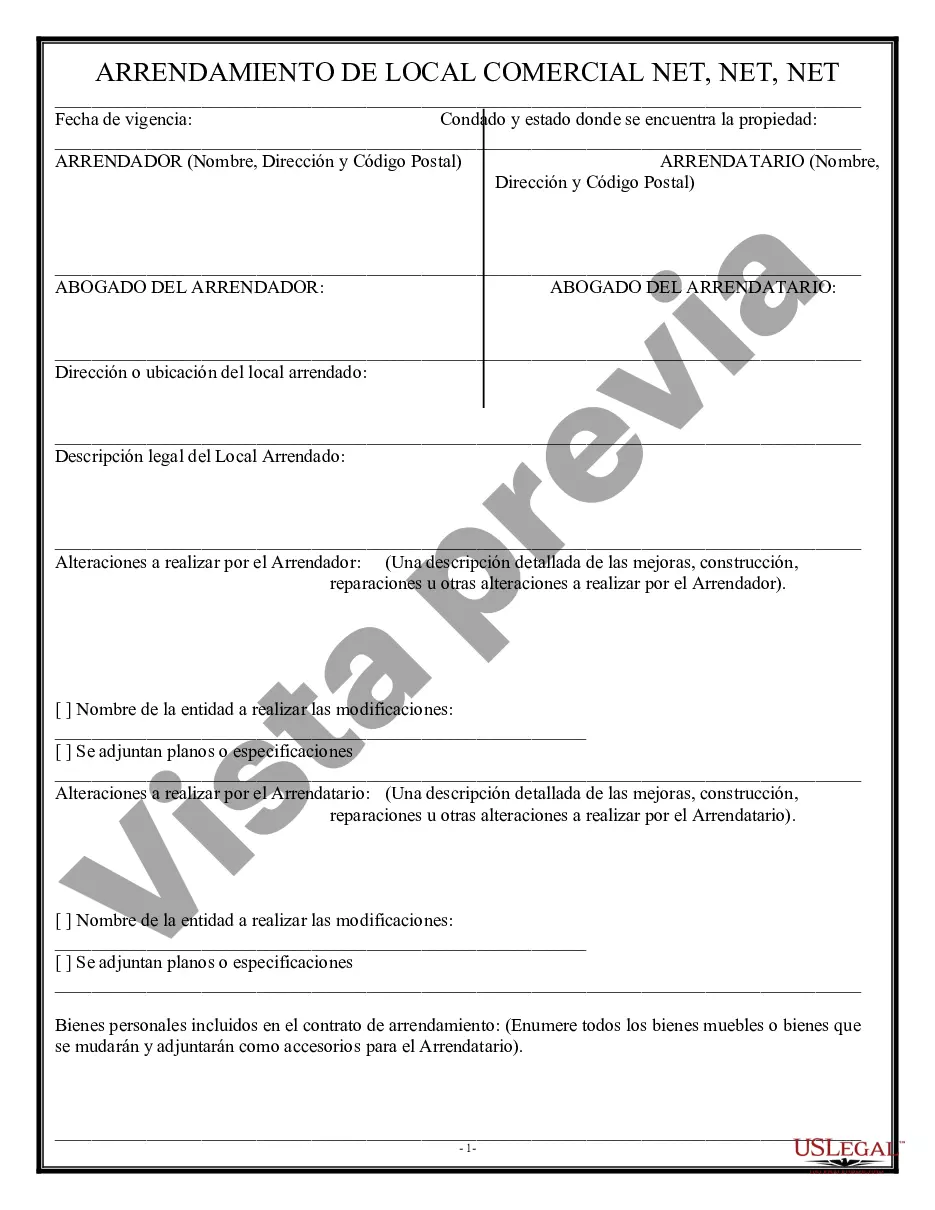

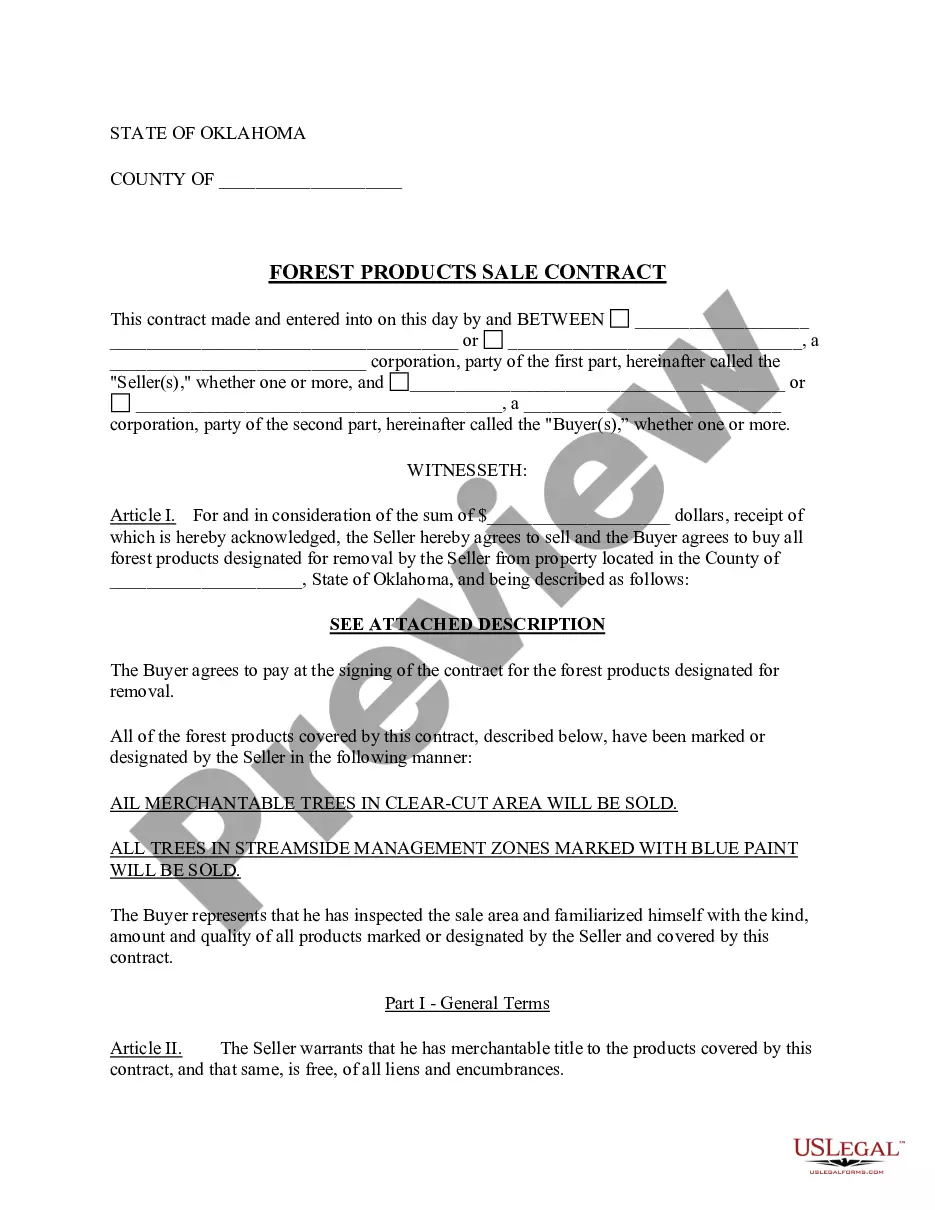

- Utilize the Preview mode (if available) and browse through the sample.

- Examine the description (if provided) to confirm the form fulfills your requirements.

- Search for another document using the search tab if the sample does not suit you.

- Click Buy Now once you discover the desired template.

- Select the suitable subscription plan, then either sign in or create an account.

- Choose the preferred payment method (via credit card or PayPal) to proceed.

- Select file format and save the Houston Triple Net Lease for Commercial Real Estate on your device.

Form popularity

FAQ

El desistimiento del inquilino se encuentra regulado en el articulo 11 de la Ley de Arrendamientos Urbanos (LAU). El arrendatario podra desistir del contrato de arrendamiento, una vez que hayan transcurrido al menos seis meses, siempre que se lo comunique al arrendador con una antelacion minima de treinta dias.

Como finalizar un contrato de arrendamiento Verifica las clausulas acordadas.Analiza que tipo de condiciones de cancelacion existen.Solicita la cancelacion a tiempo.Haz la entrega de acuerdo a lo descrito en el contrato.Preguntas frecuentes.

Si sale temprano, o sea, antes de que termine el contrato y la razon tendra nada que ver con el dueno, Usted ha violado lo prometido de su contrato de arrendamiento. El dueno, pues, le puede tratar de obligar pagar la renta por el resto del periodo del contrato.

«El arrendatario podra dar por terminado unilateralmente el contrato de arrendamiento dentro del termino inicial o durante sus prorrogas, previo aviso escrito dirigido al arrendador a traves del servicio postal autorizado, con una antelacion no menor de tres (3) meses y el pago de una indemnizacion equivalente al

Hay diferentes circunstancias en las que un contrato puede darse por terminado: cuando ambas partes terminan la relacion de mutuo acuerdo. cuando se ha logrado la finalidad economica pretendida y ambas partes han realizado todas las obligaciones previstas. cuando llega la fecha pactada para la terminacion del contrato.

Pagar la indemnizacion al arrendador por incumplir el contrato. Deberas pagar una indemnizacion equivalente a tres (3) meses de canon de arrendamiento al arrendador. Cabe aclarar que este pago solo se tendra que efectuar si tu decides terminar el contrato antes de que la fecha pactada finalice.

Usted puede rescindir el contrato avisando al propietario con un mes de antelacion. Sin embargo, el propietario tambien puede terminar el contrato de arrendamiento con un preaviso de un mes. Si esto sucede inesperadamente, es posible que necesite encontrar una casa rapidamente.

El termino de origen estadounidense refiere a una estructura de arrendamiento llamada Triple Net ''Net, Net, Net'', la cual es comun para un acuerdo de arrendamiento en hoteles, en ella el arrendatario se hace cargo del pago de seguros, impuestos y el mantenimiento de instalaciones y areas comunes.

Si el propietario no cumple con su obligacion, el inquilino adquirira el derecho de rescindir el arrendamiento o asistir con un juez para solicitar una resolucion. Todo gasto ocasionado por esta omision, sera responsabilidad del propietario. No dar a conocer vicios y defectos del inmueble antes de firmar el contrato.

Notificacion Escrita con 30 Dias de Anticipacion El dueno puede desalojarlo con una notificacion de 30 dias por cualquiera o ninguna razon.