The King Washington Triple Net Lease for Commercial Real Estate is a specific lease agreement that places certain responsibilities and financial burdens on the tenant, also known as the lessee. In this lease structure, the tenant is required to pay for the property's net operating expenses, including real estate taxes, insurance, and property maintenance costs, in addition to the base rent. This type of lease arrangement is commonly employed in commercial real estate, particularly in retail, office, and industrial sectors. One crucial aspect of the King Washington Triple Net Lease is the tenant's obligation to cover the property's operating expenses, such as property taxes. By assuming these costs, the lessee bears a significant financial burden, which can fluctuate based on market conditions and property-specific factors. Similarly, the tenant is responsible for insurance premiums, ensuring the property is adequately insured against potential risks and liabilities. Moreover, under the King Washington Triple Net Lease, the lessee has the duty to maintain the property, which typically includes upkeep, repairs, and improvements. This allows the tenant to have a more prominent role in property management while partly relieving the property owner from day-to-day maintenance responsibilities. By offloading these obligations, the property owner can focus on other investment opportunities or enjoy passive income generation. King Washington Triple Net Leases for Commercial Real Estate are often seen in various forms, depending on the specific requirements of the landlord and tenant. Examples of different types of Triple Net Leases include the Absolute Triple Net Lease, where the tenant is responsible for all expenses, including structural repairs, and the Modified Gross Lease, which combines elements of both Triple Net and Gross leases, shifting the burden of some operating expenses to the landlord. In summary, the King Washington Triple Net Lease for Commercial Real Estate is a lease agreement that places significant financial and operational responsibilities on the tenant. By assuming costs related to property taxes, insurance, and maintenance, the lessee bears the burden of the property's net operating expenses. Different variations of the Triple Net Lease may exist, tailored to landlords' and tenants' specific needs, such as the Absolute Triple Net Lease and Modified Gross Lease. Understanding the intricacies of these lease structures is crucial for anyone engaging in commercial real estate transactions.

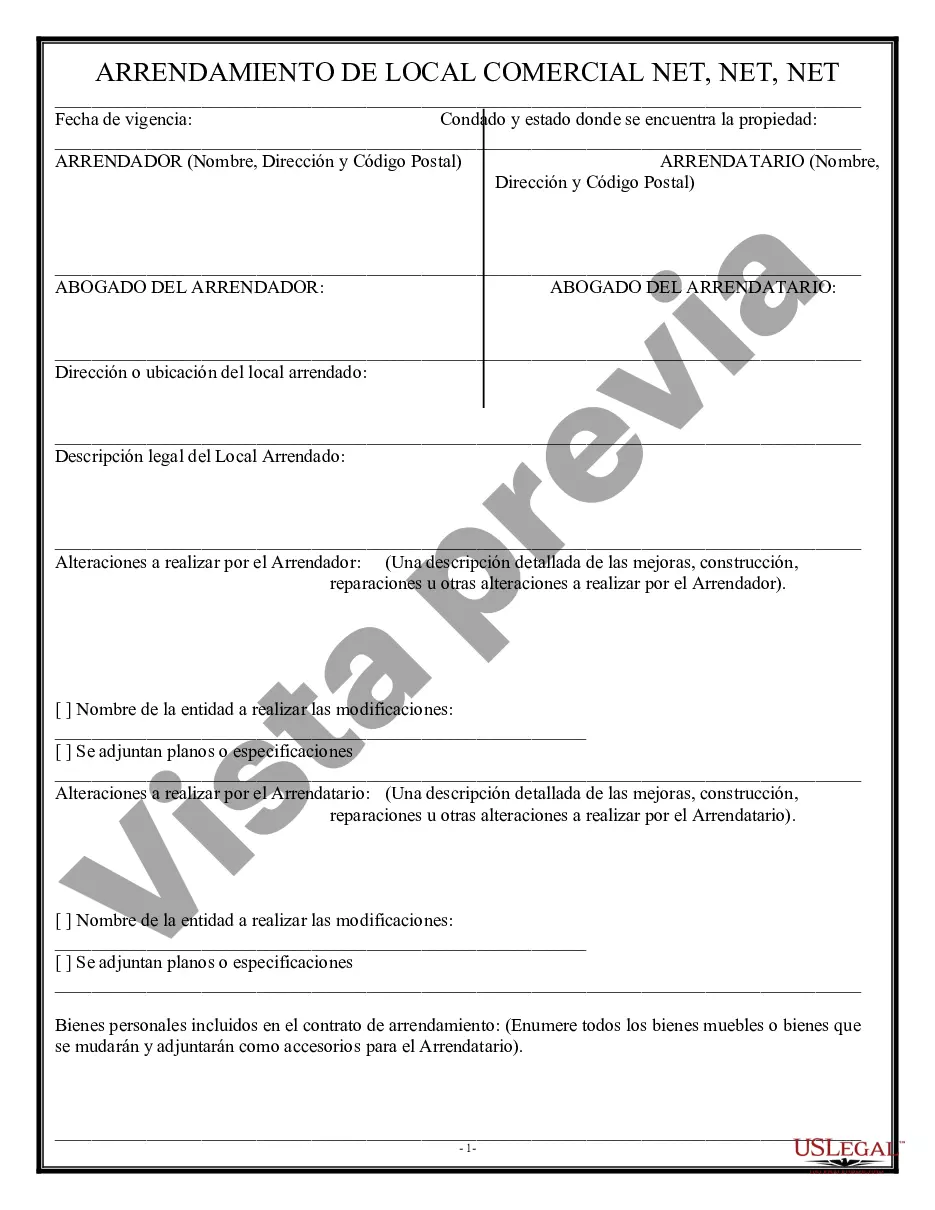

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.King Washington Arrendamiento neto triple para bienes raíces comerciales - Triple Net Lease for Commercial Real Estate

Description

How to fill out King Washington Arrendamiento Neto Triple Para Bienes Raíces Comerciales?

Draftwing documents, like King Triple Net Lease for Commercial Real Estate, to manage your legal affairs is a difficult and time-consumming task. Many circumstances require an attorney’s participation, which also makes this task not really affordable. Nevertheless, you can take your legal issues into your own hands and deal with them yourself. US Legal Forms is here to save the day. Our website comes with over 85,000 legal forms crafted for different scenarios and life situations. We ensure each document is in adherence with the laws of each state, so you don’t have to worry about potential legal problems associated with compliance.

If you're already familiar with our services and have a subscription with US, you know how straightforward it is to get the King Triple Net Lease for Commercial Real Estate form. Go ahead and log in to your account, download the form, and customize it to your needs. Have you lost your document? No worries. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new users is fairly easy! Here’s what you need to do before getting King Triple Net Lease for Commercial Real Estate:

- Ensure that your form is specific to your state/county since the rules for creating legal paperwork may vary from one state another.

- Learn more about the form by previewing it or reading a brief description. If the King Triple Net Lease for Commercial Real Estate isn’t something you were looking for, then use the header to find another one.

- Log in or register an account to start utilizing our website and download the form.

- Everything looks good on your end? Click the Buy now button and choose the subscription plan.

- Select the payment gateway and type in your payment information.

- Your form is all set. You can try and download it.

It’s an easy task to locate and purchase the needed document with US Legal Forms. Thousands of organizations and individuals are already benefiting from our extensive library. Sign up for it now if you want to check what other perks you can get with US Legal Forms!