Middlesex Massachusetts Triple Net Lease for Commercial Real Estate: A Comprehensive Overview In Middlesex County, Massachusetts, the triple net lease (NNN lease) is a widely used commercial real estate arrangement that offers numerous benefits for both landlords and tenants. This type of lease entails the tenant assuming responsibility for not only the rent but also the operating expenses associated with the property, including property taxes, insurance premiums, and maintenance costs. In this article, we will delve into the details of Middlesex Massachusetts Triple Net Lease for Commercial Real Estate, examining its features, advantages, and variations. Features of Middlesex Massachusetts Triple Net Lease: 1. Rent: In a triple net lease, the tenant pays a base rent on top of which they also cover property taxes, insurance, and maintenance expenses. The tenant essentially becomes responsible for managing and maintaining the property, offering them more control over the space. 2. Flexibility: Triple net leases often allow for customization, enabling tenants to modify the space according to their business needs. This flexibility makes triple net leases particularly attractive for businesses seeking long-term occupancy and potential expansion opportunities. 3. Financial Stability: Since tenants bear the burden of operating expenses, landlords typically receive a predictable income stream. This financial stability can be appealing for property owners, especially those seeking stable long-term investments. Types of Middlesex Massachusetts Triple Net Lease: 1. Single Net Lease: With a single net lease, tenants are responsible for covering only one of the operating expenses — commonly property taxes. The landlord takes care of insurance and maintenance costs. While this type of lease places a smaller burden on the tenant, landlords may still have operational responsibilities. 2. Double Net Lease: In a double net lease, the tenant pays both property taxes and insurance premiums, while the landlord manages maintenance costs. This distribution of expenses provides an intermediate level of financial responsibility for the tenant while reducing the landlord's operational liabilities. 3. Triple Net Lease: Under a traditional triple net lease, the tenant assumes all operating expenses, including property taxes, insurance, and maintenance costs. This type of lease often offers the highest level of financial responsibility for the tenant, granting them greater control over the property without excessive involvement from the landlord. In conclusion, the Middlesex Massachusetts Triple Net Lease for Commercial Real Estate is an arrangement that grants tenants the responsibility of operating expenses while providing potential benefits such as flexibility and control over the property. Within Middlesex County, tenants and landlords may choose from various options such as the single net lease, double net lease, and traditional triple net lease, each offering different levels of financial responsibility. Before entering into any lease agreements, both parties should carefully analyze their needs and negotiate terms that align with their goals and objectives.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Middlesex Massachusetts Arrendamiento neto triple para bienes raíces comerciales - Triple Net Lease for Commercial Real Estate

Description

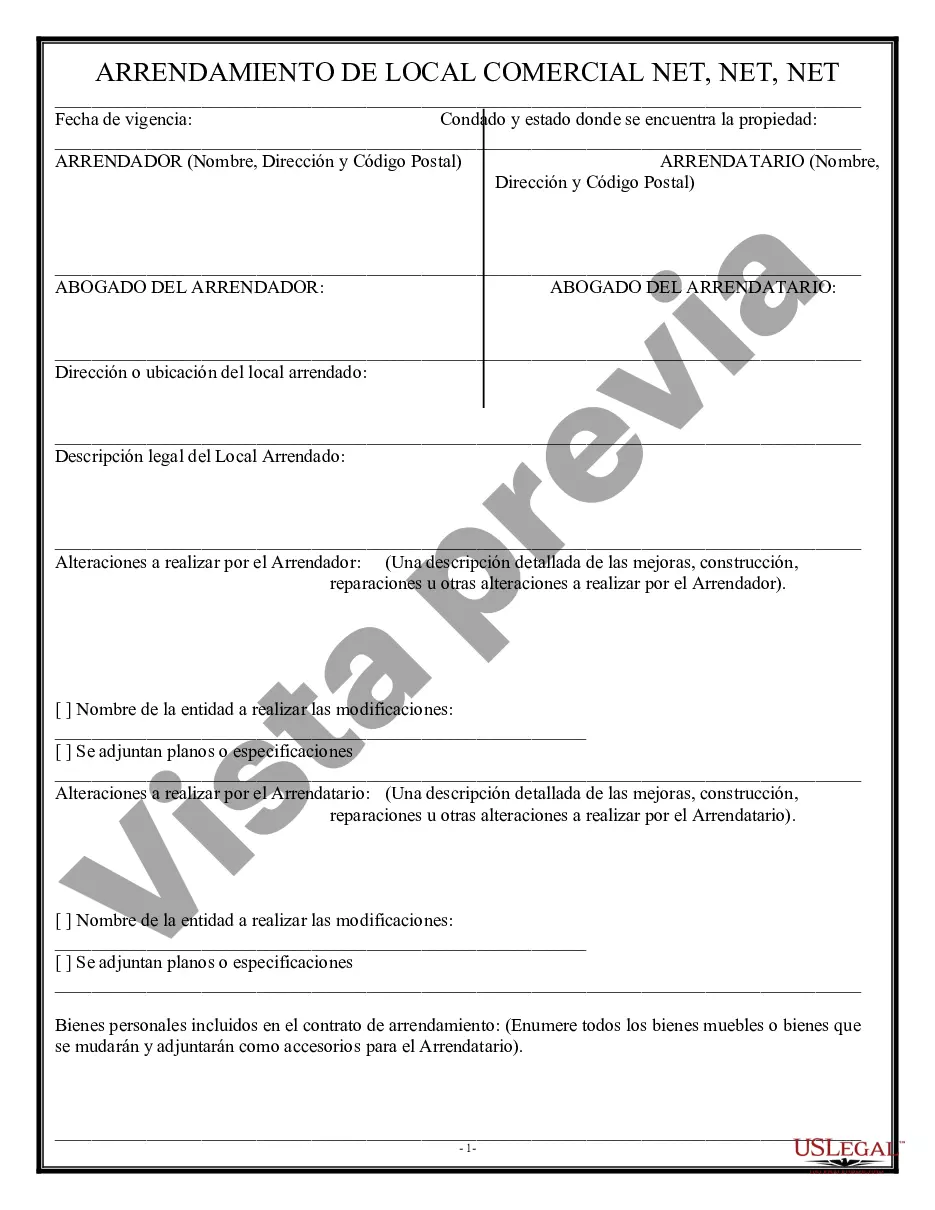

How to fill out Middlesex Massachusetts Arrendamiento Neto Triple Para Bienes Raíces Comerciales?

Preparing legal documentation can be difficult. In addition, if you decide to ask a lawyer to write a commercial contract, papers for ownership transfer, pre-marital agreement, divorce papers, or the Middlesex Triple Net Lease for Commercial Real Estate, it may cost you a lot of money. So what is the best way to save time and money and draw up legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is a perfect solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is the most extensive online library of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any scenario gathered all in one place. Therefore, if you need the current version of the Middlesex Triple Net Lease for Commercial Real Estate, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample with the Download button. If you haven't subscribed yet, here's how you can get the Middlesex Triple Net Lease for Commercial Real Estate:

- Look through the page and verify there is a sample for your area.

- Examine the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - look for the right one in the header.

- Click Buy Now once you find the required sample and choose the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a transaction with a credit card or via PayPal.

- Choose the file format for your Middlesex Triple Net Lease for Commercial Real Estate and download it.

Once finished, you can print it out and complete it on paper or import the template to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the documents ever purchased multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!