Orange California Triple Net Lease for Commercial Real Estate is a lease agreement commonly used in Orange County, California, for commercial properties. It is a type of lease agreement where the tenant is responsible for paying all costs associated with the property, including property taxes, insurance, and maintenance expenses. This type of lease is often sought after by investors and landlords as it transfers most of the financial responsibilities to the tenant. In Orange California, there are several types of Triple Net Lease options available for commercial real estate properties, each with its own terms and conditions. Some different types include: 1. Single-Tenant Net Lease: This type of lease involves a single tenant leasing a standalone property, such as a retail store, office building, or industrial facility. The tenant is responsible for all costs associated with the property, including property taxes, insurance, and maintenance. 2. Ground Lease: A ground lease is a type of Triple Net Lease where the tenant only leases the land and is responsible for constructing and maintaining any buildings or improvements on the property. The tenant pays rent to the landowner, plus all other property-related expenses. 3. Bendable Lease: A bendable lease is a type of Triple Net Lease where the tenant's lease payments are backed by a bond or other guarantee. This provides additional security to the landlord and may allow for lower interest rates. 4. Absolute Net Lease: An absolute net lease is the strictest form of Triple Net Lease, where the tenant is responsible for every expense related to the property, including structural repairs and replacements. This type of lease shifts nearly all financial responsibilities to the tenant. 5. Modified Net Lease: A modified net lease is a hybrid between a Triple Net Lease and a gross lease. In this type of lease, the tenant and landlord agree to allocate specific expenses between them, such as property taxes or insurance premiums, while sharing the burdens of others. Orange California Triple Net Lease for commercial real estate provides benefits for both the landlord and the tenant. Landlords can enjoy a consistent stream of income with minimal expenses, while tenants have control over their occupancy costs and have the flexibility to customize and manage the property to their specific needs. It is crucial for both parties to thoroughly review and negotiate the terms of the lease agreement to ensure it aligns with their respective goals and expectations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Orange California Arrendamiento neto triple para bienes raíces comerciales - Triple Net Lease for Commercial Real Estate

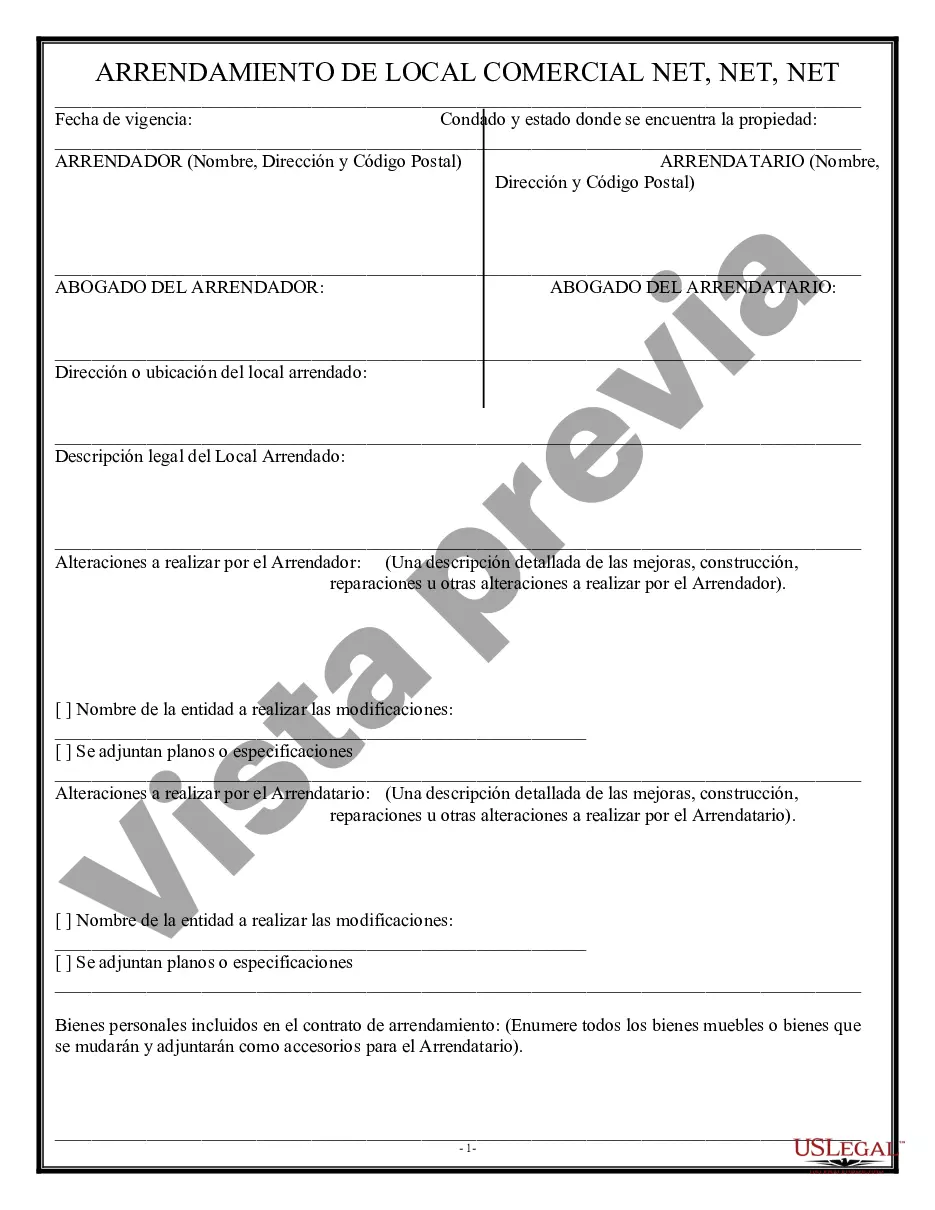

Description

How to fill out Orange California Arrendamiento Neto Triple Para Bienes Raíces Comerciales?

Preparing papers for the business or personal demands is always a huge responsibility. When drawing up a contract, a public service request, or a power of attorney, it's crucial to take into account all federal and state laws and regulations of the particular area. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these details make it stressful and time-consuming to create Orange Triple Net Lease for Commercial Real Estate without expert help.

It's possible to avoid wasting money on attorneys drafting your paperwork and create a legally valid Orange Triple Net Lease for Commercial Real Estate on your own, using the US Legal Forms web library. It is the biggest online catalog of state-specific legal templates that are professionally verified, so you can be certain of their validity when selecting a sample for your county. Earlier subscribed users only need to log in to their accounts to download the required document.

In case you still don't have a subscription, adhere to the step-by-step guide below to obtain the Orange Triple Net Lease for Commercial Real Estate:

- Look through the page you've opened and verify if it has the document you require.

- To accomplish this, use the form description and preview if these options are presented.

- To locate the one that fits your requirements, use the search tab in the page header.

- Double-check that the template complies with juridical standards and click Buy Now.

- Select the subscription plan, then log in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever purchased never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and easily obtain verified legal templates for any scenario with just a few clicks!