Philadelphia Pennsylvania Triple Net Lease for Commercial Real Estate: A Comprehensive Overview Introduction: Philadelphia, Pennsylvania, is a thriving metropolitan city with a robust commercial real estate market. One popular leasing option for commercial properties in Philadelphia is the Triple Net Lease (NNN lease). This lease structure shifts a significant portion of the financial responsibilities from the landlord to the tenant. In this article, we will delve into the details of Triple Net Lease for commercial real estate in Philadelphia, outlining its basics, benefits, and different variations available in the city. 1. Triple Net Lease Basics: A Triple Net Lease is a type of agreement that requires the tenant to pay not only the base rent for the property but also covers additional expenses associated with the property's maintenance, insurance, and taxes (commonly termed as the "triple net" expenses). Under this lease, the tenant assumes a larger share of financial obligations than in traditional leases, making it an attractive option for landlords seeking a more passive income approach. 2. Benefits for Tenants: 2.1. Cost Transparency: When entering into a Triple Net Lease, tenants have a clear understanding of the fixed costs, enabling them to accurately forecast and budget their expenditures. 2.2. Control and Customization: Tripe Net Leases often provide tenants with greater control over the property's maintenance, allowing customization as per their specific needs. 2.3. Property Appreciation Potential: Since the tenant assumes property-related expenses, they are often inclined towards maintaining and improving the property, which can potentially increase its market value. 3. Benefits for Landlords: 3.1. Reduced Management Responsibilities: With tenants handling property expenses, landlords can focus on other aspects of property management while still earning a steady rental income. 3.2. Predictable Cash Flow: Triple Net Leases provide landlords with stable and predictable cash flows, as the tenant takes responsibility for ongoing costs. 3.3. Attractive to Investors: Triple Net Leases are often appealing to investors seeking consistent income streams and long-term tenants. 4. Types of Triple Net Lease: 4.1. Single Tenant Triple Net Lease: In this arrangement, a sole tenant leases an entire property and is solely responsible for all maintenance, taxes, and insurance expenses. 4.2. Multi-Tenant Triple Net Lease: Under this lease type, multiple tenants occupy different units within the same property, each responsible for their portion of the triple net expenses. 4.3. Bendable Triple Net Lease: This variation involves the tenant posting a bond or security deposit equivalent to a predetermined number of months' rent, ensuring their financial commitment to the lease terms. Conclusion: Philadelphia, Pennsylvania, offers a range of Triple Net Lease options for commercial real estate. Whether it's a single-tenant lease, multi-tenant arrangement, or bendable lease, this leasing structure has become popular due to its cost transparency, reduced management responsibilities for landlords, and potential benefits for property appreciation. Triple Net Leases provide an opportunity for both tenants and landlords to create mutually beneficial and sustainable leasing arrangements.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Philadelphia Pennsylvania Arrendamiento neto triple para bienes raíces comerciales - Triple Net Lease for Commercial Real Estate

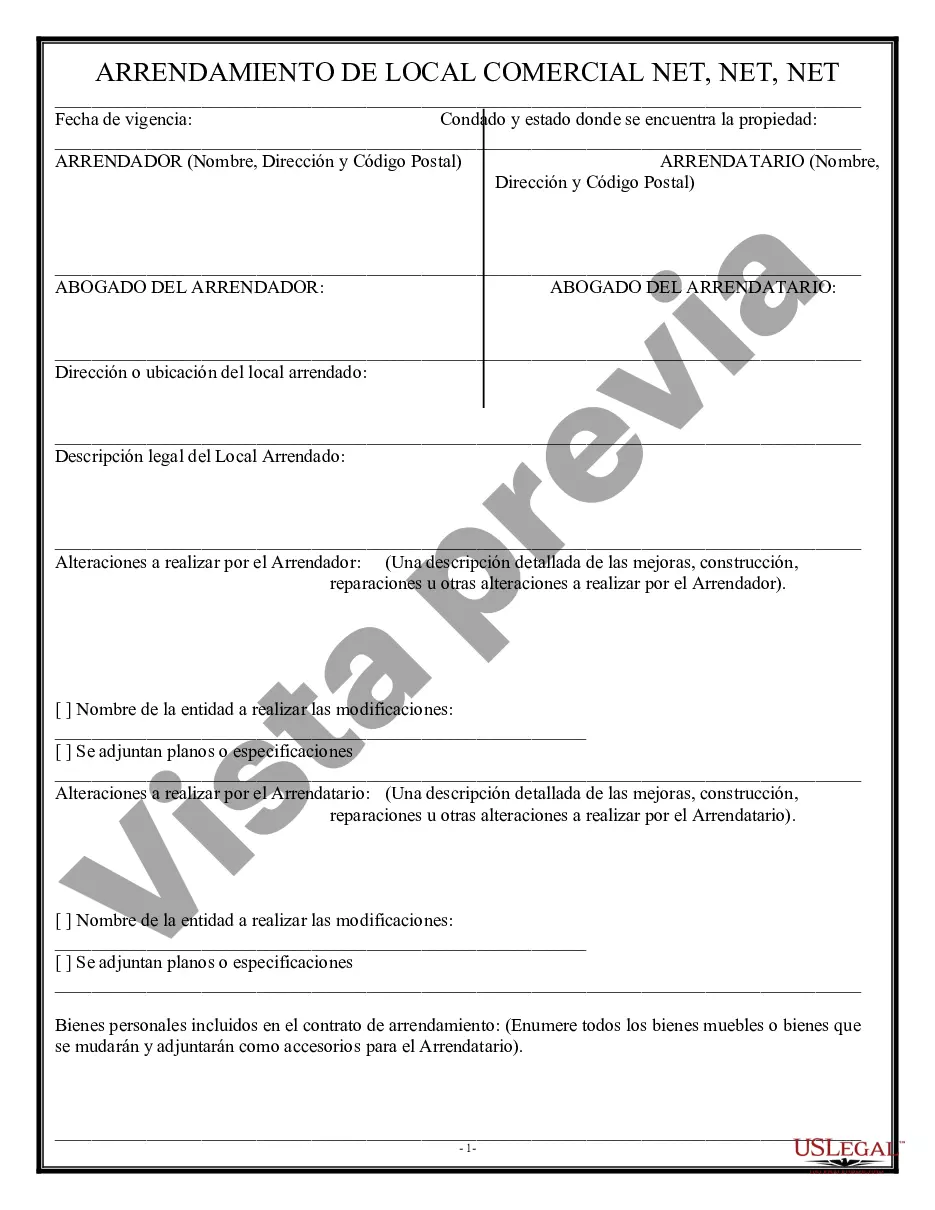

Description

How to fill out Philadelphia Pennsylvania Arrendamiento Neto Triple Para Bienes Raíces Comerciales?

Preparing legal paperwork can be cumbersome. Besides, if you decide to ask a lawyer to write a commercial agreement, documents for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Philadelphia Triple Net Lease for Commercial Real Estate, it may cost you a fortune. So what is the best way to save time and money and draft legitimate documents in total compliance with your state and local laws? US Legal Forms is an excellent solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is the most extensive online collection of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any use case collected all in one place. Consequently, if you need the current version of the Philadelphia Triple Net Lease for Commercial Real Estate, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample using the Download button. If you haven't subscribed yet, here's how you can get the Philadelphia Triple Net Lease for Commercial Real Estate:

- Glance through the page and verify there is a sample for your region.

- Check the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - look for the correct one in the header.

- Click Buy Now when you find the needed sample and pick the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a transaction with a credit card or via PayPal.

- Choose the file format for your Philadelphia Triple Net Lease for Commercial Real Estate and download it.

Once done, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the paperwork ever obtained multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!