A triple net lease (NNN lease) is a type of commercial real estate lease structure commonly used in San Antonio, Texas. In this agreement, the tenant agrees to pay all operating expenses associated with the property, including property taxes, insurance, and maintenance costs, in addition to the base rent. The triple net lease shifts a significant portion of the financial responsibilities from the landlord to the tenant, making it an attractive option for real estate investors. San Antonio, Texas, offers various types of triple net leases for commercial real estate, catering to different business needs and preferences. Some of these variants include: 1. Single-Tenant Net Lease: Single-tenant NNN leases involve an arrangement where a single tenant leases an entire building or space within a larger property. This lease type is common in retail properties, stand-alone commercial buildings, or industrial warehouses, providing tenants with complete control over their premises and operations. 2. Ground Lease: A ground lease is a type of triple net lease where the tenant leases the land on which they intend to construct a building or structure. The tenant is responsible for construction costs, property taxes, insurance, and maintenance, while the landowner retains ownership of the land. Ground leases offer long-term stability and are commonly used for commercial developments such as shopping centers or office complexes. 3. Bendable Triple Net Lease: A bendable triple net lease is designed to attract institutional lenders by providing a higher level of security. In this arrangement, the tenant takes on additional obligations to meet stricter default and credit enhancement requirements, allowing them to access lower interest rates and more favorable financing terms. This lease type is often utilized for large-scale commercial projects or properties with significant investment potential. 4. Sale-Leaseback: A sale-leaseback is an arrangement where a property owner sells their property to an investor and then leases it back on a long-term triple net lease. This type of lease allows the original property owner to release capital tied up in the property while retaining occupancy and operational control. Sale-leasebacks are commonly used by businesses looking to unlock liquidity tied up in their real estate assets. Triple net leases in San Antonio, Texas, provide benefits for both landlords and tenants. For landlords, it offers a predictable income stream, reduced operating expenses, and lower management responsibilities. Tenants benefit from the ability to customize their space, control over their operations, and potentially lower rent costs due to the additional financial responsibilities. Ultimately, the specific type of triple net lease chosen in San Antonio, Texas, for commercial real estate will depend on factors such as property type, tenant requirements, financing needs, and investment goals.

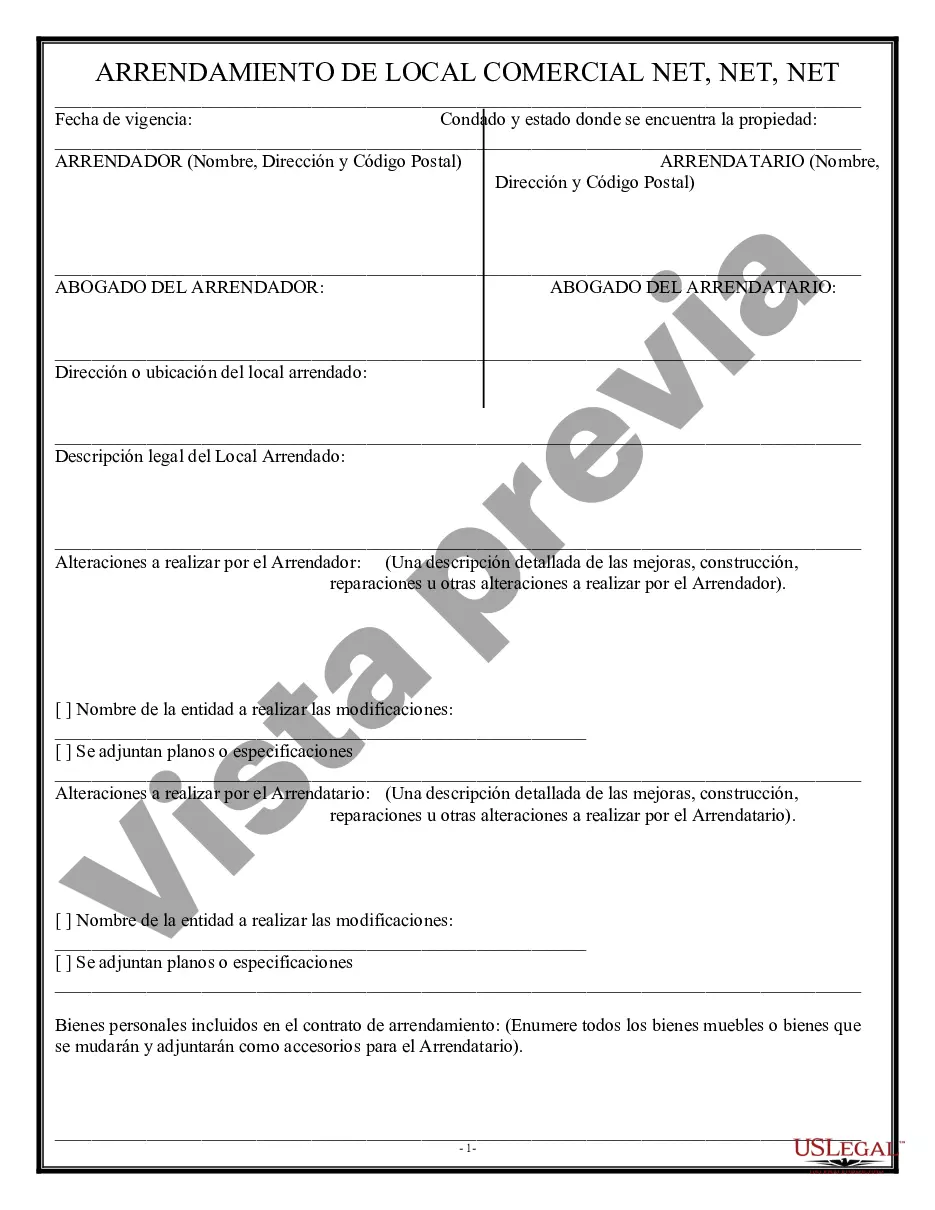

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Antonio Texas Arrendamiento neto triple para bienes raíces comerciales - Triple Net Lease for Commercial Real Estate

Description

How to fill out San Antonio Texas Arrendamiento Neto Triple Para Bienes Raíces Comerciales?

Laws and regulations in every area differ from state to state. If you're not an attorney, it's easy to get lost in countless norms when it comes to drafting legal paperwork. To avoid pricey legal assistance when preparing the San Antonio Triple Net Lease for Commercial Real Estate, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal forms. It's an excellent solution for professionals and individuals searching for do-it-yourself templates for different life and business scenarios. All the forms can be used many times: once you obtain a sample, it remains available in your profile for further use. Therefore, if you have an account with a valid subscription, you can simply log in and re-download the San Antonio Triple Net Lease for Commercial Real Estate from the My Forms tab.

For new users, it's necessary to make several more steps to get the San Antonio Triple Net Lease for Commercial Real Estate:

- Examine the page content to make sure you found the right sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Click on the Buy Now button to get the document when you find the right one.

- Opt for one of the subscription plans and log in or create an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Complete and sign the document in writing after printing it or do it all electronically.

That's the simplest and most cost-effective way to get up-to-date templates for any legal scenarios. Find them all in clicks and keep your paperwork in order with the US Legal Forms!