A Triple Net Lease (NNN Lease) is a common type of lease agreement in the commercial real estate industry. It is especially applicable to properties located in Suffolk County, New York. This lease structure places most of the financial responsibilities on the tenant, typically a business or corporation, rather than the landlord. Through a Triple Net Lease, the tenant assumes the costs related to property taxes, insurance, and maintenance expenses in addition to the base rent. Suffolk County offers various types of Triple Net Lease agreements for commercial real estate, each tailored to suit specific needs. These lease types include: 1. Absolute Triple Net Lease: In this lease, the tenant takes full responsibility for all property-related costs, including taxes, insurance premiums, and maintenance expenses. Landlords may find this lease favorable as it minimizes their financial obligations and ensures a reliable income stream. 2. Modified Triple Net Lease: This type of lease involves a shared responsibility between the landlord and tenant for certain property expenses. The tenant typically covers major costs like property taxes and insurance, while the landlord may handle capital expenditures or building structural repairs. The specific terms are negotiated between both parties and outlined in the lease agreement. 3. Bendable Triple Net Lease: This lease type integrates a bond as added security for the landlord. If the tenant fails to fulfill their financial obligations, the bond can be invoked to cover the outstanding costs. This provides additional reassurance to the landlord and offers protection against potential financial setbacks. 4. Double Net Lease: Though not a traditional Triple Net Lease, this lease type is worth mentioning. It distributes the financial responsibilities between the landlord and tenant, with the tenant responsible for paying property taxes and insurance premiums, leaving the landlord to cover maintenance expenses. For businesses considering commercial real estate options in Suffolk County, New York, Triple Net Lease agreements provide an advantageous framework that can streamline financial operations. Tenants benefit from reduced rental costs and better control over property management, while landlords can enjoy a steady income without being burdened by the additional expenses associated with property ownership.

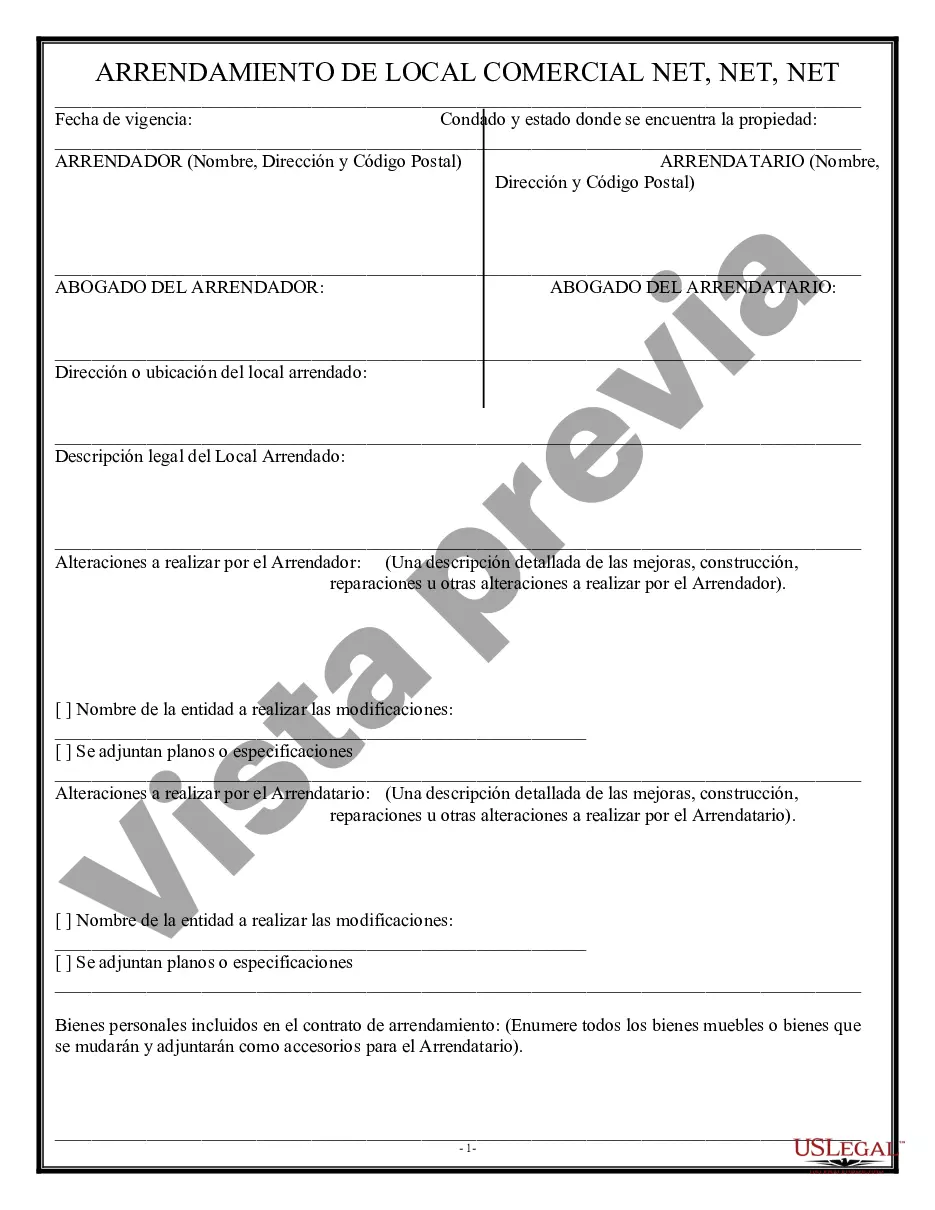

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Suffolk New York Arrendamiento neto triple para bienes raíces comerciales - Triple Net Lease for Commercial Real Estate

Description

How to fill out Suffolk New York Arrendamiento Neto Triple Para Bienes Raíces Comerciales?

How much time does it typically take you to draft a legal document? Since every state has its laws and regulations for every life sphere, locating a Suffolk Triple Net Lease for Commercial Real Estate meeting all regional requirements can be exhausting, and ordering it from a professional lawyer is often costly. Numerous online services offer the most popular state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive online collection of templates, collected by states and areas of use. Apart from the Suffolk Triple Net Lease for Commercial Real Estate, here you can get any specific form to run your business or personal deeds, complying with your regional requirements. Experts check all samples for their validity, so you can be certain to prepare your paperwork properly.

Using the service is pretty straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the required form, and download it. You can pick the file in your profile at any moment in the future. Otherwise, if you are new to the website, there will be a few more actions to complete before you obtain your Suffolk Triple Net Lease for Commercial Real Estate:

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another form utilizing the related option in the header.

- Click Buy Now once you’re certain in the selected file.

- Select the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Suffolk Triple Net Lease for Commercial Real Estate.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased template, you can locate all the files you’ve ever saved in your profile by opening the My Forms tab. Try it out!