Oakland Michigan Space, Net, Net, Net — Triple Net Lease is a popular commercial leasing arrangement in Oakland County, Michigan. This lease type, also known as a triple net lease or NNN lease, is commonly used for commercial properties, including retail, office, and industrial spaces. It offers both landlords and tenants a unique set of advantages and responsibilities. Under an Oakland Michigan Space, Net, Net, Net — Triple Net Lease, the tenant assumes three major expenses — property taxes, insurance, and maintenance costs, in addition to the base rent. This "net" lease structure allows the property owner to transfer the burden of these expenses onto the tenant, relieving themselves of financial obligations and simplifying property management. There are several types of Oakland Michigan Space, Net, Net, Net — Triple Net Leases available, depending on the specific terms and conditions negotiated between the landlord and tenant: 1. Absolute Triple Net Lease: In this type of lease, the tenant bears the responsibility for all property-related costs, including structural repairs, roof maintenance, and even expenses associated with major replacements or renovations. 2. Modified Triple Net Lease: This lease type has some variations in terms compared to an absolute triple net lease. While the tenant is still responsible for the majority of property expenses, certain costs may be shared between the landlord and tenant, such as structural repairs or large capital expenditures. 3. Double Net Lease: Although not as common as the triple net lease, a double net lease transfers the responsibility of property taxes and insurance costs to the tenant but typically leaves maintenance expenses to the landlord. 4. Ground Lease: This lease type often applies to land rather than buildings. In a ground lease, the tenant is usually responsible for all costs related to the land, including property taxes, insurance, and maintenance, while the landlord retains ownership of the building(s) on the property. Oakland Michigan Space, Net, Net, Net — Triple Net Leases provide stability for both landlords and tenants. Tenants benefit from long-term occupancy with predictable expenses, while property owners enjoy reduced financial obligations and simplified management responsibilities. It is vital for tenants and landlords to carefully negotiate and review lease agreements to ensure clarity and avoid any misunderstandings or disputes.

Oakland Michigan Space, Net, Net, Net — Triple Net Lease is a popular commercial leasing arrangement in Oakland County, Michigan. This lease type, also known as a triple net lease or NNN lease, is commonly used for commercial properties, including retail, office, and industrial spaces. It offers both landlords and tenants a unique set of advantages and responsibilities. Under an Oakland Michigan Space, Net, Net, Net — Triple Net Lease, the tenant assumes three major expenses — property taxes, insurance, and maintenance costs, in addition to the base rent. This "net" lease structure allows the property owner to transfer the burden of these expenses onto the tenant, relieving themselves of financial obligations and simplifying property management. There are several types of Oakland Michigan Space, Net, Net, Net — Triple Net Leases available, depending on the specific terms and conditions negotiated between the landlord and tenant: 1. Absolute Triple Net Lease: In this type of lease, the tenant bears the responsibility for all property-related costs, including structural repairs, roof maintenance, and even expenses associated with major replacements or renovations. 2. Modified Triple Net Lease: This lease type has some variations in terms compared to an absolute triple net lease. While the tenant is still responsible for the majority of property expenses, certain costs may be shared between the landlord and tenant, such as structural repairs or large capital expenditures. 3. Double Net Lease: Although not as common as the triple net lease, a double net lease transfers the responsibility of property taxes and insurance costs to the tenant but typically leaves maintenance expenses to the landlord. 4. Ground Lease: This lease type often applies to land rather than buildings. In a ground lease, the tenant is usually responsible for all costs related to the land, including property taxes, insurance, and maintenance, while the landlord retains ownership of the building(s) on the property. Oakland Michigan Space, Net, Net, Net — Triple Net Leases provide stability for both landlords and tenants. Tenants benefit from long-term occupancy with predictable expenses, while property owners enjoy reduced financial obligations and simplified management responsibilities. It is vital for tenants and landlords to carefully negotiate and review lease agreements to ensure clarity and avoid any misunderstandings or disputes.

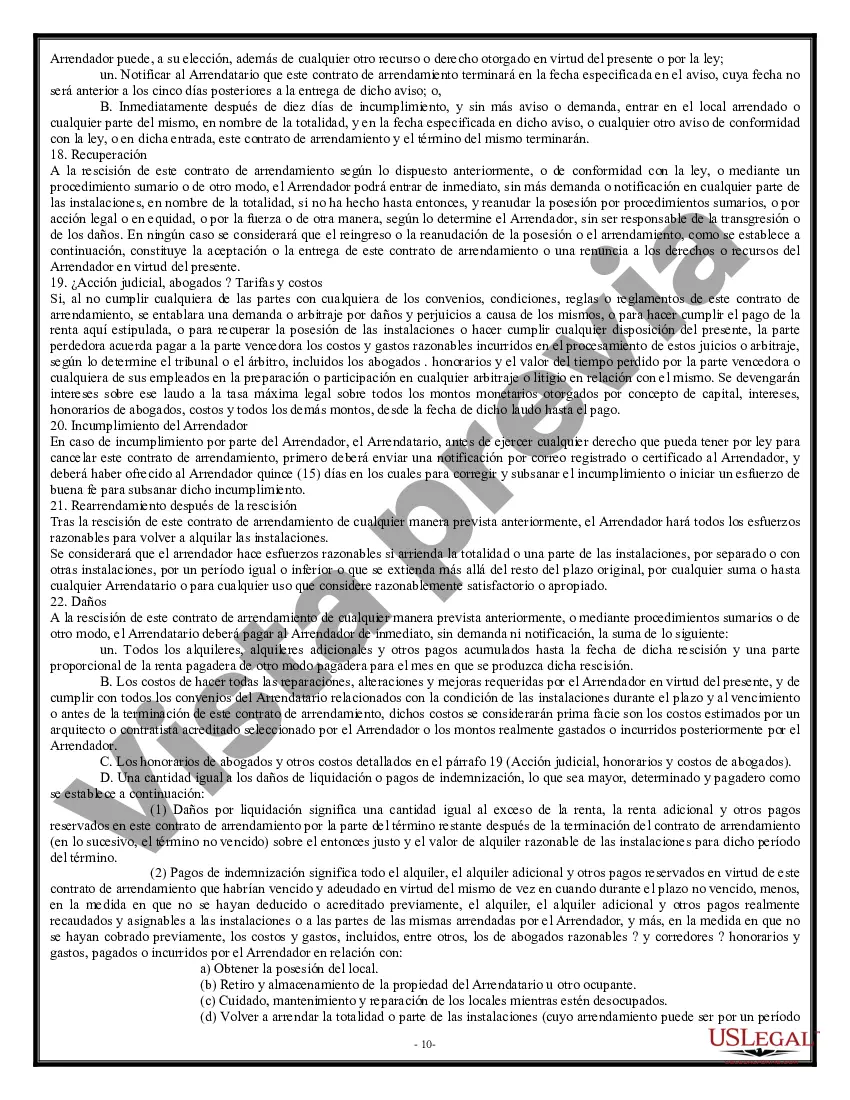

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.