Allegheny Pennsylvania Revocable Trust for House is a legal tool used by residents of Allegheny County, Pennsylvania, to manage and protect their assets, specifically real estate properties. A revocable trust is a flexible estate planning tool that allows individuals to transfer ownership of their house or other assets into a trust, to be managed by a designated trustee for the benefit of named beneficiaries. The Allegheny Pennsylvania Revocable Trust for House offers several advantages, including flexibility, privacy, probate avoidance, and potential tax benefits. By creating and funding the trust, the granter (the person creating the trust) retains control and can make changes, additions, or revoke the trust at any time during their lifetime. The trust also enables smoother transition and management of the property in the event of the granter's incapacity or death. There are various types of Allegheny Pennsylvania Revocable Trusts for House, each designed to cater to specific needs: 1. Basic Revocable Trust: This type of trust is the foundation of estate planning. It allows individuals to transfer their house into a trust, providing control and protection to the granter's assets while alive, and a seamless transfer to the designated beneficiaries upon their passing. 2. Joint Revocable Trust: Suitable for couples or co-owners of the house, this trust allows both parties to transfer their interests into one revocable trust. It ensures the smooth transition of ownership and the avoidance of probate for both individuals. 3. Irrevocable Life Insurance Trust: This type of trust focuses on using life insurance policies to provide liquidity and financial security for beneficiaries after the granter's passing. The house can be placed within the trust, ensuring its protection and proper management. 4. Qualified Personnel Residence Trust (PRT): Parts are beneficial when individuals want to transfer their house to beneficiaries while retaining the right to live in it for a specified period. This trust provides potential estate and gift tax benefits, allowing the granter to transfer their residence at a reduced value, ultimately reducing their estate tax liability. By creating an Allegheny Pennsylvania Revocable Trust for House, residents can ensure the smooth transfer of their real estate properties, maintain control, and protect their assets. It is essential to consult with an experienced estate planning attorney to determine the most suitable trust type and understand the legal requirements involved in establishing these trusts.

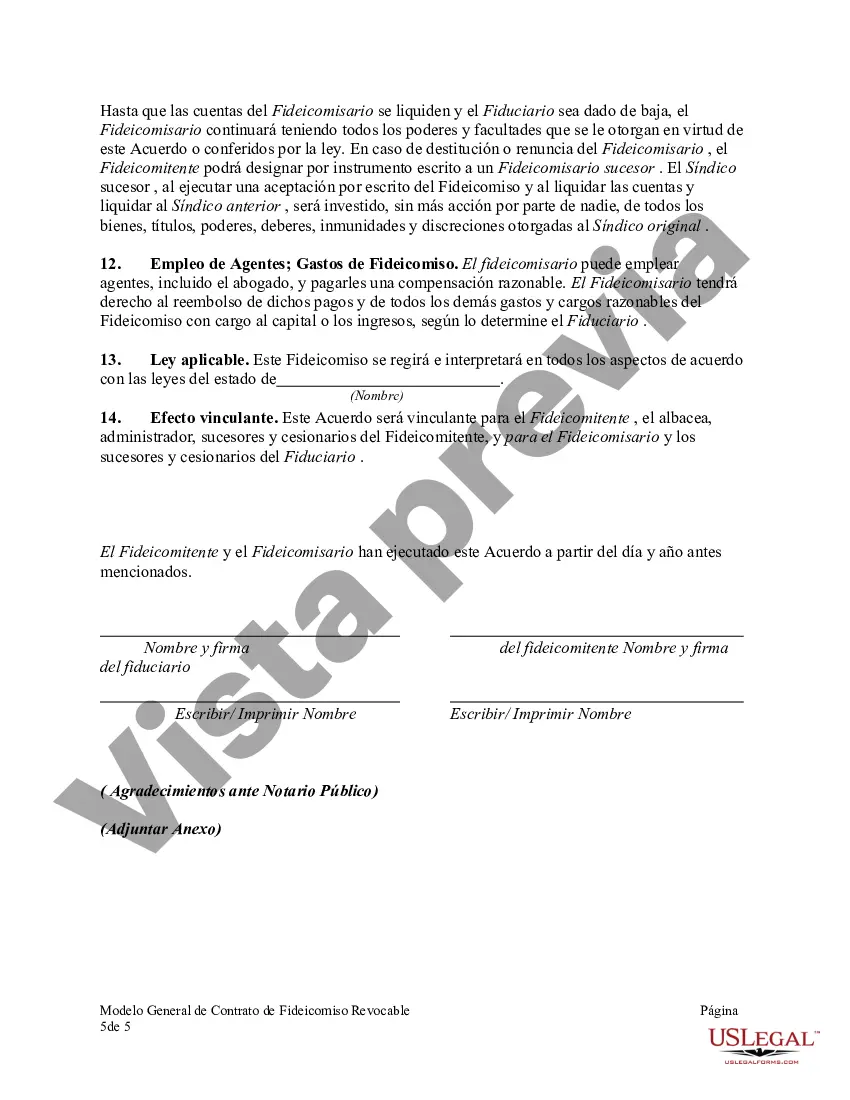

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Allegheny Pennsylvania Fideicomiso revocable para la casa - Revocable Trust for House

Description

How to fill out Allegheny Pennsylvania Fideicomiso Revocable Para La Casa?

Creating paperwork, like Allegheny Revocable Trust for House, to take care of your legal affairs is a tough and time-consumming task. A lot of situations require an attorney’s involvement, which also makes this task expensive. Nevertheless, you can consider your legal affairs into your own hands and manage them yourself. US Legal Forms is here to the rescue. Our website features over 85,000 legal documents intended for a variety of scenarios and life situations. We ensure each form is compliant with the laws of each state, so you don’t have to be concerned about potential legal pitfalls associated with compliance.

If you're already familiar with our website and have a subscription with US, you know how effortless it is to get the Allegheny Revocable Trust for House form. Go ahead and log in to your account, download the template, and customize it to your needs. Have you lost your form? No worries. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new customers is just as easy! Here’s what you need to do before getting Allegheny Revocable Trust for House:

- Make sure that your form is compliant with your state/county since the regulations for creating legal papers may vary from one state another.

- Find out more about the form by previewing it or going through a brief intro. If the Allegheny Revocable Trust for House isn’t something you were looking for, then take advantage of the search bar in the header to find another one.

- Log in or create an account to begin using our website and download the form.

- Everything looks great on your end? Hit the Buy now button and choose the subscription plan.

- Select the payment gateway and type in your payment details.

- Your form is all set. You can try and download it.

It’s an easy task to find and buy the appropriate template with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our extensive collection. Subscribe to it now if you want to check what other benefits you can get with US Legal Forms!

Form popularity

FAQ

Un fideicomiso en vida revocable (conocido en ingles como un revocable living trust) es un documento legal que le da la autoridad para tomar decisiones sobre el dinero o los bienes de otra persona mantenidos en un fideicomiso.

Hay tres partes clave que componen un fideicomiso: un otorgante, que establece un fideicomiso y lo llena con sus activos, un beneficiario, que es la persona elegida para recibir los activos del fideicomiso y un fiduciario, que es el encargado de administrar los activos que se le han confiado.

Un fideicomiso en vida revocable (conocido en ingles como un revocable living trust) es un documento legal que le da la autoridad para tomar decisiones sobre el dinero o los bienes de otra persona mantenidos en un fideicomiso.

Hay tres partes clave que componen un fideicomiso: un otorgante, que establece un fideicomiso y lo llena con sus activos, un beneficiario, que es la persona elegida para recibir los activos del fideicomiso y un fiduciario, que es el encargado de administrar los activos que se le han confiado.

Un fideicomiso no es mas que una estructura legal a traves de la cual es posible designar la administracion de unos bienes a terceras personas, todo con la finalidad de obtener la mayor cantidad de beneficios (por ejemplo, proteger la privacidad de una persona que ya no desea que una propiedad este a su nombre).

Un fideicomiso es un arreglo fiduciario que coloca bienes con un tercero (un administrador fiduciario) para que los guarde en nombre de los beneficiarios (por lo general, los hijos o los conyuges).

Un fideicomiso de inversion es un instrumento financiero que te ayudara con tu planeacion patrimonial, mediante el cual un tercero mantiene activos o dinero en resguardo y sera quien se encargue de las diligencias de otras dos partes que estan interesadas en que esos fondos sean bien utilizados.

Requisitos: Nombre y nacionalidad del fideicomitente. Nombre de la Institucion de credito (banco) que fungira como fiduciaria. Nombre y nacionalidad del fideicomisario y, si los hubiere, de los fideicomisarios en segundo lugar y de los fideicomisarios substitutos. Duracion del fideicomiso.

Una escritura de fideicomiso es un tipo de instrumento de fideicomiso que transfiere intereses en propiedades reales.

El fideicomiso es un acto juridico por medio del cual una persona entrega a otra la titularidad de unos activos para que los administre y, al vencimiento de un plazo, transmita los resultados a un tercero. Es una herramienta juridica muy utilizada en los negocios y para preservar los patrimonios familiares.