Collin Texas Revocable Trust for Asset Protection is a legal arrangement designed to protect assets owned by individuals or businesses in Collin County, Texas. This trust serves as a proactive strategy to safeguard assets from potential lawsuits, creditors, and other financial risks. The Collin Texas Revocable Trust for Asset Protection primarily functions as a revocable trust, meaning that the trust or (the individual who creates the trust) retains the ability to revoke or modify its terms during their lifetime. This flexibility allows for adjustments to be made based on changing circumstances or estate planning objectives. There are several types of Collin Texas Revocable Trusts for Asset Protection, each tailored to specific purposes: 1. Revocable Living Trust: This is the most common type of trust, often used for comprehensive asset protection and estate planning. It allows the trust or to transfer ownership of assets while maintaining control and providing instructions on their distribution. 2. Qualified Personnel Residence Trust (PRT): This specialized trust primarily focuses on protecting real estate assets, such as primary residences or vacation homes. By transferring the property into the trust, individuals can ensure its secure management while potentially reducing estate taxes. 3. Irrevocable Life Insurance Trust (IIT): This trust is specifically designed for protecting life insurance policies and their proceeds. By placing the policy into the trust, individuals can prevent the insurance proceeds from being considered part of their taxable estate. 4. Qualified Terminable Interest Property (TIP) Trust: This type of trust is typically employed in second marriage scenarios or blended families. It allows individuals to provide for their current spouse while ensuring that the trust's assets eventually pass on to their chosen beneficiaries, such as children from a prior marriage. When considering a Collin Texas Revocable Trust for Asset Protection, it is crucial to consult with an experienced estate planning attorney who can offer tailored advice based on specific circumstances. The attorney will help ensure that the trust is properly established, aligned with legal requirements, and provides the desired safeguards for assets.

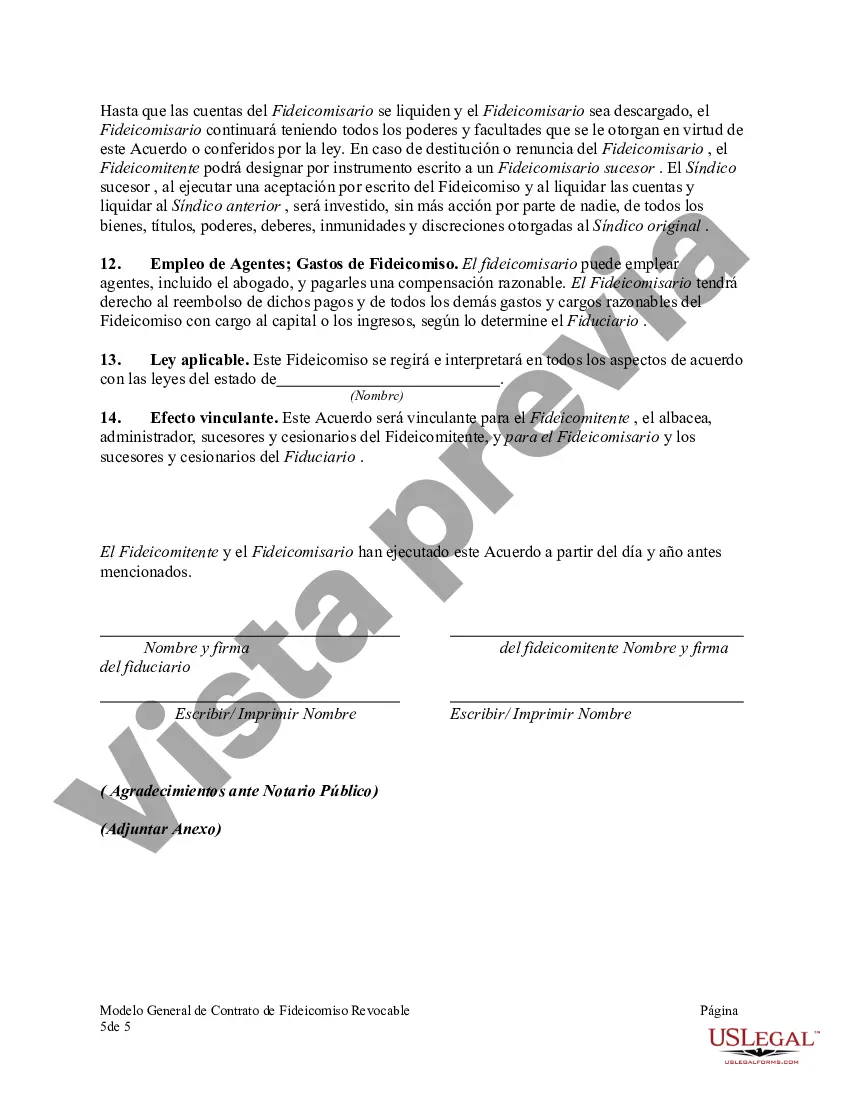

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Collin Texas Fideicomiso revocable para la protección de activos - Revocable Trust for Asset Protection

Description

How to fill out Collin Texas Fideicomiso Revocable Para La Protección De Activos?

Laws and regulations in every sphere differ throughout the country. If you're not a lawyer, it's easy to get lost in a variety of norms when it comes to drafting legal paperwork. To avoid expensive legal assistance when preparing the Collin Revocable Trust for Asset Protection, you need a verified template valid for your county. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions web catalog of more than 85,000 state-specific legal forms. It's a perfect solution for professionals and individuals looking for do-it-yourself templates for different life and business scenarios. All the documents can be used multiple times: once you obtain a sample, it remains available in your profile for further use. Thus, if you have an account with a valid subscription, you can just log in and re-download the Collin Revocable Trust for Asset Protection from the My Forms tab.

For new users, it's necessary to make a few more steps to obtain the Collin Revocable Trust for Asset Protection:

- Analyze the page content to make sure you found the correct sample.

- Use the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Use the Buy Now button to get the template once you find the correct one.

- Opt for one of the subscription plans and log in or create an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Complete and sign the template on paper after printing it or do it all electronically.

That's the simplest and most cost-effective way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your paperwork in order with the US Legal Forms!

Form popularity

FAQ

Un fideicomiso en vida revocable (conocido en ingles como un revocable living trust) es un documento legal que le da la autoridad para tomar decisiones sobre el dinero o los bienes de otra persona mantenidos en un fideicomiso.

El fideicomitente, o testador, establece un contrato con el fiduciario. En el se determinan las responsabilidades, derechos y acciones de cada parte. Cuando el contrato es firmado, el fideicomitente transfiere los bienes o activos al fiduciario quien estara a cargo de administrarlos en un periodo determinado.

Un fideicomiso irrevocable tiene un otorgante, un fideicomisario y un beneficiario o beneficiarios. Una vez que el otorgante coloca un activo en un fideicomiso irrevocable, es un regalo para el fideicomiso y el otorgante no puede revocarlo.

El fideicomiso sirve para instrumentar donaciones en vida del instituyente y tambien para establecer disposiciones de ultima voluntad o a instituciones de beneficencia y entidades de bien publico que aprovechan el beneficio para su objeto especifico.

Algunos de los tipos de contrato mas frecuente en el mercado actualmente son: Fideicomiso testamentario.Fideicomiso como medio de pago.Fideicomiso de planeacion patrimonial.Fideicomiso estructurado.

Hay tres partes clave que componen un fideicomiso: un otorgante, que establece un fideicomiso y lo llena con sus activos, un beneficiario, que es la persona elegida para recibir los activos del fideicomiso y un fiduciario, que es el encargado de administrar los activos que se le han confiado.

Hay tres partes clave que componen un fideicomiso: un otorgante, que establece un fideicomiso y lo llena con sus activos, un beneficiario, que es la persona elegida para recibir los activos del fideicomiso y un fiduciario, que es el encargado de administrar los activos que se le han confiado.

Las partes principales que intervienen usualmente en un Fideicomiso son 3: Fideicomitente, Fiduciario y Fideicomisario, como comentamos, eventualmente en algunos Fideicomisos pueden participar partes adicionales como Fideicomitentes A, Fideicomitentes B, Fideicomitentes C, etc., Fideicomisario en Primer Lugar,

Fideicomiso Irrevocable Un Fideicomiso que no puede ser cambiado.

Un fideicomiso de inversion es un instrumento financiero que te ayudara con tu planeacion patrimonial, mediante el cual un tercero mantiene activos o dinero en resguardo y sera quien se encargue de las diligencias de otras dos partes que estan interesadas en que esos fondos sean bien utilizados.