A Lima Arizona Revocable Trust for Asset Protection is a legal entity created to safeguard an individual's assets and provide them with control over the distribution and management of those assets during their lifetime and after their death. This trust offers numerous key benefits, including protection against creditors, avoidance of probate, and the ability to maintain privacy and confidentiality. One type of Lima Arizona Revocable Trust for Asset Protection is the Irrevocable Trust. This trust cannot be modified or revoked once it is established. It offers enhanced asset protection as it removes assets from the control and ownership of the individual, thereby safeguarding them from potential lawsuits, creditors, or legal judgments. Another type is the Living Trust, often referred to as a Revocable Living Trust. This is the most common form of Lima Arizona Revocable Trust for Asset Protection. It allows individuals to retain control over their assets during their lifetime while providing a seamless transfer of ownership and management control to their appointed beneficiaries upon their passing. Asset Protection is a critical component of a Revocable Trust, as it shields an individual's assets from potential claims, lawsuits, or creditors. By using this legal structure, individuals can create a protective barrier around their assets, reducing the risk of loss or depletion due to unforeseen circumstances. The Lima Arizona Revocable Trust for Asset Protection enables individuals to maintain a certain level of control and flexibility since it can be modified or revoked during their lifetime. This allows for adjustments to be made to the trust provisions as circumstances or priorities change. Some relevant keywords for this topic include: Asset Protection Trust, Revocable Trust, Irrevocable Trust, Living Trust, Lima Arizona, Probate Avoidance, Creditor Protection, Estate Planning, Successor Trustee, Trustee, Beneficiary, Asset Management, Lawsuit Protection, Privacy, Confidentiality, Control.

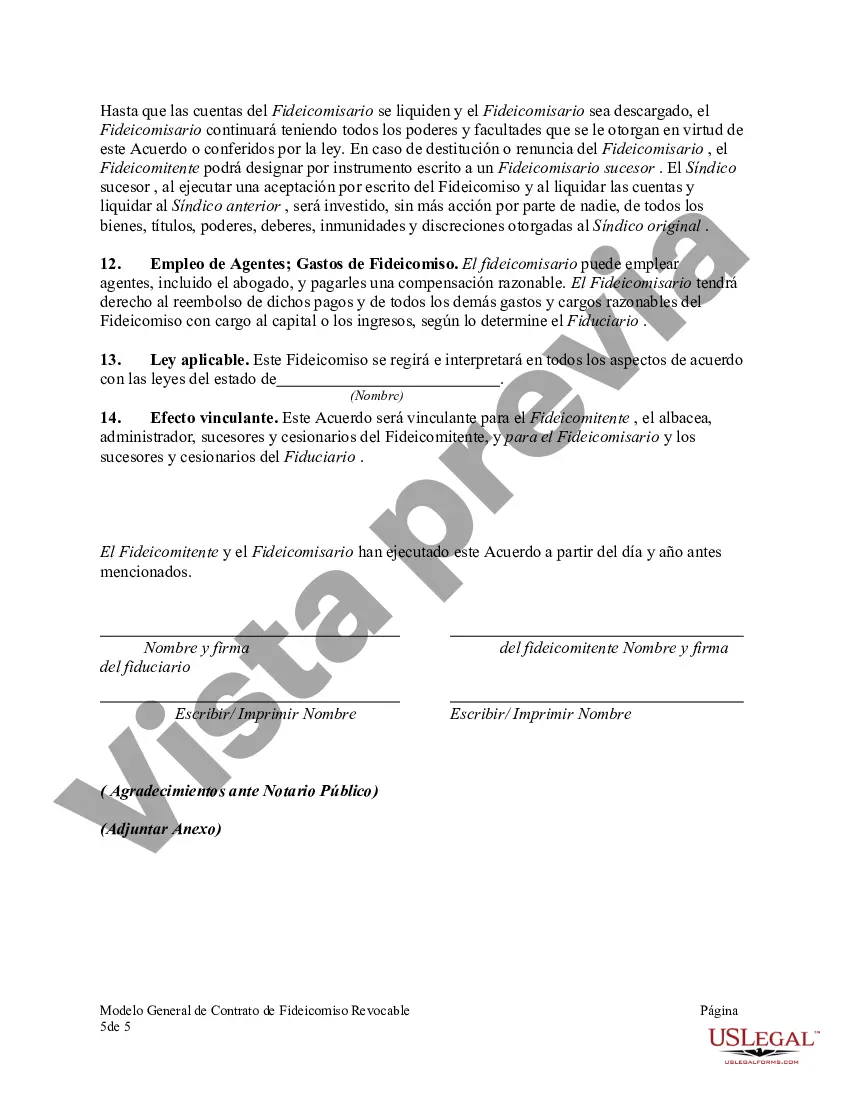

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Pima Arizona Fideicomiso revocable para la protección de activos - Revocable Trust for Asset Protection

Description

How to fill out Pima Arizona Fideicomiso Revocable Para La Protección De Activos?

Creating forms, like Pima Revocable Trust for Asset Protection, to take care of your legal affairs is a difficult and time-consumming process. Many cases require an attorney’s participation, which also makes this task expensive. However, you can consider your legal matters into your own hands and handle them yourself. US Legal Forms is here to save the day. Our website features more than 85,000 legal documents created for various cases and life circumstances. We ensure each document is in adherence with the laws of each state, so you don’t have to worry about potential legal problems compliance-wise.

If you're already aware of our website and have a subscription with US, you know how effortless it is to get the Pima Revocable Trust for Asset Protection form. Go ahead and log in to your account, download the form, and personalize it to your needs. Have you lost your document? No worries. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new customers is fairly straightforward! Here’s what you need to do before getting Pima Revocable Trust for Asset Protection:

- Make sure that your template is specific to your state/county since the regulations for creating legal documents may vary from one state another.

- Find out more about the form by previewing it or reading a quick description. If the Pima Revocable Trust for Asset Protection isn’t something you were hoping to find, then use the header to find another one.

- Sign in or create an account to start using our website and get the form.

- Everything looks good on your end? Hit the Buy now button and select the subscription option.

- Pick the payment gateway and enter your payment information.

- Your template is ready to go. You can go ahead and download it.

It’s easy to locate and buy the needed template with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our rich collection. Sign up for it now if you want to check what other advantages you can get with US Legal Forms!

Form popularity

FAQ

Clases de Fideicomisos En Garantia. Inmobiliarios. Administracion o Inversion. Translativos de Propiedad. Testamentarios. Publico. Financiero. Financiero Inmobiliario.

El pais esta mas expuesto que antes a una crisis de las finanzas federales que pueda afectar el equilibrio macroeconomico. Al 30 de junio de 2021, SHCP reporto que cuenta con 301 fideicomisos, mandatos y actos juridicos analogos sin estructura organica, los cuales suman un saldo de 508.4 mmdp.

Un fideicomiso irrevocable tiene un otorgante, un fideicomisario y un beneficiario o beneficiarios. Una vez que el otorgante coloca un activo en un fideicomiso irrevocable, es un regalo para el fideicomiso y el otorgante no puede revocarlo.

Un fideicomiso en vida revocable (conocido en ingles como un revocable living trust) es un documento legal que le da la autoridad para tomar decisiones sobre el dinero o los bienes de otra persona mantenidos en un fideicomiso.

Un fideicomiso no es mas que una estructura legal a traves de la cual es posible designar la administracion de unos bienes a terceras personas, todo con la finalidad de obtener la mayor cantidad de beneficios (por ejemplo, proteger la privacidad de una persona que ya no desea que una propiedad este a su nombre).

Un fideicomiso irrevocable tiene un otorgante, un fideicomisario y un beneficiario o beneficiarios. Una vez que el otorgante coloca un activo en un fideicomiso irrevocable, es un regalo para el fideicomiso y el otorgante no puede revocarlo.

Hay tres partes clave que componen un fideicomiso: un otorgante, que establece un fideicomiso y lo llena con sus activos, un beneficiario, que es la persona elegida para recibir los activos del fideicomiso y un fiduciario, que es el encargado de administrar los activos que se le han confiado.

Algunos de los tipos de contrato mas frecuente en el mercado actualmente son: Fideicomiso testamentario.Fideicomiso como medio de pago.Fideicomiso de planeacion patrimonial.Fideicomiso estructurado.

Existen varias razones por las que los fideicomisos son una buena alternativa para asegurar la correcta administracion de tus bienes en el futuro: Proteges tus activos de las malas intenciones.Cuidas a tus seres queridos.Resguardas tus activos.Puedes definir un plan para que tus activos generen rentas.

UN FIDEICOMISO ES: Una operacion mercantil mediante la cual una persona -fisica o moral- llamada fideicomitente, destina ciertos bienes a la realizacion de un fin licito determinado, encomendando esta a una Institucion de Credito (Art. 381 de la Ley General de Titulos y Operaciones de Credito).