San Jose, California Revocable Trust for Lottery Winnings: A Comprehensive Guide A revocable trust is a popular legal tool designed to protect and manage assets, including lottery winnings, in San Jose, California. This type of trust offers flexibility and control over your assets while still allowing you to make changes or even revoke the trust if necessary. With its unique advantages and customizable features, a San Jose Revocable Trust for Lottery Winnings ensures efficient management and distribution of your windfall. Different Types of San Jose, California Revocable Trusts for Lottery Winnings: 1. Standard Revocable Trust: This is the most common form of revocable trust used for lottery winnings. It allows you, as the granter, to retain control over your assets during your lifetime while designating specific beneficiaries who will inherit the funds after your passing. 2. Living Trust: A living trust, also considered as a type of revocable trust, allows you to manage your assets while you are still alive. This trust smoothly handles assets transfer to beneficiaries upon your death, avoiding probate and maintaining privacy. 3. Dynasty Trust: A dynasty trust extends the benefits of a revocable trust for multiple generations, ideal for substantial lottery winnings. It protects the assets from estate taxes and creditors, ensuring intergenerational wealth preservation. 4. Charitable Remainder Trust: For lottery winners who wish to contribute a portion of their winnings to charitable causes, a charitable remainder trust can be established. This trust allows you to receive regular income from the assets while donating the remaining funds to the designated charities upon your passing. Key Features and Benefits of a San Jose, California Revocable Trust for Lottery Winnings: 1. Privacy Protection: Revocable trusts offer a high level of privacy as they do not undergo probate, a public court process. This ensures that the details of your trust, including the amount and beneficiaries, remain confidential. 2. Asset Management: With a revocable trust, you can appoint a trustee to manage and distribute your lottery winnings according to your instructions. This ensures professional asset management even if you become incapacitated or pass away. 3. Probate Avoidance: Lottery winners utilizing a revocable trust can effectively avoid probate, the lengthy and expensive legal process of distributing assets to beneficiaries. This trust type allows for a seamless and prompt transfer of assets to designated beneficiaries. 4. Flexibility and Control: As the granter of a revocable trust, you have the power to modify, amend, or revoke it at your discretion. This flexibility allows you to adapt the trust to any changes in your circumstances or beneficiary preferences. 5. Tax Efficiency: A revocable trust does not provide specific tax advantages, but it can offer incredible flexibility when it comes to estate tax planning. By structuring the trust properly, you can minimize or reduce any potential tax implications. In conclusion, a San Jose, California Revocable Trust for Lottery Winnings provides an excellent option for preserving, managing, and distributing your lottery winnings precisely as you desire. With various types available, you can tailor the trust to your specific needs and goals. Seek professional advice from an estate planning attorney to explore suitable options and ensure a comprehensive and well-structured revocable trust for your lottery winnings.

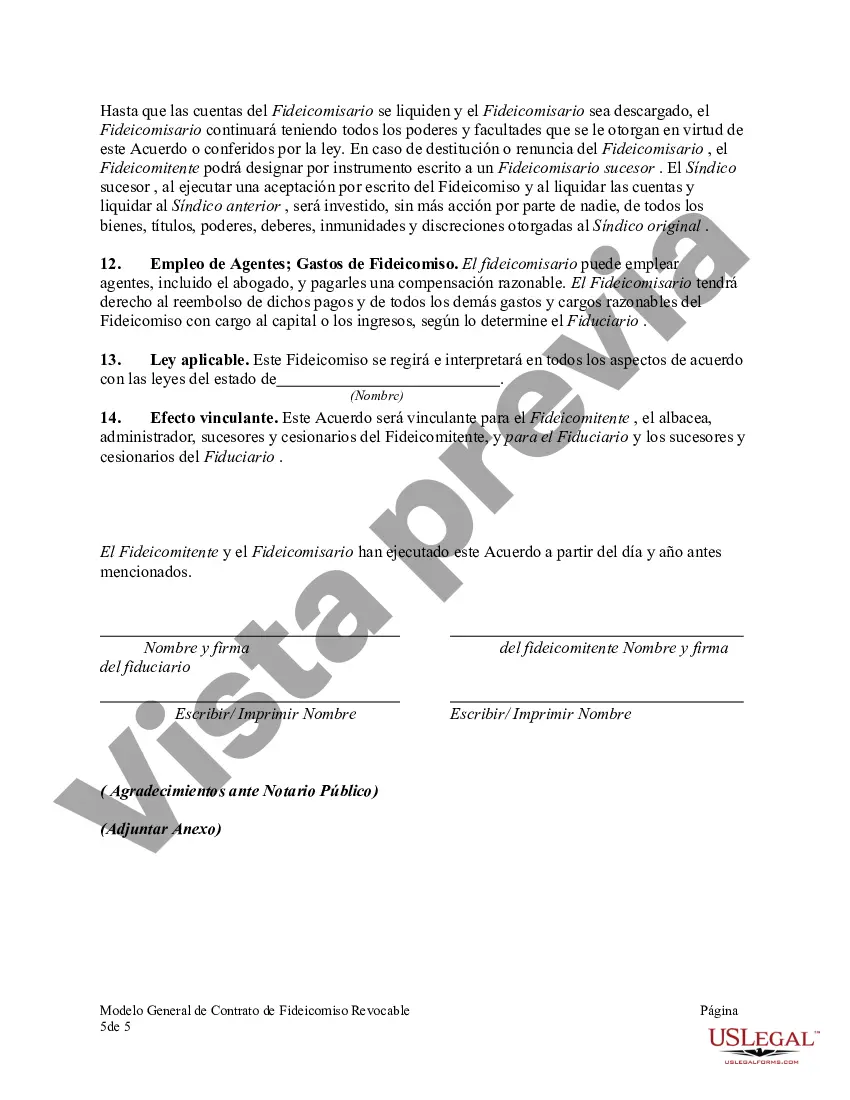

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Jose California Fideicomiso revocable para premios de lotería - Revocable Trust for Lottery Winnings

Description

How to fill out San Jose California Fideicomiso Revocable Para Premios De Lotería?

Creating legal forms is a necessity in today's world. Nevertheless, you don't always need to look for qualified assistance to create some of them from the ground up, including San Jose Revocable Trust for Lottery Winnings, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 forms to pick from in various categories ranging from living wills to real estate papers to divorce documents. All forms are arranged based on their valid state, making the searching experience less frustrating. You can also find information materials and guides on the website to make any tasks related to document completion simple.

Here's how you can find and download San Jose Revocable Trust for Lottery Winnings.

- Take a look at the document's preview and description (if available) to get a general idea of what you’ll get after getting the form.

- Ensure that the document of your choosing is adapted to your state/county/area since state laws can impact the validity of some documents.

- Examine the similar document templates or start the search over to find the appropriate file.

- Click Buy now and register your account. If you already have an existing one, choose to log in.

- Pick the option, then a needed payment gateway, and purchase San Jose Revocable Trust for Lottery Winnings.

- Select to save the form template in any offered format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the appropriate San Jose Revocable Trust for Lottery Winnings, log in to your account, and download it. Of course, our website can’t replace an attorney entirely. If you need to cope with an exceptionally difficult situation, we recommend getting an attorney to check your form before signing and filing it.

With over 25 years on the market, US Legal Forms became a go-to provider for many different legal forms for millions of customers. Become one of them today and get your state-compliant documents effortlessly!