A Riverside California Revocable Trust for Real Estate is a legal arrangement in which an individual (known as the granter) transfers their property ownership rights to a trust, managed by a trustee, for the benefit of designated beneficiaries. This type of trust offers flexibility as it can be modified or revoked by the granter during their lifetime, allowing for changes in circumstances or preferences. Keywords: Riverside California, Revocable Trust, Real Estate, legal arrangement, property ownership, trustee, beneficiaries, flexibility, modified, revoked, circumstances, preferences. There are a few different types of Riverside California Revocable Trusts for Real Estate, including: 1. Living Trust: A commonly used trust that allows the granter to maintain control over their assets while alive and simplifies the distribution of property upon their death. It bypasses the probate process, saving time and money for the beneficiaries. 2. Joint Revocable Trust: This type of trust is created by couples who jointly hold property. It allows for the seamless transfer of assets to the surviving spouse or designated beneficiaries upon the death of the first spouse. 3. Pour-Over Trust: This trust is often used in conjunction with a will. It ensures that any property not explicitly transferred into the trust during the granter's lifetime is "poured over" into the trust upon their death, avoiding probate. 4. Testamentary Trust: Unlike other revocable trusts, this trust is created in a will and only takes effect upon the granter's death. It can be used to hold and manage real estate assets for the benefit of specific beneficiaries, like minors or individuals with special needs. 5. Special Needs Trust: Designed specifically for individuals with disabilities, this trust allows for the management of real estate assets while preserving the beneficiary's eligibility for government benefits and assistance programs. 6. Charitable Trust: This trust allows the granter to donate their real estate to a charitable organization while continuing to receive certain tax benefits during their lifetime. It can be revocable or irrevocable and provides a philanthropic opportunity for Riverside residents. By utilizing a Riverside California Revocable Trust for Real Estate, individuals can protect their assets, simplify the transfer of property, and ensure their wishes are carried out efficiently. Each type of trust mentioned above has its own unique features and benefits, catering to different circumstances and goals.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Riverside California Fideicomiso Revocable para Bienes Raíces - Revocable Trust for Real Estate

Description

How to fill out Riverside California Fideicomiso Revocable Para Bienes Raíces?

How much time does it typically take you to draft a legal document? Given that every state has its laws and regulations for every life scenario, finding a Riverside Revocable Trust for Real Estate meeting all regional requirements can be stressful, and ordering it from a professional attorney is often expensive. Numerous online services offer the most common state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive online catalog of templates, collected by states and areas of use. Aside from the Riverside Revocable Trust for Real Estate, here you can find any specific document to run your business or individual affairs, complying with your regional requirements. Professionals verify all samples for their validity, so you can be sure to prepare your documentation properly.

Using the service is remarkably easy. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the required sample, and download it. You can pick the file in your profile at any time in the future. Otherwise, if you are new to the website, there will be a few more steps to complete before you get your Riverside Revocable Trust for Real Estate:

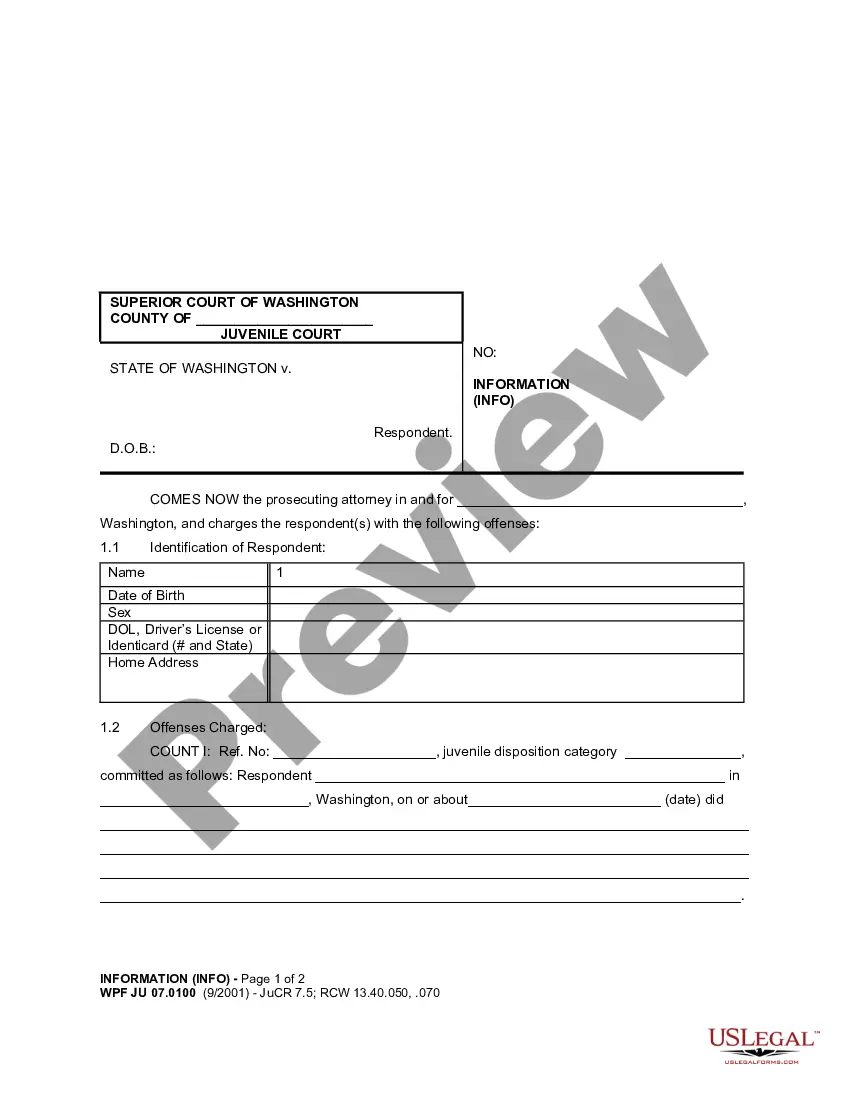

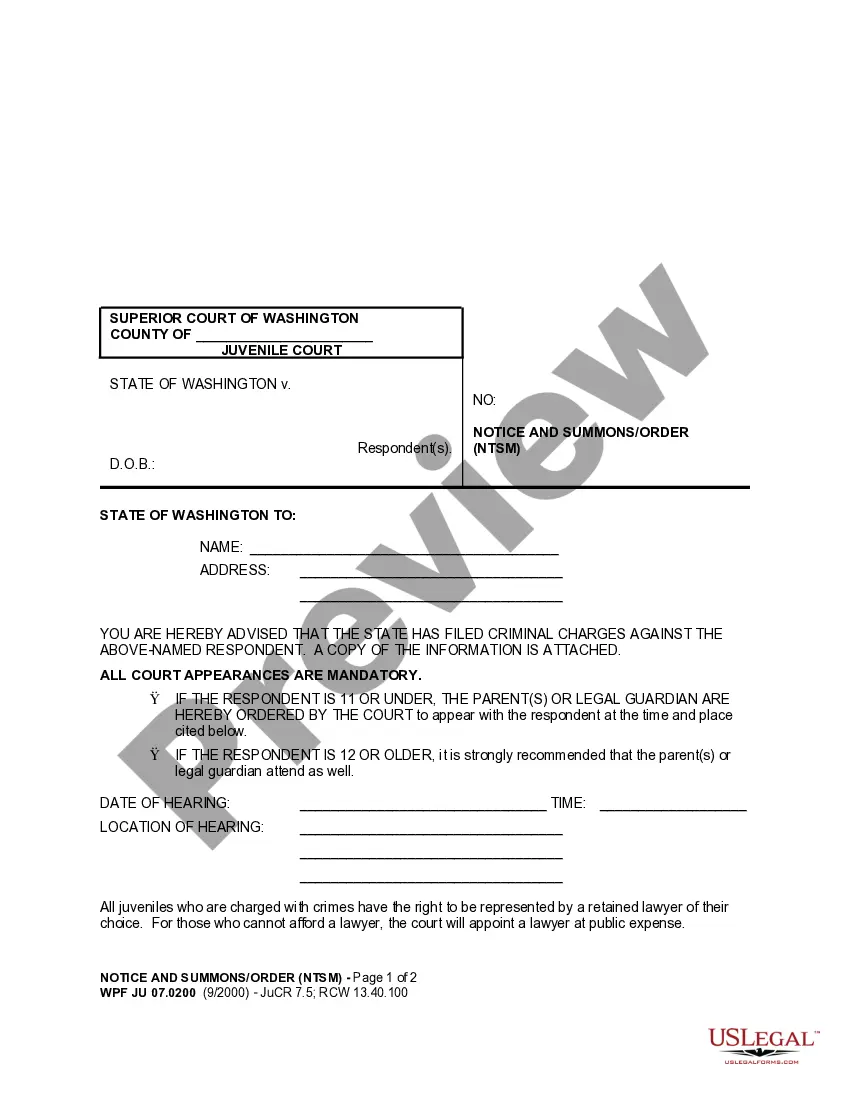

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another document utilizing the related option in the header.

- Click Buy Now when you’re certain in the chosen file.

- Decide on the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Riverside Revocable Trust for Real Estate.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired template, you can locate all the samples you’ve ever saved in your profile by opening the My Forms tab. Give it a try!