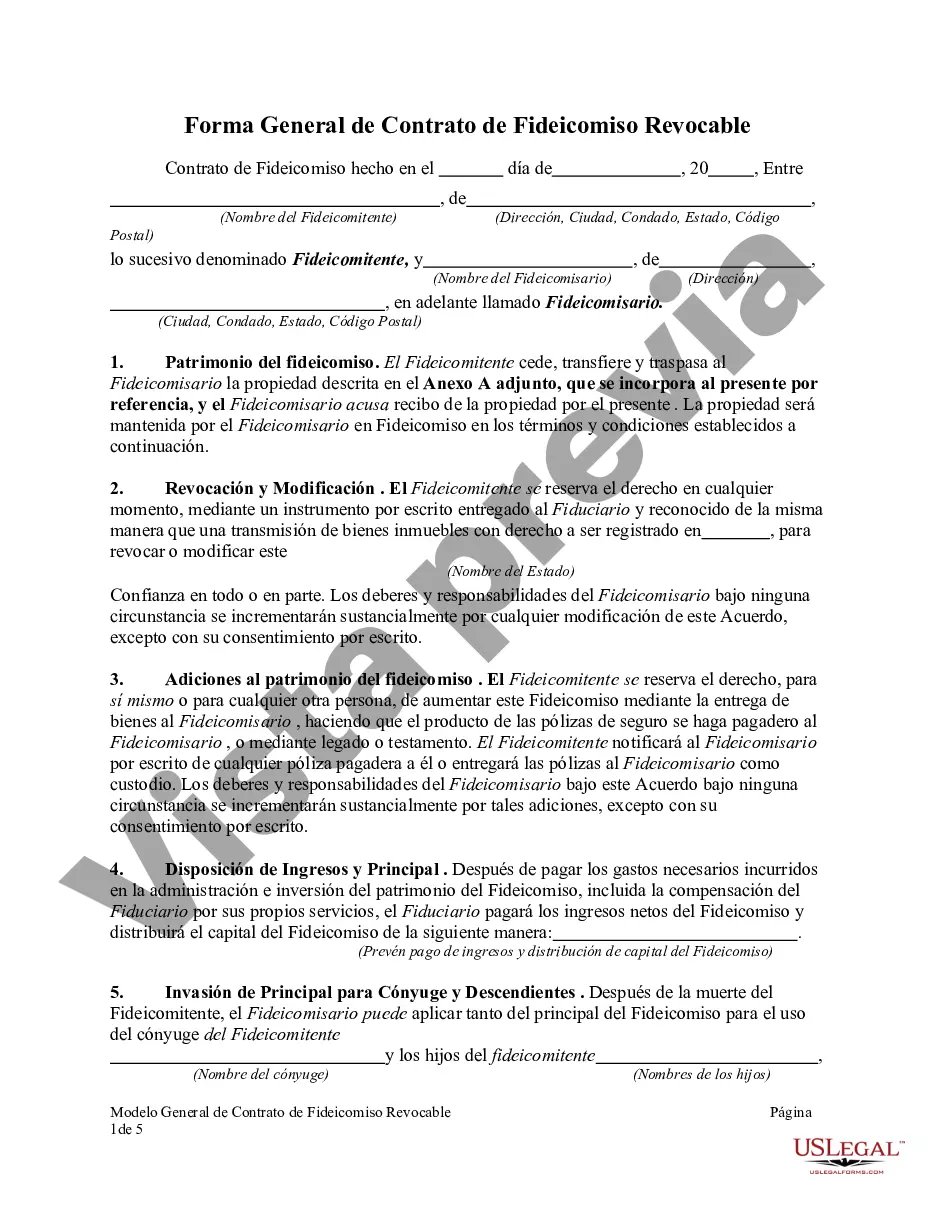

Travis Texas Revocable Trust for Real Estate is a legal arrangement that allows individuals or entities to transfer ownership and management rights of their real estate assets in Travis County, Texas, in a flexible and secure manner. This type of trust is specifically designed to provide individuals with control over their real estate assets during their lifetime, while also ensuring a smooth transition for beneficiaries upon the granter's death. Keywords: Travis Texas, Revocable Trust, Real Estate, ownership, management rights, transfer, assets, lifetime, beneficiaries, granter, death. There are different types of Travis Texas Revocable Trusts for Real Estate based on specific goals and requirements: 1. Standard Revocable Trust: This type of trust offers basic control and flexibility over real estate assets, allowing the granter to make changes, additions, or revocations during their lifetime. 2. Living Trust: Also known as an inter vivos trust, a living trust is created during the granter's lifetime and helps avoid probate while still allowing them to retain control and use of the real estate assets. 3. Family Trust: A family trust is created to manage and distribute real estate assets among family members, ensuring the long-term financial security and protection of these assets. 4. Charitable Trust: This type of revocable trust is established to benefit one or multiple charitable organizations through the transfer and management of real estate assets, while still providing certain provisions for the granter's needs. 5. Generation-Skipping Trust: This trust is designed to pass real estate assets to grandchildren or future generations, bypassing immediate children, in order to maximize estate tax savings and provide for the long-term preservation of the assets. 6. Testamentary Trust: Unlike other revocable trusts, a testamentary trust is created through the granter's will and only becomes effective upon their death. This trust can be used to transfer and manage real estate assets for specific beneficiaries as outlined in the will. By utilizing a Travis Texas Revocable Trust for Real Estate, individuals can ensure efficient management, protection, and distribution of their real estate assets while maintaining privacy and minimizing probate costs. Consultation with a qualified estate planning attorney is recommended to determine the most suitable type of trust based on one's specific circumstances and objectives.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Travis Texas Fideicomiso Revocable para Bienes Raíces - Revocable Trust for Real Estate

Description

How to fill out Travis Texas Fideicomiso Revocable Para Bienes Raíces?

How much time does it usually take you to create a legal document? Given that every state has its laws and regulations for every life scenario, locating a Travis Revocable Trust for Real Estate suiting all local requirements can be tiring, and ordering it from a professional attorney is often costly. Many web services offer the most common state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive web catalog of templates, collected by states and areas of use. Apart from the Travis Revocable Trust for Real Estate, here you can find any specific form to run your business or personal deeds, complying with your county requirements. Specialists check all samples for their validity, so you can be certain to prepare your documentation properly.

Using the service is pretty simple. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the needed form, and download it. You can retain the file in your profile at any time in the future. Otherwise, if you are new to the website, there will be a few more steps to complete before you obtain your Travis Revocable Trust for Real Estate:

- Examine the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Search for another form using the related option in the header.

- Click Buy Now when you’re certain in the selected file.

- Choose the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Travis Revocable Trust for Real Estate.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased document, you can locate all the files you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!