Maricopa Arizona Revocable Trust for Married Couple: A Detailed Description A Maricopa Arizona Revocable Trust for Married Couple, also known as a Maricopa Arizona Joint Revocable Trust, is a legal arrangement designed to provide married couples with the ability to protect and manage their assets during their lifetime, as well as facilitate the distribution of those assets after their passing. This trust offers flexibility, control, and privacy while avoiding probate. Here are different types of Maricopa Arizona Revocable Trusts for Married Couples: 1. Maricopa Arizona Revocable Living Trust: This type of trust allows married couples to retain full control and access to their assets during their lifetime. They can modify, revoke, or amend the trust at any time, making it flexible and adjustable for changing circumstances. With a Maricopa Arizona Revocable Living Trust, the couple acts as the granters, trustees, and beneficiaries, meaning they have complete control over the trust assets. 2. Maricopa Arizona AB Trust: Also known as a Maricopa Arizona Marital and Family Trust, this type of trust mainly focuses on achieving estate tax savings. The AB Trust splits the trust into two separate trusts upon the death of the first spouse: the "A" trust, also called the marital trust or survivor's trust, and the "B" trust, also known as the bypass trust or family trust. The surviving spouse maintains control over the assets in the "A" trust while still benefiting from the assets in the "B" trust. This structure helps in preserving the maximum estate tax exemption for the couple. 3. Maricopa Arizona TIP Trust: The Maricopa Arizona Qualified Terminable Interest Property (TIP) Trust allows a spouse to provide for their surviving spouse while maintaining control over their assets. This type of trust is often used when there are previous marriages or children from prior relationships. With a Maricopa Arizona TIP Trust, the assets are transferred to the trust upon the first spouse's death, providing income to the surviving spouse, ensuring their financial security, and ultimately allowing for the predetermined distribution of assets. 4. Maricopa Arizona Credit Shelter Trust: A Maricopa Arizona Credit Shelter Trust, also referred to as the Maricopa Arizona Bypass Trust or Exemption Trust, is designed to maximize estate tax savings. It utilizes both spouses' estate tax exemptions, ensuring that substantial assets pass to their heirs tax-free. Upon the first spouse's death, their share of assets transfers to the trust, effectively utilizing the first-to-die spouse's estate tax exemption. The surviving spouse can maintain control and receive income from the assets held in the trust during their lifetime. In conclusion, a Maricopa Arizona Revocable Trust for Married Couple offers flexibility, control, and privacy. Various types of trusts cater to different needs, such as the Maricopa Arizona Revocable Living Trust, AB Trust, TIP Trust, and Credit Shelter Trust. An estate planning attorney can provide expert guidance and assistance in determining the most suitable trust option for a married couple's specific circumstances.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Maricopa Arizona Fideicomiso revocable para pareja casada - Revocable Trust for Married Couple

Description

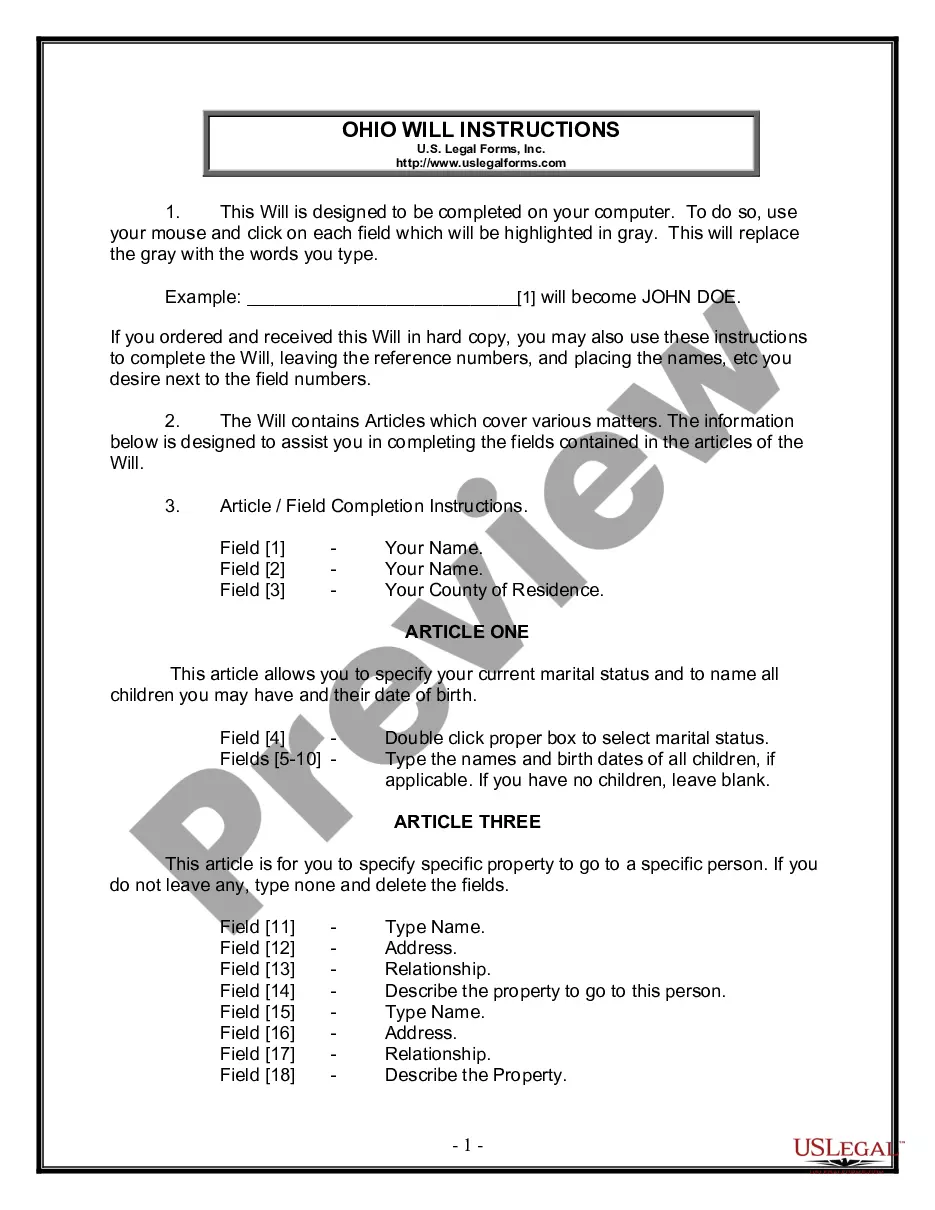

How to fill out Maricopa Arizona Fideicomiso Revocable Para Pareja Casada?

How much time does it typically take you to draw up a legal document? Because every state has its laws and regulations for every life sphere, finding a Maricopa Revocable Trust for Married Couple meeting all regional requirements can be stressful, and ordering it from a professional lawyer is often costly. Many web services offer the most popular state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive web collection of templates, grouped by states and areas of use. Apart from the Maricopa Revocable Trust for Married Couple, here you can find any specific form to run your business or individual affairs, complying with your county requirements. Specialists verify all samples for their validity, so you can be certain to prepare your documentation properly.

Using the service is remarkably simple. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the required form, and download it. You can retain the file in your profile anytime later on. Otherwise, if you are new to the website, there will be a few more actions to complete before you get your Maricopa Revocable Trust for Married Couple:

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another form using the related option in the header.

- Click Buy Now once you’re certain in the chosen file.

- Select the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Maricopa Revocable Trust for Married Couple.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired document, you can locate all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!