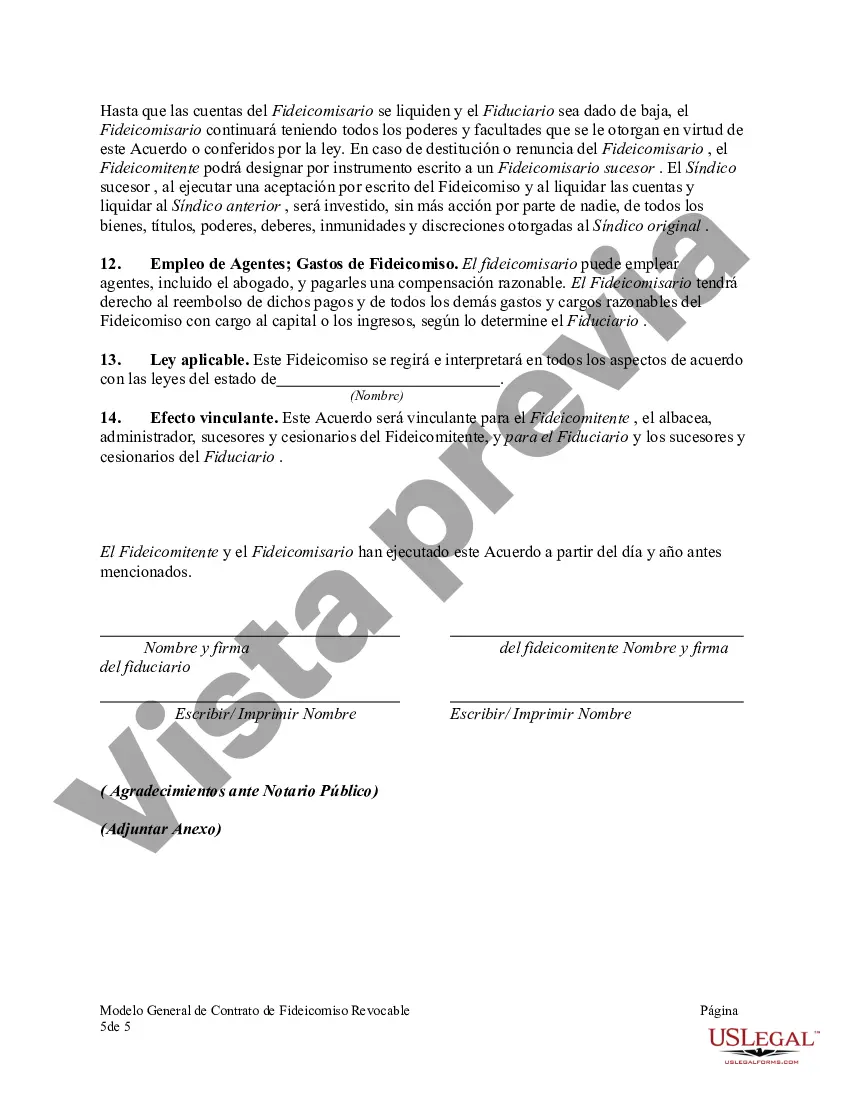

Dallas Texas Fideicomiso revocable para la propiedad - Revocable Trust for Property

Description

How to fill out Dallas Texas Fideicomiso Revocable Para La Propiedad?

How much time does it usually take you to create a legal document? Because every state has its laws and regulations for every life situation, finding a Dallas Revocable Trust for Property meeting all local requirements can be stressful, and ordering it from a professional lawyer is often expensive. Numerous online services offer the most common state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive online collection of templates, grouped by states and areas of use. Aside from the Dallas Revocable Trust for Property, here you can get any specific document to run your business or personal affairs, complying with your regional requirements. Experts check all samples for their validity, so you can be certain to prepare your documentation properly.

Using the service is remarkably simple. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the needed form, and download it. You can retain the document in your profile at any time later on. Otherwise, if you are new to the website, there will be some extra steps to complete before you obtain your Dallas Revocable Trust for Property:

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Search for another document using the corresponding option in the header.

- Click Buy Now when you’re certain in the selected document.

- Choose the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Dallas Revocable Trust for Property.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased template, you can find all the files you’ve ever saved in your profile by opening the My Forms tab. Try it out!

Form popularity

FAQ

Un fideicomiso no es mas que una estructura legal a traves de la cual es posible designar la administracion de unos bienes a terceras personas, todo con la finalidad de obtener la mayor cantidad de beneficios (por ejemplo, proteger la privacidad de una persona que ya no desea que una propiedad este a su nombre).

Fideicomiso Irrevocable Un Fideicomiso que no puede ser cambiado.

Para establecer un fideicomiso, cualquiera de los bancos en Mexico cobrara una cuota anual por mantener el fideicomiso, un promedio de $450 a $550 USD por ano.

El fideicomiso es un acto juridico por medio del cual una persona entrega a otra la titularidad de unos activos para que los administre y, al vencimiento de un plazo, transmita los resultados a un tercero. Es una herramienta juridica muy utilizada en los negocios y para preservar los patrimonios familiares.

Un fideicomiso es un arreglo fiduciario que coloca bienes con un tercero (un administrador fiduciario) para que los guarde en nombre de los beneficiarios (por lo general, los hijos o los conyuges).

El fideicomiso es un acto juridico por medio del cual una persona entrega a otra la titularidad de unos activos para que los administre y, al vencimiento de un plazo, transmita los resultados a un tercero. Es una herramienta juridica muy utilizada en los negocios y para preservar los patrimonios familiares.

Es un contrato mediante el cual una persona fisica o moral, nacional o extranjera; afecta ciertos bienes o derechos para un fin licito y determinado, en beneficio propio o de un tercero, encomendando la realizacion de dicho fin a una institucion fiduciaria.

¿Que documentos se necesitan para un fideicomiso? Se deben presentar los documentos de identidad del constituyente, fiduciario y el (los) beneficiarios. Si se trata de un inmueble se debe presentar la escritura, el certificado de tradicion y libertad, el paz y salvo impuesto predial, y el impuesto de valorizacion.

Algunos de los tipos de contrato mas frecuente en el mercado actualmente son: Fideicomiso testamentario.Fideicomiso como medio de pago.Fideicomiso de planeacion patrimonial.Fideicomiso estructurado.

Un fideicomiso en vida revocable (conocido en ingles como un revocable living trust) es un documento legal que le da la autoridad para tomar decisiones sobre el dinero o los bienes de otra persona mantenidos en un fideicomiso.

Interesting Questions

More info

Trusts are not easy to set up. They typically entail expensive legal fees and sometimes involve complex forms. There are two reasons trust planning is a complex affair. Trusts generally are established by an attorney who must also establish their legitimacy. Trusts also can require the sale of family heirlooms, investments, and other items that are normally held in confidence without the need for a trust. The second reason is the complexity to properly administer a trust. Trusts and revocable require specific laws, rules, and regulations. The federal National Trust Act, for example requires that assets be set up in the “best interest of the community,” which means there must be safeguards in place to ensure assets are not transferred to people who do not have a “reasonable expectation of benefit.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.